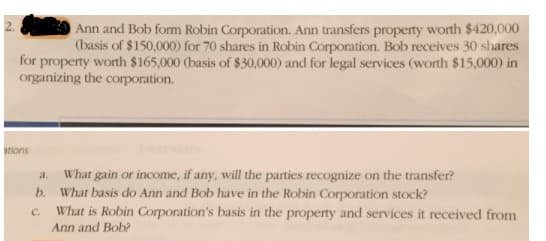

Ann and Bob form Robin Corporation. Ann transfers property worth $420,000 (basis of $150,000) for 70 shares in Robin Corporation. Bob receives 30 shares for property worth $165,000 (basis of $30,000) and for legal services (worth $15,000) in organizing the corporation. tions a. What gain or income, if any, will the parties recognize on the transfer? b. What basis do Ann and Bob have in the Robin Corporation stock? What is Robin Corporation's basis in the property and services it received from C. Ann and Bob?

Ann and Bob form Robin Corporation. Ann transfers property worth $420,000 (basis of $150,000) for 70 shares in Robin Corporation. Bob receives 30 shares for property worth $165,000 (basis of $30,000) and for legal services (worth $15,000) in organizing the corporation. tions a. What gain or income, if any, will the parties recognize on the transfer? b. What basis do Ann and Bob have in the Robin Corporation stock? What is Robin Corporation's basis in the property and services it received from C. Ann and Bob?

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 31P

Related questions

Question

100%

Transcribed Image Text:Ann and Bob form Robin Corporation. Ann transfers property worth $420,000

(basis of $150,000) for 70 shares in Robin Corporation. Bob receives 30 shares

for property worth $165,000 (basis of $30,000) and for legal services (worth $15,000) in

organizing the corporation.

ations

What gain or income, if any, will the parties recognize on the transfer?

b. What basis do Ann and Bob have in the Robin Corporation stock?

What is Robin Corporation's basis in the property and services it received from

Ann and Bob?

a.

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you