As a financial consultant you have customers with different investment risk preferences. You have a client who is interested in purchasing either AT&T stock or Google stock. This client, however, is risk adverse. Clients who are 'risk adverse' try to minimize their risk. To determine the relative risk/volatility between the 2 stock options, you use regression analysis to estimate the percent gain/loss of each stock as compared to the market: the S&P 500 percent gain/loss. The results of your regression models are given in the table below. Level of

As a financial consultant you have customers with different investment risk preferences. You have a client who is interested in purchasing either AT&T stock or Google stock. This client, however, is risk adverse. Clients who are 'risk adverse' try to minimize their risk. To determine the relative risk/volatility between the 2 stock options, you use regression analysis to estimate the percent gain/loss of each stock as compared to the market: the S&P 500 percent gain/loss. The results of your regression models are given in the table below. Level of

Functions and Change: A Modeling Approach to College Algebra (MindTap Course List)

6th Edition

ISBN:9781337111348

Author:Bruce Crauder, Benny Evans, Alan Noell

Publisher:Bruce Crauder, Benny Evans, Alan Noell

Chapter3: Straight Lines And Linear Functions

Section3.CR: Chapter Review Exercises

Problem 15CR: Life Expectancy The following table shows the average life expectancy, in years, of a child born in...

Related questions

Question

Please help me this question.

Transcribed Image Text:e File Preview

ZOOM

+

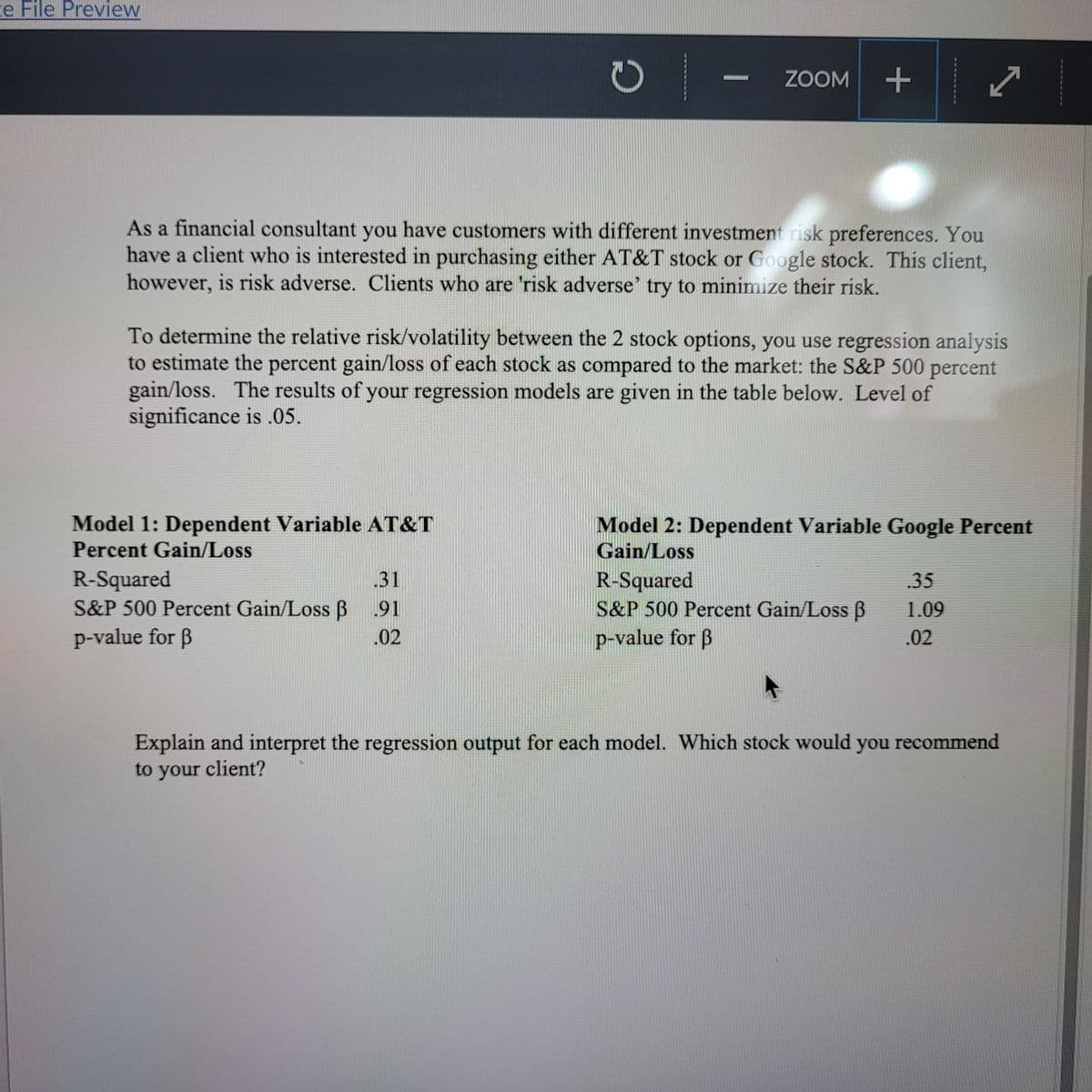

As a financial consultant you have customers with different investment risk preferences. You

have a client who is interested in purchasing either AT&T stock or Google stock. This client,

however, is risk adverse. Clients who are 'risk adverse' try to minimize their risk.

To determine the relative risk/volatility between the 2 stock options, you use regression analysis

to estimate the percent gain/loss of each stock as compared to the market: the S&P 500 percent

gain/loss. The results of your regression models are given in the table below. Level of

significance is .05.

Model 1: Dependent Variable AT&T

Model 2: Dependent Variable Google Percent

Gain/Loss

Percent Gain/Loss

R-Squared

S&P 500 Percent Gain/Loss B 91

31

R-Squared

S&P 500 Percent Gain/Loss B

p-value for ß

.35

1.09

p-value for B

.02

.02

Explain and interpret the regression output for each model. Which stock would you recommend

to your client?

2AHLCLH C - -

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Functions and Change: A Modeling Approach to Coll…

Algebra

ISBN:

9781337111348

Author:

Bruce Crauder, Benny Evans, Alan Noell

Publisher:

Cengage Learning

Algebra and Trigonometry (MindTap Course List)

Algebra

ISBN:

9781305071742

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill