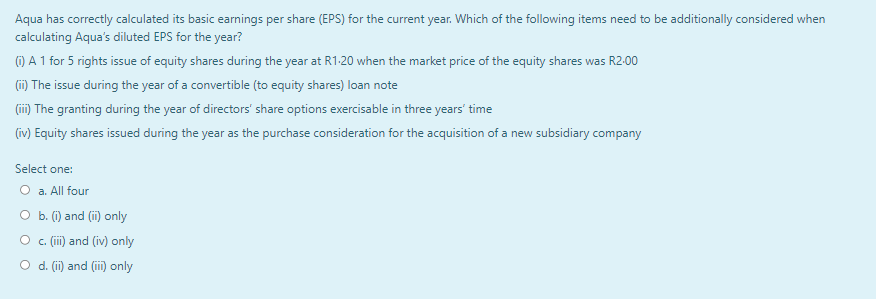

Aqua has correctly calculated its basic earnings per share (EPS) for the current year. Which of the following items need to be additionally considered when calculating Aqua's diluted EPS for the year? (1) A 1 for 5 rights issue of equity shares during the year at R1-20 when the market price of the equity shares was R2.00 (ii) The issue during the year of a convertible (to equity shares) loan note (iii) The granting during the year of directors' share options exercisable in three years' time (iv) Equity shares issued during the year as the purchase consideration for the acquisition of a new subsidiary company Select one: O a. All four O b. (i) and (ii) only c. (iii) and (iv) only d. (ii) and (iii) only

Aqua has correctly calculated its basic earnings per share (EPS) for the current year. Which of the following items need to be additionally considered when calculating Aqua's diluted EPS for the year? (1) A 1 for 5 rights issue of equity shares during the year at R1-20 when the market price of the equity shares was R2.00 (ii) The issue during the year of a convertible (to equity shares) loan note (iii) The granting during the year of directors' share options exercisable in three years' time (iv) Equity shares issued during the year as the purchase consideration for the acquisition of a new subsidiary company Select one: O a. All four O b. (i) and (ii) only c. (iii) and (iv) only d. (ii) and (iii) only

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.16E

Related questions

Question

Transcribed Image Text:Aqua has correctly calculated its basic earnings per share (EPS) for the current year. Which of the following items need to be additionally considered when

calculating Aqua's diluted EPS for the year?

(i) A 1 for 5 rights issue of equity shares during the year at R1-20 when the market price of the equity shares was R2.00

(ii) The issue during the year of a convertible (to equity shares) loan note

(iii) The granting during the year of directors' share options exercisable in three years' time

(iv) Equity shares issued during the year as the purchase consideration for the acquisition of a new subsidiary company

Select one:

O a. All four

O b. (i) and (ii) only

c. (iii) and (iv) only

d. (ii) and (iii) only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Select one:

a.

(iii) and (iv) only

b.

(ii) and (iii) only

c.

(i) and (ii) only

d.

All four

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning