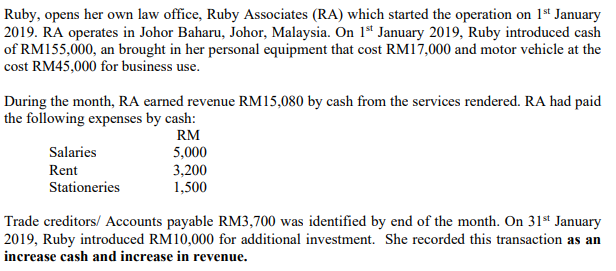

Ruby, opens her own law office, Ruby Associates (RA) which started the operation on 1st January 2019. RA operates in Johor Baharu, Johor, Malaysia. On 1* January 2019, Ruby introduced cash of RM155,000, an brought in her personal equipment that cost RM17,000 and motor vehicle at the cost RM45,000 for business use. During the month, RA carned revenue RM15,080 by cash from the services rendered. RA had paid the following expenses by cash: RM 5,000 3,200 1,500 Salaries Rent Stationeries Trade creditors/ Accounts payable RM3,700 was identified by end of the month. On 31* January 2019, Ruby introduced RM10,000 for additional investment. She recorded this transaction as an increase cash and increase in revenue.

Ruby, opens her own law office, Ruby Associates (RA) which started the operation on 1st January 2019. RA operates in Johor Baharu, Johor, Malaysia. On 1* January 2019, Ruby introduced cash of RM155,000, an brought in her personal equipment that cost RM17,000 and motor vehicle at the cost RM45,000 for business use. During the month, RA carned revenue RM15,080 by cash from the services rendered. RA had paid the following expenses by cash: RM 5,000 3,200 1,500 Salaries Rent Stationeries Trade creditors/ Accounts payable RM3,700 was identified by end of the month. On 31* January 2019, Ruby introduced RM10,000 for additional investment. She recorded this transaction as an increase cash and increase in revenue.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 46P

Related questions

Question

Assume that Ruby Associates is in the process of applying financing facility from MyBank. For that purpose, MyBank requires RA to submit the company’s financial statements to be reviewed by the bank.

i. Why MyBank request the financial statements? Give TWO (2) reasons

ii. Identify and explain the relevant information from the financial statements the important for MyBank in making decision.

Transcribed Image Text:Ruby, opens her own law office, Ruby Associates (RA) which started the operation on 1st January

2019. RA operates in Johor Baharu, Johor, Malaysia. On 1ª January 2019, Ruby introduced cash

of RM155,000, an brought in her personal equipment that cost RM17,000 and motor vehicle at the

cost RM45,000 for business use.

During the month, RA earned revenue RM15,080 by cash from the services rendered. RA had paid

the following expenses by cash:

RM

Salaries

5,000

3,200

1,500

Rent

Stationeries

Trade creditors/ Accounts payable RM3,700 was identified by end of the month. On 31st January

2019, Ruby introduced RM10,000 for additional investment. She recorded this transaction as an

increase cash and increase in revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT