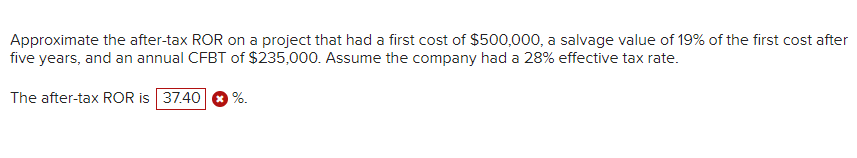

Approximate the after-tax ROR on a project that had a first cost of $500,000, a salvage value of 19% of the first cost after five years, and an annual CFBT of $235,000. Assume the company had a 28% effective tax rate. The after-tax ROR is 37.40 %.

Q: Quantity Total of Labor Product 45 95 120 4 135 140 91 138 130 Given the above table, the marginal…

A: Marginal product refers to the change in total product with respect to change in quantity of labor.

Q: For a Saturday matinee, adult tickets cost $7.50 and kids under 12 pay only $5.00. If 110 tickets…

A: Expenditure on the good refers to price of the good multiplied by the quantity purchased.

Q: Question 2: Multiple choice questions and True/False Choose one correct Answer: 1. By definition,…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: With the illustration of demand and supply curves, discuss how the relaxation of development control…

A: Demand refers to the total quantity of goods and services that can be consumed by consumer and they…

Q: Suppose that Andrew’s Hotel will be open for only two days: a peak season day and an off-peak day.…

A: Peak Demand : P = 1000 - Q Off Peak Demand : P = 500 - 2Q Cost of building a room = 400 Cost of…

Q: 14. Choose the best answer. Market demand is equal to a country's total for a specific product or…

A: Market demand is defined as the total quantity demanded of a particular good or service by consumers…

Q: Please list and explain in your own words the benefits and costs when a country adopts a flexible…

A: Central banks no longer need to retain international reserves because of flexible exchange rates.…

Q: Required Q (2) if the demand function for a particular project is in the following form: Q = 75 - 5P…

A: As given Demand function is Q = 75 - 5P Price elasticity of demand = -dQdP×PQ

Q: Price MC, =S Ds D Quantity Figure 10 Demand and supply curves Towards the right of Figure 10 are two…

A: Subsidy refers to the sum of money provided by the government to suppliers or producers in order for…

Q: Suppose there are two goods, that the prices are given, and that there is a consumer worth a certain…

A: Normal good – a good in which an increase in income raises its sales.

Q: The demand for a good is QD = 19 – 2P + 4l where P and I represent price and income respectively. At…

A: Answer; The income elasticity of demand is 0.32

Q: Output (gall ons of ice cream per hour) Total cost (dollars) 1 1 3 3 4 8. 11 The Jerry - Berry Ice…

A: Fixed cost is the cost at 0 output and average fixed cost is the fixed cost divided by output.

Q: Period 1 3 4 5 6 Gross Requirements 50 50 50 50 50 50 Scheduled Receipts On Hand Inventory 75…

A: The complete MRP table is shown below. Based on this we can answer

Q: Question 45 TRUE or FALSE. *Each question requires explanations (Max 3 sentences)* A negative…

A: Any form of additional compensation is referred to as a liquidity premium. Compensation required to…

Q: Question 8 Real GDP in the economy is $7,900 Billion and the Marginal Propensity to Consume is 0.56.…

A: Marginal propensity to consume is the proportion of income that is spent on consumption of goods and…

Q: Given the information in the table below, what is country A's real aggregate product in B$ at…

A: The aggregate product function represents the total output for an economy to the total amount of…

Q: 1. Identify the four basic inputs to an economic system, and give examples for each of them.

A: Economic System is a structural organization which allocates resources, and plays the basic…

Q: Pizza Hut Total product Labor (workers) (pizzas produced per hour) 1 6. 12 14 15 Using the data in…

A: Evaluating the MP of the labor from TP.

Q: A wife and her husband choose to go to Bach or Stravinsky concert. Wife has incomplete information…

A: The first matrix when the husband is romantic is: P(R) = 2/3

Q: Suppose a monopolist expects to encounter 7 customers on a typical day. Their reservation prices are…

A: There are 7 customers with theirs willingness to pay and the mC of product is $58

Q: Economic growth dynamics?

A: Economic growth dynamics is concerned with the economy's oscillations. The majority of economic…

Q: Question 3 (Market Failure - Externalities) Consider the inverse demand function p = 400 – 2q in a…

A: In economics, a scenario is known as a "market failure" is one in which the supply of commodities…

Q: Graphic below show the relationship between money growth and inflation, explain clearly 14 12 10…

A: In macroeconomics, the money supply refers to the total volume of currency held by the public at a…

Q: The rate of nominal depreciation is faster, the higher is the home coun- try's inflation rate…

A: Since you have posted a question with multiple sub-parts, we will solve first three questions for…

Q: Which of the following four - firm concentration ratios would be the best indication of a perfectly…

A: Four firm concentration is a concept ehich is used to means the extent of the competition in the…

Q: What is supply side economics and what is the general assessment of the efficacy of supply-side…

A: Some refer to supply-side economics as "Reaganomics" or the "trickle-down" doctrine advocated by…

Q: The figure below illustrates the effect of an excise tax (per unit tax) imposed on sellers (S means…

A: Equilibrium in the market occurs at the intersection of demand and supply curves.

Q: Which one of the following indicators is not correct as evidence that integration is raising a…

A: In the mentioned question we have been asked which evidence is not correct for raising the steady…

Q: Q 2/ In a certain city, the number of power outages per month is a random variable, having a…

A: N = 22 and p=0.7 and q= 0.3

Q: A decrease in the demand for chocolate with no change in the supply of chocolate will create a _____…

A: Equilibrium is achieved at a point where demand curve intersects supply curve.

Q: Price and cost (dollars per pound of steak) 20.00 18.00 16.00 S=MC 14.00 12.00 10.00 8.00 6.00 4.00…

A: A) in perfect competitive market:- 1) in perfect competitive market, there are many number of…

Q: economics emphasizes the inherent instability in the macroeconomy and the resulting need for…

A: Government intervention can correct the economy when it is not producing at full employment.

Q: When they act as a profit-maximizing cartel, each company will produce cans and charge $ per can.…

A: Given:- MC of producing can=$0.80 per canMC=ATC Please find the images attached below for detailed…

Q: Price and cost (dollars)

A: A monopoly is a market structure where there is only one firm in the market for a good or service.…

Q: 4. Maria manages a bakery that specializes in ciabatta bread (monopolistically competitive firm),…

A: According to the question, Maria is the owner of a bakery that specializes in ciabatta bread (a…

Q: Next If firms in an oligopolistic industry successfully collude and form a cartel, what price and…

A: Oligopolistic:- An oligopoly can be described as a form of market wherein a limited amount of…

Q: A BA ERFECT-INFO GAME) Consider the game shown at the right. 2 1 .What is the number of pure…

A: Above question is an example of a sequential game with following sequence -

Q: A firm is in a monopoly market. The demand function (Qp) and total cost function (TC) of this firm…

A: We have second degree price discrimination where each block is charged with different prices.

Q: NEXI quest Use the figure to the right to answer this question. Mary is the only veterinarian in a…

A: In monopoly, the point of profit maximization is MR = MC, where, Marginal Revenue Marginal Cost

Q: Quantity Marginal Benefit Marginal Cost 1 $50 $2 $45 $15 $39 $16 4 $5 $21 $-18 $38 Using the above…

A: Marginal cost is defined as the cost which is incurred by the producer in order to produce one more…

Q: Suppose Ming spends his entire income on two goods, X and Y, has "standard-looking" indifference…

A: Consumption refers to the intermediate or ultimate process through which institutional entities…

Q: specify which issues below are “Distributive”, “Compatible”, or “Integrative”. 1. First-year…

A: A number of differences in interests and objectives leads to interdependence of several players.…

Q: Firm X's strategies 180 rides 60 rides $3,000 $1,000 100 rides $3,000 $6,000 Firm Y's strategies…

A: We have 2×2 matrix game in which each firm has two actions 100 rides and 60 rides.

Q: A cake valued at $40 is divided among five players (P1, P2, P3, P4, P5) using the last diminisher…

A: Given; Value of cake= $40 Player 2 Player 3 Player 4 Player5 Value of current C-piece $5.50…

Q: How do you evaluate your opportunity cost in terms of the alternative decisions that you have to…

A: Oportunity cost is the following best elective which we have renounced because of purpose of present…

Q: The cross-price elasticity of demand between movie tickets and movie theater popcorn is estimated to…

A: Cross price elasticity measures how quantity demanded of one good changes when price of other good…

Q: The following maintenance alternatives are considered for a new assembly line that has an a cost of…

A: Expected life = ∑Probability *Life Regime Service life by probability Expected Life 0…

Q: 10. If the United States changed its laws to allow for the legal sale of a kidney, which of the…

A: The quantity of a product that is sold into the market is referred to as supply.Because it is more…

Q: Suppose Ming spends his entire income on two goods, X and Y, has "standard-looking" indifference…

A: Consumption is the intermediate or ultimate process through which institutional units consume items…

Q: Q1 a) Given a production function depicting the response of paddy rice to fertilizer application, Y…

A: Production function : Y = 3X + 9X2 - X3 MPP(Marginal physical product ) refers to the additional…

I need help with this problem and the answer is not 37.40, 26.93, and 86.2.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash inflows (before depreciation and taxes) are expected to be $5,000 per year for five years. The firm uses the straight-line depreciation method with a zero salvage value and has a (marginal) income tax rate of 40 percent. The firms cost of capital is 12 percent. Compute the IRR and the NPV. Should the firm accept or reject the project?A company with a 34% marginal income tax rate is considering the purchase of a $75,000 piece of equipment that is classified as 3-year property in the MACRS depreciation schedule. The equipment will provide the following estimated benefits in Year 1-5. Year Before-Tax Cash Flow 0 −$75,000 1 $10,000 2 $25,000 3 $50,000 4 $15,000 If the company purchases the equipment, how much income tax will it owe in Year 3? Group of answer choices $13,223 $17,000 $25,500 No income tax is owedPlant Company is contemplating the purchase of a new piece of equipment for $40,000. Plant is in the 20% income tax bracket. Predicted annual after-tax cash inflows from this investment are $14,000, $12,000, $5,000, $13,000 and $1,000 for years 1 through 5, respectively. The firm uses straight-line depreciation with no residual value at the end of five years. The hurdle rate for accepting new capital investment projects is 4%, after-tax. The estimated accounting rate of return (ARR) on this project (rounded to two decimal points), based on the initial investment is: Multiple Choice 2.50%. 3.16%. 6.50%. 9.83%. 11.83%.

- has a cost of $53,600, lasts 9 years with no salvage value, and costs $150,000 per year in operating expenses. It is in the 3-year property class. Investment B has a cost of $84,500.00, lasts 9 years with no salvage value, and costs $125,000 per year. Investment B, however, is in the 7-year property class. The company marginal tax rate is 25%, and MARR is an after-tax 10%. Based upon the use of MACRS-GDS depreciation, compare the AW of each alternative.AWA = $enter a dollar amount AWB = $enter a dollar amount Which should be selected? What must be Investment B's cost of operating expenses for these two investments to be equivalent? $enter a dollar amountGiven: Before -Tax Cash Flow (BT-CF) for Kal Tech Systems in 2012 for an equipment that will be depreciated using the SL method with salvage value of $10,000. Year 0 1 2 3 4 5 BT-CF -$120,000 32,000 32,000 32,000 32,000 32,000 Market value - $36,000 What is the after-tax return if the company is in the 34% income tax bracket? The incremental tax rate is 34%. Also, it is known that the before-tax return is 16.65% Group of answer choices 9.65% 11.29% 10.16% 10.99%Olivia’s asset is purchased for Php 25,000. Its estimated life is 12 years after which it will be sold for Php 15,000. Find the depreciation for the 5th year and book value at the end of 8th year using Straight Line Method. a. 833.33 - 18,333.36 b. 833.33 - 4,166.67 c. 4,166.67 - 18,333.36 d. 533.33 - 4,166.67

- An asset that is book-depreciated over a 5-year period by the straight line method has C3 = P 2,800,000 with a depreciation charge of P1,170,000 per year. Using straight line method what is the assumed salvage value? a) P 250,050 b) P 350,020 c) P 587,000 d) P 460,000The UST-ECE Department purchased a Communications Trainer worth P 250,000. Freight and insurance charges amounted to P 18,000; customs’, cargo and broker’s fee, P 8,500; taxes, permits, and other expenses, P 25,000. If the estimated life of the trainer is 10 years with a salvage value at the end of life of P 20,000 Using SYDM: The depreciation charge during the 4th year is: P 31,745.65 B. P 174,018.18 C. P 31,818.18 D. P 35,827.27 The book value at the end of 6 years is: P 61,818.18 B. P 59,201.53 C. P 71,181.82 D. P 96,772.73Consider the following information for year 1 of a project using equipment that had an initial cost of $100,000, and an estimated salvage value of $10,000 at disposal: BTCF = $16,000MACRS 10-year property classState & Federal Combined Income Tax Rate: 45% What is the ATCF for year 1?

- If the after-tax rate of return for a cash flow series is 11.2% and the corporate effective tax rate is 39%, the approximated before-tax rate of return is closest to: (a) 6.8% (b) 5.4% (c) 18.4% (d ) 28.7%The first costs of an equipment is P 65,000 and a salvage value of X at the end of its life of 7 years. Find the value x if using Straight Line Method, the total depreciation after 3 years is P 26,571.43. a. P 3,000 b. 0 c. P 4,000 d. P 5,000A corporation in 2018 expects a gross income of $680,000, total operating expenses of $480,000, and capital investments of $29,000. In addition the corporation is able to declare $53,000 of depreciation charges for the year. The federal income tax rate is 21%. What is the expected taxable income and total federal income taxes owed for the year 2018?