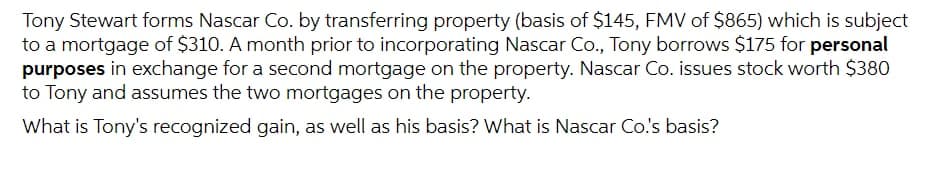

Tony Stewart forms Nascar Co. by transferring property (basis of $145, FMV of $865) which is subject to a mortgage of $310. A month prior to incorporating Nascar Co., Tony borrows $175 for personal purposes in exchange for a second mortgage on the property. Nascar Co. issues stock worth $380 to Tony and assumes the two mortgages on the property. What is Tony's recognized gain, as well as his basis? What is Nascar Co.'s basis?

Tony Stewart forms Nascar Co. by transferring property (basis of $145, FMV of $865) which is subject to a mortgage of $310. A month prior to incorporating Nascar Co., Tony borrows $175 for personal purposes in exchange for a second mortgage on the property. Nascar Co. issues stock worth $380 to Tony and assumes the two mortgages on the property. What is Tony's recognized gain, as well as his basis? What is Nascar Co.'s basis?

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 34P

Related questions

Question

answer quickly

Transcribed Image Text:Tony Stewart forms Nascar Co. by transferring property (basis of $145, FMV of $865) which is subject

to a mortgage of $310. A month prior to incorporating Nascar Co., Tony borrows $175 for personal

purposes in exchange for a second mortgage on the property. Nascar Co. issues stock worth $380

to Tony and assumes the two mortgages on the property.

What is Tony's recognized gain, as well as his basis? What is Nascar Co's basis?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you