Anthony spends his income on fishing lures (L ) and guitar picks (6 ). while a package of guitar picks costs $1. Assume that Anthony has $30 to spend and his utility function can be represented as U(L,G) = L 0.5 G 0.5 a. Given the utility function in this problem, use calculus to derive the marginal utilities of fishing lures and guitar picks. b. Using the tangency condition, what is the MRSL,G? c. What is the optimal number of lures and guitar picks for Anthony to purchase? d. At the optimal bundle, how much utility does Anthony have? e. If the price of guitar picks doubles to $2, how much income must Anthony have to maintain the same level of utility? f. Suppose that the prices of lures and guitar picks are $2 and $1 (as they were before the price change) and that Anthony still has only $30 to spend. Use a Lagrangian to solve his constrained utility maximization problem and confirm that the answer is the same as that to part (c). 3. Now suppose that the prices of lures and guitar picks are $2 and $2 (as they were after the price change). Assuming Anthony wants to maintain the same level of utility as he did before the price change with the lowest possible expenditure, write a statement of Anthony's constrained optimization problem. Use a Lagrangian to solve Anthony's expenditure-minimization problem and confirm that the answer is the same as that to part (e). Again suppose that the prices of lures and guitar picks are $2 and $2 (as they were after the price change). This time, however, assume that Anthony still has only $30 to spend. Use a Lagrangian to solve his constrained utility-maximization problem.

Anthony spends his income on fishing lures (L ) and guitar picks (6 ). while a package of guitar picks costs $1. Assume that Anthony has $30 to spend and his utility function can be represented as U(L,G) = L 0.5 G 0.5 a. Given the utility function in this problem, use calculus to derive the marginal utilities of fishing lures and guitar picks. b. Using the tangency condition, what is the MRSL,G? c. What is the optimal number of lures and guitar picks for Anthony to purchase? d. At the optimal bundle, how much utility does Anthony have? e. If the price of guitar picks doubles to $2, how much income must Anthony have to maintain the same level of utility? f. Suppose that the prices of lures and guitar picks are $2 and $1 (as they were before the price change) and that Anthony still has only $30 to spend. Use a Lagrangian to solve his constrained utility maximization problem and confirm that the answer is the same as that to part (c). 3. Now suppose that the prices of lures and guitar picks are $2 and $2 (as they were after the price change). Assuming Anthony wants to maintain the same level of utility as he did before the price change with the lowest possible expenditure, write a statement of Anthony's constrained optimization problem. Use a Lagrangian to solve Anthony's expenditure-minimization problem and confirm that the answer is the same as that to part (e). Again suppose that the prices of lures and guitar picks are $2 and $2 (as they were after the price change). This time, however, assume that Anthony still has only $30 to spend. Use a Lagrangian to solve his constrained utility-maximization problem.

Chapter10: Consumer Choice Theory

Section: Chapter Questions

Problem 8P

Related questions

Question

Focus on parts e-h

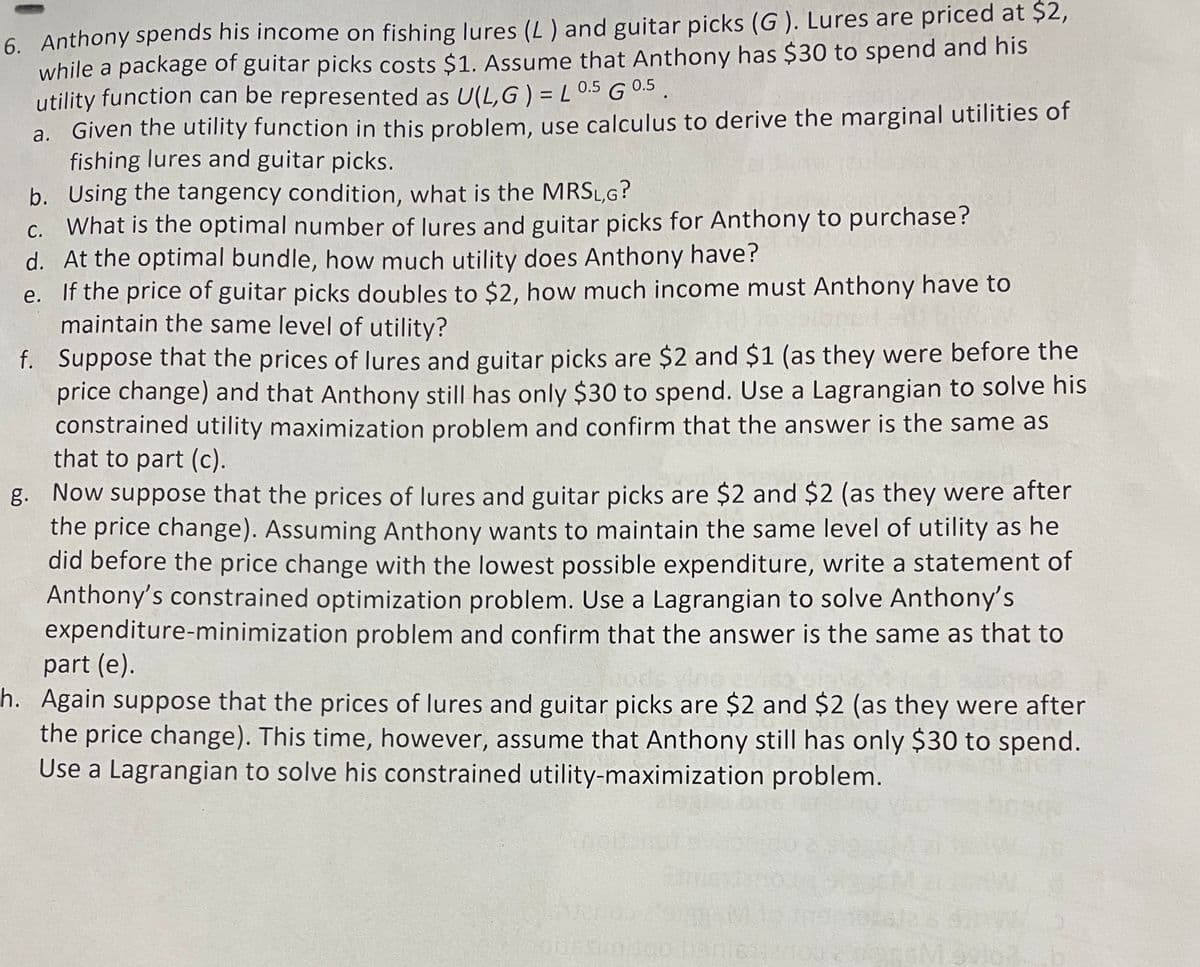

Transcribed Image Text:6. Anthony spends his income on fishing lures (L ) and guitar picks (G ). Lures are priced at $2,

while a package of guitar picks costs $1. Assume that Anthony has $30 to spend and his

utility function can be represented as U(L,G) = L 0.5 GO5.

a. Given the utility function in this problem, use calculus to derive the marginal utilities of

fishing lures and guitar picks.

b. Using the tangency condition, what is the MRSL,G?

c. What is the optimal number of lures and guitar picks for Anthony to purchase?

d. At the optimal bundle, how much utility does Anthony have?

e. If the price of guitar picks doubles to $2, how much income must Anthony have to

maintain the same level of utility?

f. Suppose that the prices of lures and guitar picks are $2 and $1 (as they were before the

price change) and that Anthony still has only $30 to spend. Use a Lagrangian to solve his

constrained utility maximization problem and confirm that the answer is the same as

that to part (c).

g. Now suppose that the prices of lures and guitar picks are $2 and $2 (as they were after

the price change). Assuming Anthony wants to maintain the same level of utility as he

did before the price change with the lowest possible expenditure, write a statement of

Anthony's constrained optimization problem. Use a Lagrangian to solve Anthony's

expenditure-minimization problem and confirm that the answer is the same as that to

part (e).

h. Again suppose that the prices of lures and guitar picks are $2 and $2 (as they were after

the price change). This time, however, assume that Anthony still has only $30 to spend.

Use a Lagrangian to solve his constrained utility-maximization problem.

codar

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning