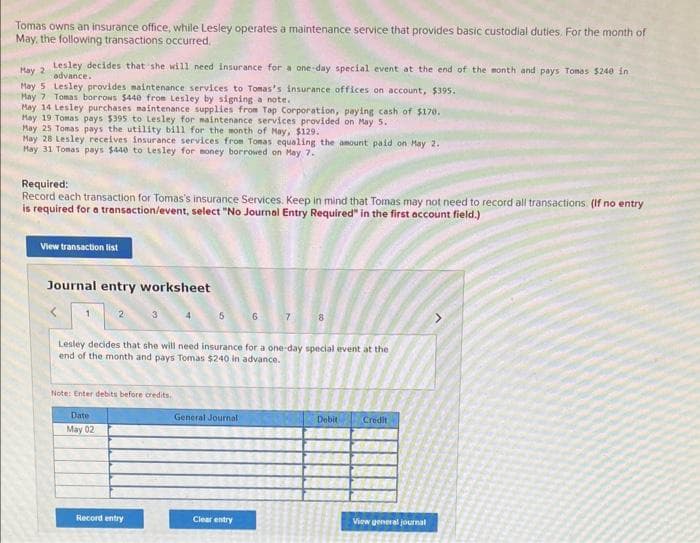

Tomas owns an insurance office, while Lesley operates a maintenance service that provides basic custodial duties. For the month of May, the following transactions occurred. May 2 Lesley decides that she will need insurance for a one-day special event at the end of the month and pays Tomas $240 in advance. May 5 Lesley provides maintenance services to Tomas's insurance offices on account, $395. May 7 Tomas borrows $440 from Lesley by signing a note. May 14 Lesley purchases maintenance supplies from Tap Corporation, paying cash of $170. May 19 Tomas pays $395 to Lesley for maintenance services provided on May 5. May 25 Tomas pays the utility bill for the month of May, $129. May 28 Lesley receives insurance services from Tomas equaling the amount paid on May 2. Hay 31 Tomas pays $440 to Lesley for money borrowed on May 7. Required: Record each transaction for Tomas's insurance Services. Keep in mind that Tomas may not need to record all transactions: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 3 Note: Enter debits before credits. Date May 02 Record entry 4 5 Lesley decides that she will need insurance for a one-day special event at the end of the month and pays Tomas $240 in advance. General Journal 6 Clear entry 7 8 Debit Credit View general journal

Tomas owns an insurance office, while Lesley operates a maintenance service that provides basic custodial duties. For the month of May, the following transactions occurred. May 2 Lesley decides that she will need insurance for a one-day special event at the end of the month and pays Tomas $240 in advance. May 5 Lesley provides maintenance services to Tomas's insurance offices on account, $395. May 7 Tomas borrows $440 from Lesley by signing a note. May 14 Lesley purchases maintenance supplies from Tap Corporation, paying cash of $170. May 19 Tomas pays $395 to Lesley for maintenance services provided on May 5. May 25 Tomas pays the utility bill for the month of May, $129. May 28 Lesley receives insurance services from Tomas equaling the amount paid on May 2. Hay 31 Tomas pays $440 to Lesley for money borrowed on May 7. Required: Record each transaction for Tomas's insurance Services. Keep in mind that Tomas may not need to record all transactions: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 3 Note: Enter debits before credits. Date May 02 Record entry 4 5 Lesley decides that she will need insurance for a one-day special event at the end of the month and pays Tomas $240 in advance. General Journal 6 Clear entry 7 8 Debit Credit View general journal

Chapter6: Business Expenses

Section: Chapter Questions

Problem 32P

Related questions

Question

100%

please do not provide solution in image format thank you!

Transcribed Image Text:Tomas owns an insurance office, while Lesley operates a maintenance service that provides basic custodial duties. For the month of

May, the following transactions occurred.

May 2

Lesley decides that she will need insurance for a one-day special event at the end of the month and pays Tomas $240 in

advance.

May 5 Lesley provides maintenance services to Tomas's insurance offices on account, $395.

May 7 Tomas borrows $440 from Lesley by signing a note.

May 14 Lesley purchases maintenance supplies from Tap Corporation, paying cash of $170.

May 19 Tomas pays $395 to Lesley for maintenance services provided on May 5.

May 25 Tomas pays the utility bill for the month of May, $129.

May 28 Lesley receives insurance services from Tomas equaling the amount paid on May 2.

May 31 Tomas pays $440 to Lesley for money borrowed on May 7.

Required:

Record each transaction for Tomas's insurance Services. Keep in mind that Tomas may not need to record all transactions. (If no entry

is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

View transaction list

Journal entry worksheet

2

Date

May 02

3

Note: Enter debits before credits.

Record entry

4

5

Lesley decides that she will need insurance for a one-day special event at the

end of the month and pays Tomas $240 in advance.

General Journal

6

Clear entry

7

8

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning