Ariel Company for the manutacture of cotton clothes in Turkey sels 40% of its production in Turkey and sels 10s of its production in Arab countries, and 20% in European countries. The company is studying to find new markets for its products. The administration aims to bring its sales in Europe to 40%. In order to achieve this goal, it will have to invest heavily, In recent years, therefore, the company decided to build a new facility, The desired new location should be ether in Jordan or Tunisia. The following are the data for the estimates related to each location. Jordan Tunis Intial investment $400 5300 Estimated useful ife 10 years 10 years Annual cash inflows $1.300,000 s900,000 Annual cash outfiows so0.000 53s0,000 Annual revenues (accrual) S600.000 Annual expenses laccrual) suo0.000 S60.000 Estimated salvage value S600,000 Discount rate 125 125 Instructions (aCalculate the cash payback period for each alternative.

Ariel Company for the manutacture of cotton clothes in Turkey sels 40% of its production in Turkey and sels 10s of its production in Arab countries, and 20% in European countries. The company is studying to find new markets for its products. The administration aims to bring its sales in Europe to 40%. In order to achieve this goal, it will have to invest heavily, In recent years, therefore, the company decided to build a new facility, The desired new location should be ether in Jordan or Tunisia. The following are the data for the estimates related to each location. Jordan Tunis Intial investment $400 5300 Estimated useful ife 10 years 10 years Annual cash inflows $1.300,000 s900,000 Annual cash outfiows so0.000 53s0,000 Annual revenues (accrual) S600.000 Annual expenses laccrual) suo0.000 S60.000 Estimated salvage value S600,000 Discount rate 125 125 Instructions (aCalculate the cash payback period for each alternative.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter10: Decentralization: Responsibility Accounting, Performance Evaluation, And Transfer Pricing

Section: Chapter Questions

Problem 14E

Related questions

Question

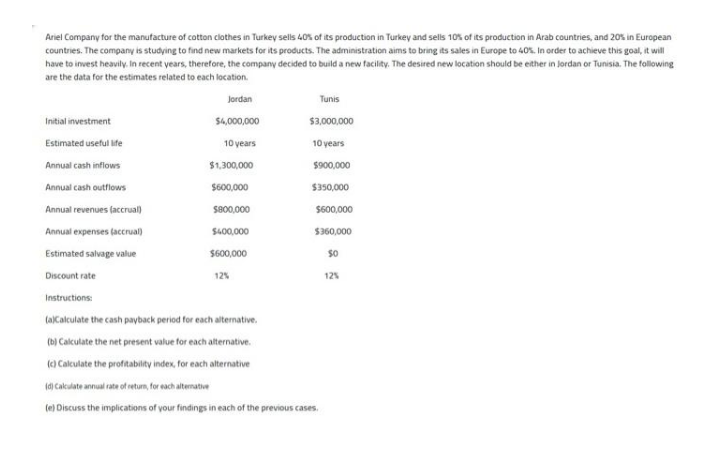

Transcribed Image Text:Ariel Company for the manufacture of cotton clothes in Turkey sells 40% of its production in Turkey and sells 10% of its production in Arab countries, and 20% in European

countries. The company is studying to find new markets for its products. The administration aims to bring its sales in Europe to 40%. In order to achieve this goal, it will

have to invest heavily. In recent years, therefore, the company decided to build a new facility. The desired new location should be either in Jordan or Tunisia. The following

are the data for the estimates related to each location.

Jordan

Tunis

Initial investment

$4,000,000

s3.000.000

Estimated useful life

10 years

10 years

Annual cash inflows

$1.300,000

5900,000

Annual cash outflows

S600,000

$350,000

Annual revenues (accrual)

s800,000

$600,000

Annual expenses (accrual)

$400,000

$360,000

Estimated salvage value

$600,000

Discount rate

12%

125

Instructions:

(aCalculate the cash payback period for each alternative.

(b) Calculate the net present value for each alternative.

(a Calculate the profitabilit index, for each alternative

(d) Calculate annual rate of return, for each altemative

(e) Discuss the implications of your findings in each of the previous cases.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning