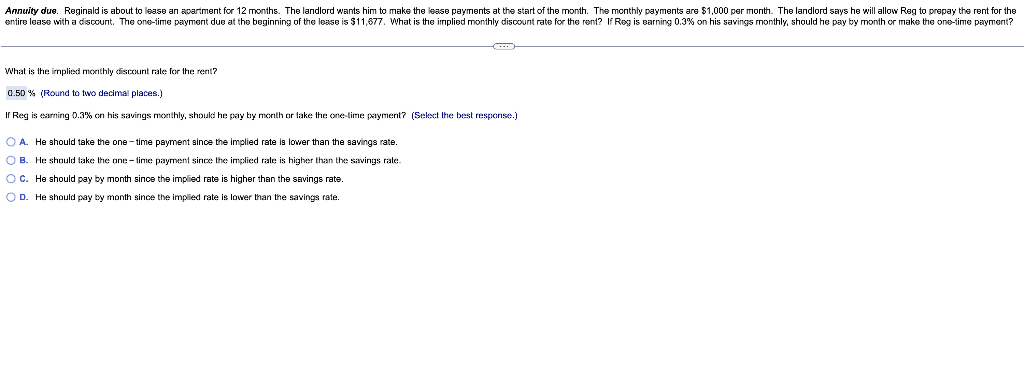

Annuity due. Reginald is about to lease an apartment for 12 months. The landlord wants him to make the lease payments at the start of the month. The monthly payments are $1,000 per month. The landlord says he will allow Reg to prepay the rent for the entire lease with a discount. The one-time payment due at the beginning of the lease is $11,677. What is the implied monthly discount rate for the rent? If Reg is earning 0.3% on his savings monthly, should he pay by month or make the one-time payment? What is the implied monthly discount rate for the rent? 0.50% (Round to two decimal places.) If Reg is earning 0.3% on his savings monthly, should he pay by month or take the one-time payment? (Select the best response.) OA. He should take the one-time payment since the implied rate is lower than the savings rate. OB. He should take the one-time payment since the implied rate is higher than the savings rale. OC. He should pay by month since the implied rate is higher than the savings rate. OD. He should pay by month since the implied rate is lower than the savings rate.

Annuity due. Reginald is about to lease an apartment for 12 months. The landlord wants him to make the lease payments at the start of the month. The monthly payments are $1,000 per month. The landlord says he will allow Reg to prepay the rent for the entire lease with a discount. The one-time payment due at the beginning of the lease is $11,677. What is the implied monthly discount rate for the rent? If Reg is earning 0.3% on his savings monthly, should he pay by month or make the one-time payment? What is the implied monthly discount rate for the rent? 0.50% (Round to two decimal places.) If Reg is earning 0.3% on his savings monthly, should he pay by month or take the one-time payment? (Select the best response.) OA. He should take the one-time payment since the implied rate is lower than the savings rate. OB. He should take the one-time payment since the implied rate is higher than the savings rale. OC. He should pay by month since the implied rate is higher than the savings rate. OD. He should pay by month since the implied rate is lower than the savings rate.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 27M

Related questions

Question

Ee 154.

Transcribed Image Text:Annuity due. Reginald is about to lease an apartment for 12 months. The landlord wants him to make the lease payments at the start of the month. The monthly payments are $1,000 per month. The landlord says he will allow Reg to prepay the rent for the

entire lease with a discount. The one-time payment due at the beginning of the lease is $11,677. What is the implied monthly discount rate for the rent? If Reg is earning 0.3% on his savings monthly, should he pay by month or make the one-time payment?

What is the implied monthly discount rate for the rent?

0.50 % (Round to two decimal places.)

If Reg is earning 0.3% on his savings monthly, should he pay by month or take the one-time payment? (Select the best response.)

O A. He should take the one-time payment since the implied rate is lower than the savings rate.

OB. He should take the one-time payment since the implied rate is higher than the savings rate.

OC. He should pay by month since the implied rate is higher than the savings rate.

O D. He should pay by month since the implied rate is lower than the savings rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT