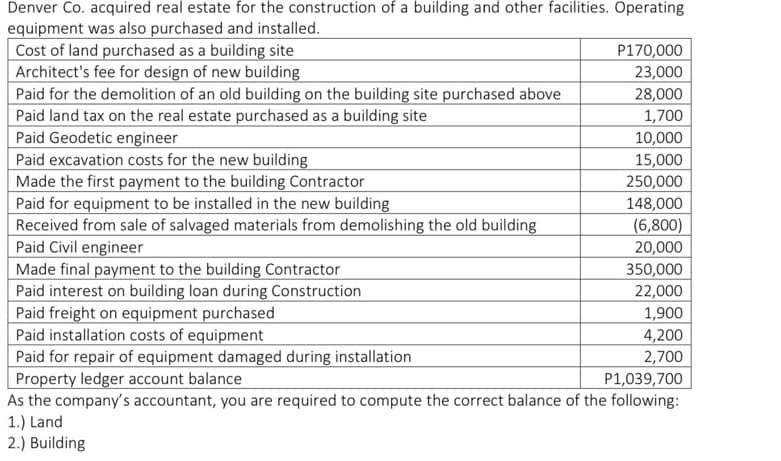

Denver Co. acquired real estate for the construction of a building and other facilities. Operating equipment was also purchased and installed. P170,000 Cost of land purchased as a building site Architect's fee for design of new building 23,000 28,000 Paid for the demolition of an old building on the building site purchased above Paid land tax on the real estate purchased as a building site 1,700 Paid Geodetic engineer 10,000 Paid excavation costs for the new building 15,000 Made the first payment to the building Contractor 250,000 Paid for equipment to be installed in the new building 148,000 (6,800) Received from sale of salvaged materials from demolishing the old building Paid Civil engineer 20,000 Made final payment to the building Contractor 350,000 Paid interest on building loan during Construction 22,000 Paid freight on equipment purchased 1,900 Paid installation costs of equipment 4,200 Paid for repair of equipment damaged during installation 2,700 Property ledger account balance P1,039,700 As the company's accountant, you are required to compute the correct balance of the following: 1.) Land 2.) Building

Denver Co. acquired real estate for the construction of a building and other facilities. Operating equipment was also purchased and installed. P170,000 Cost of land purchased as a building site Architect's fee for design of new building 23,000 28,000 Paid for the demolition of an old building on the building site purchased above Paid land tax on the real estate purchased as a building site 1,700 Paid Geodetic engineer 10,000 Paid excavation costs for the new building 15,000 Made the first payment to the building Contractor 250,000 Paid for equipment to be installed in the new building 148,000 (6,800) Received from sale of salvaged materials from demolishing the old building Paid Civil engineer 20,000 Made final payment to the building Contractor 350,000 Paid interest on building loan during Construction 22,000 Paid freight on equipment purchased 1,900 Paid installation costs of equipment 4,200 Paid for repair of equipment damaged during installation 2,700 Property ledger account balance P1,039,700 As the company's accountant, you are required to compute the correct balance of the following: 1.) Land 2.) Building

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:Denver Co. acquired real estate for the construction of a building and other facilities. Operating

equipment was also purchased and installed.

Cost of land purchased as a building site

Architect's fee for design of new building

P170,000

23,000

28,000

Paid for the demolition of an old building on the building site purchased above

Paid land tax on the real estate purchased as a building site

1,700

Paid Geodetic engineer

10,000

Paid excavation costs for the new building

15,000

Made the first payment to the building Contractor

250,000

Paid for equipment to be installed in the new building

148,000

Received from sale of salvaged materials from demolishing the old building

Paid Civil engineer

(6,800)

20,000

Made final payment to the building Contractor

350,000

Paid interest on building loan during Construction

22,000

Paid freight on equipment purchased

1,900

Paid installation costs of equipment

4,200

Paid for repair of equipment damaged during installation

2,700

Property ledger account balance

P1,039,700

As the company's accountant, you are required to compute the correct balance of the following:

1.) Land

2.) Building

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning