FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

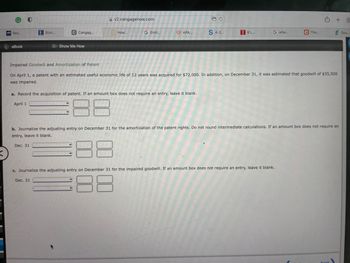

Impaired goodwill and amortization of patent

Transcribed Image Text:**Impaired Goodwill and Amortization of Patent**

On April 1, a patent with an estimated useful economic life of 12 years was acquired for $72,000. In addition, on December 31, it was estimated that goodwill of $35,500 was impaired.

### Instructions

**a. Record the acquisition of the patent. If an amount box does not require an entry, leave it blank.**

- **Date: April 1**

- **Account Titles:**

- Debit:

- Credit:

**b. Journalize the adjusting entry on December 31 for the amortization of the patent rights. Do not round intermediate calculations. If an amount box does not require an entry, leave it blank.**

- **Date: December 31**

- **Account Titles:**

- Debit:

- Credit:

**c. Journalize the adjusting entry on December 31 for the impaired goodwill. If an amount box does not require an entry, leave it blank.**

- **Date: December 31**

- **Account Titles:**

- Debit:

- Credit:

### Notes:

- The steps include recording the acquisition of the patent, adjusting for amortization, and recording the impairment of goodwill.

- Make sure to enter the correct account titles and amounts based on the given information.

- No graphs or diagrams are included in this part of the task.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An impairment loss for goodwill is calculated as the difference between ________. Group of answer choices the fair value of the reporting unit (including goodwill) and the book value of the reporting unit (including goodwill) the implied fair value of goodwill and its book value the fair value of the reporting unit (including goodwill) and the fair value of its net assets (without goodwill) the book value of the reporting unit (including goodwill) and the book value of its net assets (without goodwill)arrow_forwardcan goodwill be amoritized?arrow_forwardWhich of the following factors cannot be used to determine an insurer's limit of liability on property coverage? O A. Actual cash value Replacement cost Salvage value Policy limits OB. O C. D. Whiteboardarrow_forward

- Which of the following cannot be protected as intellectual property? a. an idea b. an invention c. a trademark d. artistic expressionarrow_forwardHow does APB #17differ from current requirements under FASB Codification for expensing of goodwill?arrow_forwardIf a trademark is developed internally, it cannot be recognized as an intangible asset on the statement of financial position. True or Falsearrow_forward

- How might a license for symbolic intellectual property be treated differently under IFRS as compared to U.S. GAAP?arrow_forwardResearch & Development costs: A)Are included in the cost of a patent on the balance sheet B) Should be expensed C) Are amortized over the useful life of the patent D) Both A&B are correctarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education