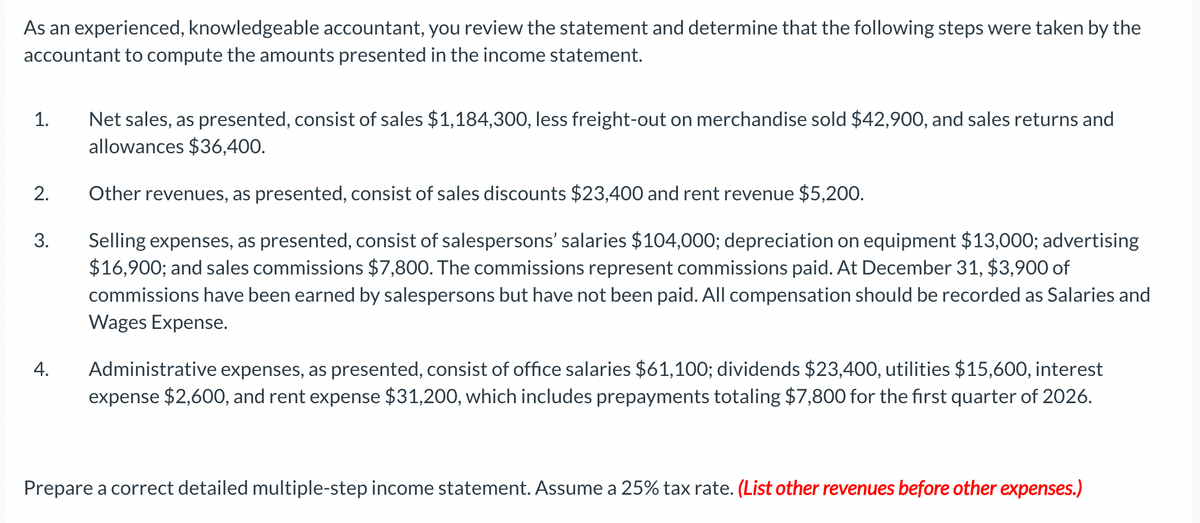

As an experienced, knowledgeable accountant, you review the statement and determine that the following steps were taken by the accountant to compute the amounts presented in the income statement. 1. 2. 3. 4. Net sales, as presented, consist of sales $1,184,300, less freight-out on merchandise sold $42,900, and sales returns and allowances $36,400. Other revenues, as presented, consist of sales discounts $23,400 and rent revenue $5,200. Selling expenses, as presented, consist of salespersons' salaries $104,000; depreciation on equipment $13,000; advertising $16,900; and sales commissions $7,800. The commissions represent commissions paid. At December 31, $3,900 of commissions have been earned by salespersons but have not been paid. All compensation should be recorded as Salaries and Wages Expense. Administrative expenses, as presented, consist of office salaries $61,100; dividends $23,400, utilities $15,600, interest expense $2,600, and rent expense $31,200, which includes prepayments totaling $7,800 for the first quarter of 2026. Prepare a correct detailed multiple-step income statement. Assume a 25% tax rate. (List other revenues before other expenses.)

As an experienced, knowledgeable accountant, you review the statement and determine that the following steps were taken by the accountant to compute the amounts presented in the income statement. 1. 2. 3. 4. Net sales, as presented, consist of sales $1,184,300, less freight-out on merchandise sold $42,900, and sales returns and allowances $36,400. Other revenues, as presented, consist of sales discounts $23,400 and rent revenue $5,200. Selling expenses, as presented, consist of salespersons' salaries $104,000; depreciation on equipment $13,000; advertising $16,900; and sales commissions $7,800. The commissions represent commissions paid. At December 31, $3,900 of commissions have been earned by salespersons but have not been paid. All compensation should be recorded as Salaries and Wages Expense. Administrative expenses, as presented, consist of office salaries $61,100; dividends $23,400, utilities $15,600, interest expense $2,600, and rent expense $31,200, which includes prepayments totaling $7,800 for the first quarter of 2026. Prepare a correct detailed multiple-step income statement. Assume a 25% tax rate. (List other revenues before other expenses.)

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 3E

Related questions

Topic Video

Question

Transcribed Image Text:As an experienced, knowledgeable accountant, you review the statement and determine that the following steps were taken by the

accountant to compute the amounts presented in the income statement.

1.

2.

3.

4.

Net sales, as presented, consist of sales $1,184,300, less freight-out on merchandise sold $42,900, and sales returns and

allowances $36,400.

Other revenues, as presented, consist of sales discounts $23,400 and rent revenue $5,200.

Selling expenses, as presented, consist of salespersons' salaries $104,000; depreciation on equipment $13,000; advertising

$16,900; and sales commissions $7,800. The commissions represent commissions paid. At December 31, $3,900 of

commissions have been earned by salespersons but have not been paid. All compensation should be recorded as Salaries and

Wages Expense.

Administrative expenses, as presented, consist of office salaries $61,100; dividends $23,400, utilities $15,600, interest

expense $2,600, and rent expense $31,200, which includes prepayments totaling $7,800 for the first quarter of 2026.

Prepare a correct detailed multiple-step income statement. Assume a 25% tax rate. (List other revenues before other expenses.)

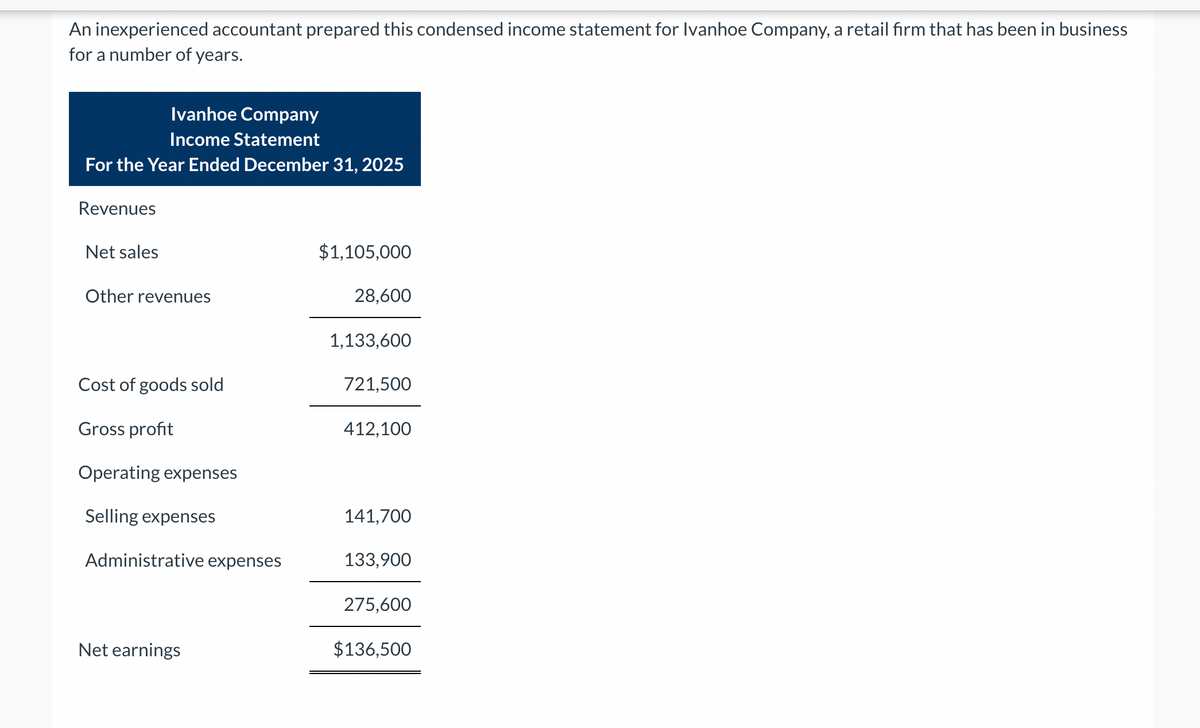

Transcribed Image Text:An inexperienced accountant prepared this condensed income statement for Ivanhoe Company, a retail firm that has been in business

for a number of years.

Ivanhoe Company

Income Statement

For the Year Ended December 31, 2025

Revenues

Net sales

Other revenues

Cost of goods sold

Gross profit

Operating expenses

Selling expenses

Administrative expenses

Net earnings

$1,105,000

28,600

1,133,600

721,500

412,100

141,700

133,900

275,600

$136,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College