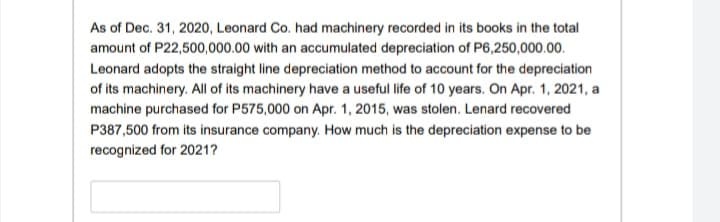

As of Dec. 31, 2020, Leonard Co. had machinery recorded in its books in the total amount of P22,500,000.00 with an accumulated depreciation of P6,250,000.00. Leonard adopts the straight line depreciation method to account for the depreciation of its machinery. All of its machinery have a useful life of 10 years. On Apr. 1, 2021, a machine purchased for P575,000 on Apr. 1, 2015, was stolen. Lenard recovered P387,500 from its insurance company. How much is the depreciation expense to be recognized for 2021?

Q: On April 1, 2021, DG Corporation purchased an equipment with cost of P150,000. The company estimate…

A: From April 1, 2021 to December 31, 2021 = 9 months Depreciation on equipment will be charged for 9…

Q: What is the depreciation expense for 2024?

A: Sum-of-the-years' digits is an accelerated method for determining an asset's expected depreciation…

Q: At December 31, 2020, the following existed on the records of BULGOGI Co.: Fixed Assets: $86,000…

A: Net Book Value = Fixed Assets - Accumulated Depreciation

Q: On January 2, 2015, Moser, Inc., purchased equipment for $100,000. The equipment was expected to…

A: Annual Depreciation = (Cost of the assets - Salvage value) / life of the assets = ($100000 - 10000)…

Q: The December 31, 2020 balance sheet of Swifty Company showed Equipment of $75,000 and Accumulated…

A: Revised annual depreciation = Depreciable cost / Remaining useful life

Q: On January 1, 2021, PANCHITAS CAFÉ purchased equipment for $180,000. The equipment had an estimated…

A: SLM depreciation = (cost - salvage value)/life = (180000-40000)/10 = 14000 SLM rate = SLM…

Q: Muggsy Bogues Company purchased equipment for $212,000 on October 1, 2020. It is estimated that the…

A: Depreciation: Depreciation is a method of reducing the capitalized cost of long-lived operating…

Q: Steele Company purchased on January 1, 2020, a new machine for $2,100,000. The new machine has an…

A: Sum-of-the-years'-digits = 1+2+3+4+5+6+7+8+9 = 45 years

Q: On January 1, 2017, Jungkook Company purchased an equipment for P1,970,000. On this date, the…

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or…

Q: On January 1, 2024, Sanderson Company acquired a machine for $1,000,000. The estimated useful life…

A: Depreciation: Decreasing value of Assets over its useful life period.

Q: On January 1, 2018, Shopee Company purchased an equipment with an estimated useful life of 8 years.…

A: Solution: Under sum of years digit method of depreciation, depreciation is expected to be higher in…

Q: Winsey Company purchased equipment on January 2, 2019, for $700,000. The equipment has the following…

A: Depreciation is an accounting technique for distributing a tangible or fixed asset's cost over its…

Q: On April 1, 2019, Coronado Industries purchased new machinery for $453000. The machinery has an…

A: The depreciation expense is charged on fixed assets as reduction in value of fixed assets with the…

Q: anuary 1, 2018, Hot Corporation acquired equipment at a cost of ₱1,800,000. Hot adopted the…

A: Depreciation is the decrease in the value of the assets due to their usage. Every asset has certain…

Q: On January 1, 2018, Check Co. bought a machine for $15,000. Residual value was estimated to be…

A: The answer is as fallows

Q: On March 10, 2020, Waterway Limited sold equipment that it bought for $266,880 on August 21, 2013.…

A: Depreciation: When a new fixed asset is purchased, it does not have the price that was at the time…

Q: On January 2, 2021, Oriole Enterprises reports balances in the Equipment account of $34,100 and…

A: Given: Purchase cost as stated in equipment account=$34,100 Accumulated Depreciation=$8,660 Book…

Q: On January 1, 2017, Rabbit Company purchased a machinery for P600,000. The machinery had been…

A: The depreciation is a decline in the value of tangible assets over their useful life. it is a…

Q: Brave Corporation acquired equipment on January 3, 2018 at a cost of P100,000. The estimated useful…

A:

Q: On January 1, 20x1, DOC WILLIE Company acquired equipment from Catanduanes Factory Supplies with an…

A: Note: As per the norms of Bartleby, in case of many independent questions, 1 question can be…

Q: On January 1, 2020, the Metlock, Inc. ledger shows Equipment $38,000 and Accumulated…

A: Annual Depreciation as per Straight-line method = (Cost - Salvage value)/Useful life To find the…

Q: On January 1, 2017, Easy Company acquired an equipment for P8,000,000. The equipment is depreciated…

A: Thanks for the Question Bartleby's Guidelines “Since you have posted a question with multiple…

Q: On December 31, 2020, Flounder Inc. has a machine with a book value of $1,071,600. The original cost…

A: Journal entries are recording of the transaction in the accounting journal in a chronological order.…

Q: On October 1, 2021, Hess Company places a new asset into service. The cost of the asset is $120,000…

A: Depreciation expense: Depreciation expense is the reduction in a particular asset due to its use or…

Q: On December 31, 2020, RJ Co. had delivery equipment in the total cost of P1,000,000.00 and…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: Max purchased 10 Machinery and Equipment in the total amount of P240,000 on June 1, 2018 with an…

A: Annual depreciation = P240,000 / 12 years Annual depreciation = P20,000

Q: company purchased several pieces of equipment for a total of $ 60,000 on January 1, 2019, which is…

A: Net Book Value of Asset: The value at which a firm reports an asset on its balance sheet is referred…

Q: n September 30, 2021, Shamille Company purchased machinery for P7,600,000. Residual value was…

A: The depreciation expense is charged on fixed assets as reduction in the value of fixed assets with…

Q: On April 1, 2021, Robert Sporting Goods Company purchased some new machinery for $3 300 000 to…

A: LUnder this method, depreciation is calculated consideringh the remaining life of asset.

Q: SYD method, how much is the depreciation expense

A: Estimated useful life = 5 years Sum of years' digits = 5 + 4 + 3 + 2 + 1 = 15

Q: On July 1, 2020, Flint Company purchased for $3,960,000 snow-making equipment having an estimated…

A: Depreciation is the amortization of fixed asset cost over its useful life. Under Sum of years digit…

Q: On January 1, 2018, Jane Company purchased an equipment with an estimated useful life of 8 years.…

A: Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of the…

Q: Spiderman Company purchased a machine on January 1, 2017 for P3,760,000. The machine was estimated…

A: Total Sum-of-the-years'-digits = 1+2+3+4+5 = 15 years Total sum of life remaining at the end of 2019…

Q: For the year 2020, how much should be recognized as depreciation expense?

A: Depreciation Expenses:- These are those expenses that appear in the income statement of the company,…

Q: On July 1, 2020, Concord Corporation purchased factory equipment for $283000. Salvage value was…

A: Solution: Under Double declining balance method of depreciation, depreciation is based on double the…

Q: On January 1, 2019, Chiz Company acquired equipment to be used in its manufacturing operations. The…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: Bradley Company purchased a machine for $34,000 on January 1, 2017. It depreciates the machine using…

A: Straight-line method refers to the method by which owners of company extent the value of asset for…

Q: Jaen Advertising Inc. reported the following on its December 31, 2020, balance sheet: Equipment,…

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by…

Q: On December 31, 2020, Riverbed Inc. has a machine with a book value of $1,410,000. The original cost…

A: Solution: Depreciation in 2021 upto April 1, 2021 = $90,000*3/12 = $22,500 Book value of machine on…

Q: At November 1, 2021, the following existed in the records of Lauren Company:Plant and equipment…

A: In this question, we are required to compute the net amount that should appear in Lauren’s statement…

Q: On January 1, 2014, Raven Company acquired a building at cost of P5,000,000. The building has been…

A: 1. Carrying amount = building cost - depreciation = P5,000,000 - (P5,000,000/20 years)*5 year =…

Q: Brown Company purchased equipment in 2014 for $150,000 and estimated a $10,000 salvage value at the…

A:

Q: King Company purchased a machine on July 1, 2021, for P600,000. The machine has an estimated useful…

A: If the value of an asset gets reduced due to the normal usage in the the operation of the business,…

Q: On January 1, 2015, Jersey Corporation purchased for $800,000, equipment having a useful life of ten…

A: Assets are the resources of the business which it has acquired for business purpose. Assets can be…

Q: On January 1, 2021, Canton Inc. has equipment having a useful life of 10 years with the following…

A: Impairment of assets means reducing the book value of assets when carrying amount is more than…

Q: On January 1, 2019, the Morgantown Company ledger shows Equipment $32,000 and Accumulated…

A: Straight-line depreciation method: The depreciation method which assumes that the consumption of…

Q: On January 1, 2017, Mogul company acquired equipment to be used in the manufacturing operations. The…

A: Sum of 5 years = 1+2+3+4+5 = 15 years Sum of 3 years i.e 2017 to 2019 = 5+4+3 = 12

Q: On January 1, 2020, Miller Company purchased a machine for P2,750,000. The machine was depreciated…

A: Working: Total sum of 10 years = 1 + 2 + 3 + 4 + 5 + 6 + 7 + 8 + 9 + 10 = 55 years Sum of Remaining…

Q: Spiral Company uses the sun-of-the years’ digits method to depreciate equipment purchased in January…

A: Solution: Depreciation is a reduction in the value of an asset over time, due to normal wear and…

Q: Equipment was purchased for $86200 on January 1, 2021. Freight charges amounted to $2800 and there…

A: First we need to find capitalized cost of asset Then depreciable value of asset is to be found…

Step by step

Solved in 2 steps

- On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000

- Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.

- Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Dinnell Company owns the following assets: In the year of acquisition and retirement of an asset, Dinnell records depreciation expense for one-half year. During 2020, Asset A was sold for 7,000. Required: Prepare the journal entries to record depreciation on each asset for 2017 through 2020 and the sale of Asset A. Round all answers to the nearest dollar.

- Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.Depreciation Methods On January 1, 2019, Loeffler Company acquired a machine at a cost of $200,000. Loeffler estimates that it will use the machine for 4 years or 8,000 machine hours. It estimates that after 4 years the machine can be sold for $20,000. Loeffler uses the machine for 2,100 and 1,800 machine hours in 2019 and 2020, respectively. Required: Compute depreciation expense for 2019 and 2020 using the (1) straight-line, (2) double-declining-balance, and (3) units-of-production methods of depreciation.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.