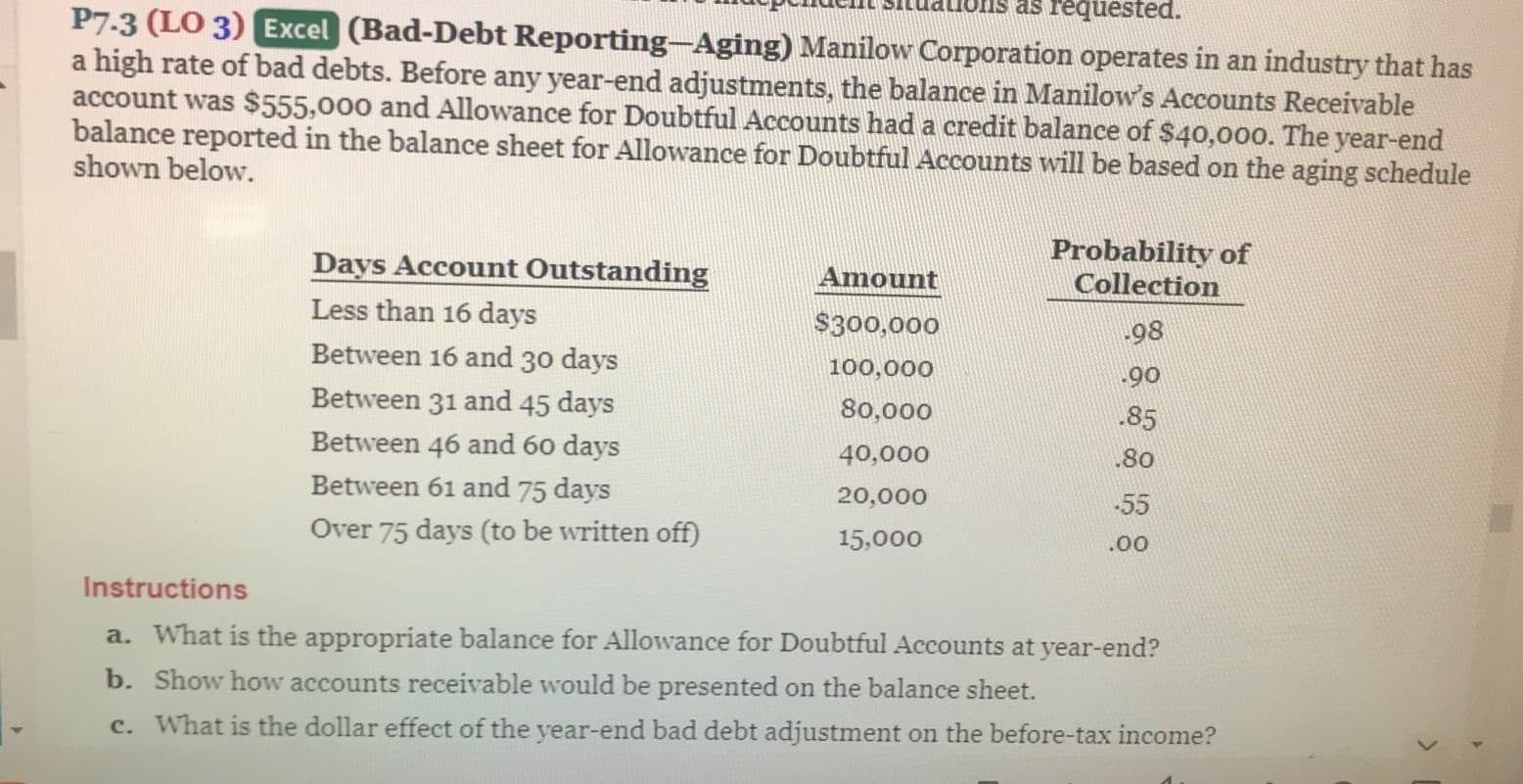

as requested. P7.3 (LO 3) Excel (Bad-Debt Reporting-Aging) Manilow Corporation operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in Manilow's Accounts Receivable account was $555,000 and Allowance for Doubtful Accounts had a credit balance of $40,000. The year-end balance reported in the balance sheet for Allowance for Doubtful Accounts will be based on the aging schedule shown below. Days Account Outstanding Probability of Collection Amount Less than 16 days $300,000 -98 Between 16 and 30 days 100,000 -90 Between 31 and 45 days 80,000 .85 Between 46 and 60 days 40,000 80 Between 61 and 75 days 20,000 -55 Over 75 days (to be written off) 15,000 .00 Instructions a. What is the appropriate balance for Allowance for Doubtful Accounts at year-end? b. Show how accounts receivable would be presented on the balance sheet. c. What is the dollar effect of the year-end bad debt adjustment on the before-tax income?

as requested. P7.3 (LO 3) Excel (Bad-Debt Reporting-Aging) Manilow Corporation operates in an industry that has a high rate of bad debts. Before any year-end adjustments, the balance in Manilow's Accounts Receivable account was $555,000 and Allowance for Doubtful Accounts had a credit balance of $40,000. The year-end balance reported in the balance sheet for Allowance for Doubtful Accounts will be based on the aging schedule shown below. Days Account Outstanding Probability of Collection Amount Less than 16 days $300,000 -98 Between 16 and 30 days 100,000 -90 Between 31 and 45 days 80,000 .85 Between 46 and 60 days 40,000 80 Between 61 and 75 days 20,000 -55 Over 75 days (to be written off) 15,000 .00 Instructions a. What is the appropriate balance for Allowance for Doubtful Accounts at year-end? b. Show how accounts receivable would be presented on the balance sheet. c. What is the dollar effect of the year-end bad debt adjustment on the before-tax income?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 85APSA: Determining Bad Debt Expense Using the Aging Method At the beginning of the year, Tennyson Auto...

Related questions

Question

Good night

Transcribed Image Text:as requested.

P7.3 (LO 3) Excel (Bad-Debt Reporting-Aging) Manilow Corporation operates in an industry that has

a high rate of bad debts. Before any year-end adjustments, the balance in Manilow's Accounts Receivable

account was $555,000 and Allowance for Doubtful Accounts had a credit balance of $40,000. The year-end

balance reported in the balance sheet for Allowance for Doubtful Accounts will be based on the aging schedule

shown below.

Days Account Outstanding

Probability of

Collection

Amount

Less than 16 days

$300,000

-98

Between 16 and 30 days

100,000

-90

Between 31 and 45 days

80,000

.85

Between 46 and 60 days

40,000

80

Between 61 and 75 days

20,000

-55

Over 75 days (to be written off)

15,000

.00

Instructions

a. What is the appropriate balance for Allowance for Doubtful Accounts at year-end?

b. Show how accounts receivable would be presented on the balance sheet.

c. What is the dollar effect of the year-end bad debt adjustment on the before-tax income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT