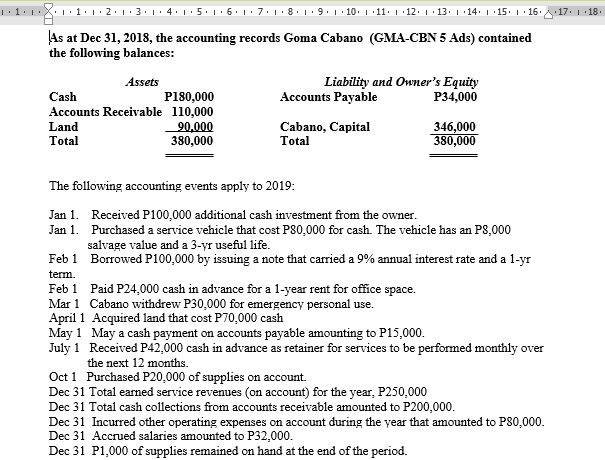

As at Dec 31, 2018, the accounting records Goma Cabano (GMA-CBN 5 Ads) contained the following balances: Liability and Owner's Equity Accounts Payable Assets Cash P34,000 P180,000 Accounts Receivable 110,000 90,000 380,000 Land Total Cabano, Capital Total 346,000 380,000 The following accounting events apply to 2019: Jan 1. Received P100,000 additional cash investment from the owner. Jan 1. Purchased a service vehicle that cost P80,000 for cash. The vehicle has an P8,000 salvage value and a 3-yr useful life. Feb 1 Borrowed P100,000 by issuing a note that carried a 9% annual interest rate and a 1-y: term. Feb 1 Paid P24,000 cash in advance for a 1-year rent for office space. Mar 1 Cabano withdrew P30,000 for emergency personal use. April 1 Acquired land that cost P70,000 cash

As at Dec 31, 2018, the accounting records Goma Cabano (GMA-CBN 5 Ads) contained the following balances: Liability and Owner's Equity Accounts Payable Assets Cash P34,000 P180,000 Accounts Receivable 110,000 90,000 380,000 Land Total Cabano, Capital Total 346,000 380,000 The following accounting events apply to 2019: Jan 1. Received P100,000 additional cash investment from the owner. Jan 1. Purchased a service vehicle that cost P80,000 for cash. The vehicle has an P8,000 salvage value and a 3-yr useful life. Feb 1 Borrowed P100,000 by issuing a note that carried a 9% annual interest rate and a 1-y: term. Feb 1 Paid P24,000 cash in advance for a 1-year rent for office space. Mar 1 Cabano withdrew P30,000 for emergency personal use. April 1 Acquired land that cost P70,000 cash

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 6.5APR: Multiple-step income statement and report form of balance sheet The following selected accounts and...

Related questions

Question

Prepare a

Transcribed Image Text:• 1 ·1• j · 2• 1 • 3• 1 · 4. 1·5• 1 • 6.

7.1. 8. 1. 9:1 • 10. 1 11. 1 ·12. 1 13. 1 14: 1 15. 1· 16. 17. 1 18.

As at Dec 31, 2018, the accounting records Goma Cabano (GMA-CBN 5 Ads) contained

the following balances:

Liability and Owner's Equity

Accounts Payable

Assets

Cash

P34,000

P180,000

Accounts Receivable 110,000

90,000

380,000

Land

Cabano, Capital

Total

346,000

380,000

Total

The following accounting events apply to 2019:

Jan 1. Received P100,000 additional cash investment from the owner.

Jan 1. Purchased a service vehicle that cost P80,000 for cash. The vehicle has an P8,000

salvage value and a 3-yr useful life.

Feb 1 Borrowed P100,000 by issuing a note that carried a 9% annual interest rate and a 1-yr

term.

Feb 1 Paid P24,000 cash in advance for a 1-year rent for office space.

Mar 1 Cabano withdrew P30,000 for emergency personal use.

April 1 Acquired land that cost P70,000 cash

May 1 May a cash payment on accounts payable amounting to P15,000.

July 1 Received P42,000 cash in advance as retainer for services to be performed monthly over

the next 12 months.

Oct 1 Purchased P20,000 of supplies on account.

Dec 31 Total eaned service revenues (on account) for the year, P250,000

Dec 31 Total cash collections from accounts receivable amounted to P200,000.

Dec 31 Incurred other operating expenses on account during the year that amounted to P80,000.

Dec 31 Accrued salaries amounted to P32,000.

Dec 31 P1,000 of supplies remained on hand at the end of the period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning