Assets Liabilities and Equity $ 20,000 280,000 400,000 100,000 Current liabilities. Common stock ($5 par). Paid-in capital in excess of par Retained earnings . Total liabilities and equity Cash $250,000 Inventory Property, plant, and equipment (net) . Goodwill 50,000 130,000 370,000 Total assets. $800,000 $800,000

Q: On December 30, Draco, Inc. acquired a 100% ownership interest in Lamya Corporation at a cost of…

A: After consolidation in the balance sheet, stockholder equity of only Draco, Inc. is reported. So,…

Q: 1.Assume no significant influence was acquired. Prepare the appropriate journal entries from the…

A: Requirement 1: Pass necessary journal entry.

Q: On January 1, Beckman, Inc., acquires 60 percent of the outstanding stock of Calvin for $61,680.…

A: Non-controlling interest represents the shareholders that have a minority interest in the company.

Q: Shark Company purchased inventory from Dolphin Corporation for P120,000 on October 4, 2020, and…

A: Consolidated Sales is the total sales of the group less inter company sales Consolidated Sales =…

Q: Jimin, Inc. purchased 40% of Hope Inc.’s outstanding ordinary shares on January 2, 2021, for…

A: Investment in an associate is calculated by the following equation:- Investment in associate =…

Q: During the past several years the annual net income of Avery Company has averaged $540,000.At the…

A: Goodwill: Goodwill is the good reputation developed by a company over years. This is recorded as an…

Q: On July 1, Zamora Inc. agreed to sell the assets of its Golfright Division to Benito Inc. for $71…

A: Once a division fulfills criteria to classify as a discontinued operation it shall be disclosed in…

Q: Allapacan Company bought 20% of Amulung Corporation’s ordinary shares on January 1, 2009 for…

A: Formula: Total investment income = Total dividends paid x percentage of stake

Q: What is the consolidated amount of machinery on December 31, 20x1? ans. 500,000 2. What is the…

A: Answer:

Q: PAR Inc. purchased 70% of SUBS Inc. on January 1, 2020 for $2,100,000. SUBS's common shares and…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: the amount paid, how much is attributable to goodwill?

A: Goodwill is an intangible asset that can't be touched but increases the image of the company. The…

Q: On January 1, BB Acquired 60 percent of the outstanding voting stock of SS for P260,000 cash…

A: In the consolidated balance sheet, the total assets are determined after adjusting depreciation on…

Q: On January 1, BB Acquired 60 percent of the outstanding voting stock of SS for P260,000 cash…

A: Consolidation is a process where income statement and balance sheet of BB (parent) and SS…

Q: On January 2, 20X1, Entity X purchases 75% of the common stock of Entity Y for P250,000. Entity Y…

A: Solution:

Q: Quail Company purchases 80% of the common stock of Commo Company for $800,000. At the time of the…

A: 1. a.

Q: Pederson Company acquires the net assets of Shelby Company by issuing 100,000 of its $1 par value…

A: Calculation of net identifiable assets is as follows: Resultant table: Calculation of value of…

Q: Parekoy Company acquires 150,000 of the 1,000,000 Marekoy Company’s common stock for P500,000 cash…

A: Under the full goodwill method, the goodwill is calculated by using the fair value of…

Q: Pillow Company is purchasing an 80% interest in the common stock of Sleep Company. Sleep’s balance…

A: a.

Q: At the beginning of current year, Sage Company bought 40% of Eve Company’s outstanding ordinary…

A:

Q: At the beginning of the current year, Lemon Company purchased 40% of the outstanding ordinary shares…

A: In case of an investment in associate for more than 20% shareholding but less than 50%, the investor…

Q: On January 1, 2011, Pat Corporation paid $400,000 for purchase of Sad Corporation, when Sad's…

A: Fair value of net identifiable assets = Common stock + Retained earnings + fair value adjustments…

Q: In the December 31, 2011, consolidated balance sheet, non-controlling interest on a full-fair value…

A: Consolidated Balance Sheet: The consolidated balance sheet is the merger of the parent company…

Q: Prepare the necessary entries to be made by both companies for 20X1 and 20X2. • Allocate the…

A:

Q: Lamberson Cookie Corporation purchased 40% of the 325,000 outstanding shares of HC's Fine Foods,…

A: Journal entry - It refers to the process where the business transactions are recorded in the books…

Q: Sage, Inc. bought 40% of Adams Corp.'s outstanding common stock on January 2, 20x3 for P400,000. The…

A: Given the following information: Sage, Inc. bought 40% of Adams Corp.'s outstanding common stock on…

Q: On January 1, Beckman, Inc., acquires 60 percent of the outstanding stock of Calvin for $57,732.…

A: SOLUTION- CONSOLIDATED BALANCE SHEET IS MERE CONSOLIDATION OF FINANCIAL DETAILS OF ALL A SUBSIDIARY…

Q: Weavile Company acquires 25% of Rhyperior Company's common stock for P380,000 cash and carries the…

A: SOLUTION- TOTAL FAIR VALUE ON ACQUISITION DATE = PURCHASE OF 25% SHARE + PURCHASE OF 55% SHARE +…

Q: Gusion Company purchases 9,000 shares of Layla Company for P70 per share. Before acquisition, Layla…

A: Purchase price = 9000 * 750 = 675000

Q: On January 1, 20X1, Pinto Company purchased an 80% interest in Sands Inc. for $1,000,000. The equity…

A: Income distribution schedule for non controlling Interest: Calculation of net income = 300000 +…

Q: What is the amount of consolidated assets on December 31?

A: Investment in subsidiary does not reported in consolidation financial statement because the parent…

Q: On June 28, Lexicon Corporation acquired 100% of the common stock of Gulf & Eastern. The…

A: Calculate the amortization of patent expenses as follows: Patent = (Amount / Life)*(Period/12)…

Q: Mast Corporation acquires a 75% interest in the common stock of Shaw Company on January 1, 2014,…

A:

Q: On January 1, Beckman, Inc., acquires 60 percent of the outstanding stock of Calvin for $66,312.…

A: Consolidation is a term used for merging of several companies of an industry. The assets,…

Q: On January 1, 2022, Lucas Company acquired 85% of outstanding shares of Luna Corp. The consideration…

A: Solution Non controlling interest is an ownership position wherein a shareholder owns less than 50%…

Q: TRICKY Company acquires 25% of JOKER Corporations ordinary shards for P190,000 cash and carries the…

A: Goodwill is calculated as the difference between the amount of consideration transferred from…

Q: At the beginning of the current year, Occidental Company purchased 40% of the outstanding ordinary…

A: Correct answer is option (a) 1,350,000.

Q: On January 1, BB Acquired 60 percent of the outstanding voting stock of SS for P260,000 cash…

A: Consolidated financial statements are a set of financial statements prepared for a group company…

Q: The following book and fair values were available for Westmont Company as of March 1.Arturo Company…

A: Journal entries are the transactions that are recorded in the primary book. They are chronological…

Q: equired: Show and label calculations. Calculate consolidated ending retained earnings reported on…

A: Consolidate financial statement:A financial statement in which the company reports financial…

Q: P Co acquired 75% of the shares in S Co on 1 January 20X2 when the retained earnings of S Co stood…

A: A consolidated financial position statement is a key fiscal summary if there should be an occurrence…

Q: Pillow Company is purchasing an 80% interest in the common stock of Sleep Company for $800,000.…

A: Non controlling interest is the aggregate interest of all minority shareholders of the company. It…

Q: At the beginning of current year, Cynosure Company purchased 40% of the ordinary shares of another…

A: The following computations are done for Cynosure Company.

Q: Detner International purchases 80% of the outstanding stock of Hardy Company for $1,600,000 on…

A: Determination of value analysis…

Q: On January 1, 2016, Ronald Company purchased 40% of the outstanding ordinary shares of New Company,…

A: Stake percentage of company R in company N = 40% Net income reported by N = ₱5,000,000 Dividend…

Q: Perke Corporation purchased 80% of the stock of Superstition Company for $1,970,000 on January 1,…

A: Net Income is that income is that income which income a businessman gets after deducting all the…

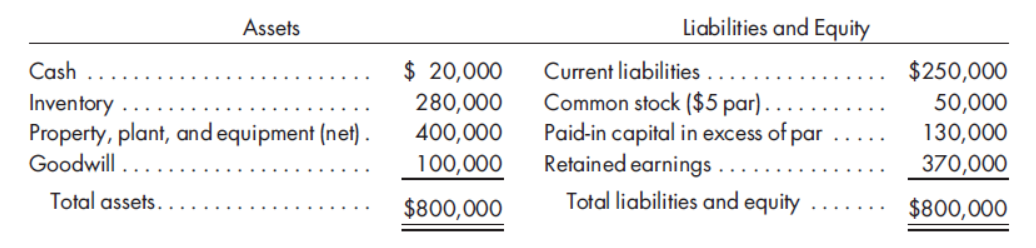

Venus Company purchases 8,000 shares of Sundown Company for $64 per share. Just prior to the purchase, Sundown Company has the following balance sheet: (see attachment)

Venus Company believes that the inventory has a fair value of $400,000 and that the property plant, and equipment is worth $500,000.

1. Prepare the value analysis schedule and the determination and distribution of excess schedule.

2. Prepare the elimination entries that would be made on a consolidated worksheet prepared on the date of acquisition.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

- Current Assets P 1,375,000Property, plant and equipment 3,375,000Other non-current assets 500,000Total Assets P 5,250,000 Liabilities and Shareholders’ equity Total liabilities P 1,500,000Ordinary shares, P10 par value 4,000,000Additional paid in capital 750,000Deficit (1,000,000)Total liabilities and equity P 5,250,000The stockholders and creditors approved the quasi reorganization effective July 1,2011, to be accomplishedby a reduction in property, plant and equipment (net) P 875,000, a reduction in other non-current assets ofP375,000, and a reduction in par value from P10 to P51. Logan’s July 1 balan ce sheet after the quasi-reorganization should show total assets ofa. P 4,000,000b. P 2,500,000c. P 4,375,000d. P 3,875,0002. The balance in additional paid in capital after the quasi-reorganization on July 1 is:a. P 750,000b. P 2,000,000c. P 500,000d. P-0-3. Logan’s deficit after the quasi -reorganization on July 1,2011 should be:a. P 750,000b. P 250,000c.…Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…

- Orbit Limited Statement of Financial Position as at 31 December: 2022 2021 R R ASSETS Non-current assets 11 810 000 7 560 000 Property, plant and equipment 10 025 000 6 250 000 Investments 1 785 000 1 310 000 Current assets 4 190 000 4 690 000 Inventories 1 875 000 2 350 000 Accounts receivable 1 925 000 2 200 000 Cash 390 000 140 000 Total assets 16 000 000 12 250 000 EQUITY AND LIABILITIES Equity ? ? Ordinary share capital 5 480 000 3 680 000 Retained earnings ? ? Non-current liabilities 4 500 000 3 800 000 Loan (20% p.a.) 4 500 000 3 800 000 Current liabilities 2 300 000 1 500 000 Accounts payable 2 300 000 1 500 000 Total equity and liabilities 16 000 000 12 250 000 Statement of Comprehensive Income for the year ended 31 December: 2022 2021 R R Sales 10 800 000 7 150 000 Cost of sales (6 000 000) (3 650 000) Gross profit 4 800 000 3 500 000 Operating expenses (1 800 000) (1 200 000) Depreciation 580 000 200 000…Computational (Show your computations. Round off as follows: e.g. ₩10.64=> ₩11, 0.123456 => 12.35%, 2.4321 => 2.43) . KG Co. had total assets of ₩1,200,000, total liabilities of ₩500,000, and retainedearnings of ₩300,000 at the beginning of 20x1. For the year, the corporationdeclared cash dividends of ₩50,000. At the end of the year, the company hadtotal assets of ₩1,400,000 and showed the debt ratio of 0.4. The company hadno accumulated other comprehensive income.1) Compute the total stockholders’ equity at the end of 20x1. 2) Compute KG’s net profit for 20x1, assuming no change in contributed capitalduring the yearMyers Company provides you with the following condensed balance sheet information. Assets 0000 Liabilities and Stockholders’ Equity Current assets $ 40,000 Current and long-term liabilities 00 $100,000 Equity investments 60,000 Stockholders’ equity 00 00 Equipment (net) 250,000 00Common stock ($5 par) $ 20,000 00 Intangibles $160,000 00Paid-in capital in excess of par 110,000 00 00Total assets $410,000 00Retained earnings 0180,000 $310,000 00 00 0000Total liabilities and stockholders’ equity 00 $410,000 Instructions For each of the following transactions, indicate the dollar impact (if any) on the following five items: (1) total assets, (2) common stock, (3) paid-in capital in excess of par, (4) retained earnings, and (5) stockholders’ equity. (Each situation is independent.) a. Myers declares and pays a $0.50 per share cash dividend. b. Myers declares and issues a 10% stock dividend when the market price of the stock is $14 per share. c.…

- Sandy Corporation’s balance sheet at January 2, 20x5 is as follows:Sandy-Dr(Cr)Cash and receivables P200,000,000Inventories 600,000,000.00Property, plant and equipment, net 7,500,000,000.00 Current liabilities (400,000,000.00)Long-term debt (7,200,000,000.00)Capital stock (7,200,000.00)Retained earnings (25,000,000.00)Accumulated othercomprehensive income (5,000,000.00) An analysis of Sandy’s assets and liabilities reveals that book values of some reported itemsdo not reflect their market values at the date of acquisition:● Inventories are overvalued by P200,000,000● Property, plant and equipment is overvalued by P2,000,000,000● Long-term debt is undervalued by P100,000,000 On January 2, 20x5, Velasco issues new stock with a market value of P700,000,000 toacquire the assets and liabilities of Sandy. Stock registration fees are P100,000,000, paid incash. Consulting, accounting, and legal fees connected with the merger are P150,000,000,paid in cash. In addition, Velasco enters into an…Celloscope Ltd. Balance Sheet 31-Dec-19 Current Assets Cash 18000 Accounts Receivable 20000 Inventory 12000 Prepaid Insurance 600 Sub total 50600 Non-current Assets Land 80000 Building 60000 Less: Accumulated Depreciation 10,000 50000 Sub total 130000 Total Assets 180600 Current Liabilities Accounts payable 50000 Taxes Payable 8000 Sub total 58000 Non-Current Liabilities Bonds Payable (10%) 40000 40000 Owners’ Equity Share Capital 60000 Retained Earning 22600 Sub total 82600 Total Liabilities and Owners’ Equity 180600 The following are expected in the next 3 months January…Pip’s Paw Patrol had the following account Balances on Dec 31, 2021:BOOK Value FMVCurrent Assets $225,000 $250,000Land $320,000 $350,000Building $450,000 $650,000Accum Dep ($50,000)Equipment $195,000 $50,000Accum Dep ($100,000)Current Liabilities ($75,000) ($75,000)Bonds Payable ($200,000) ($300,000)Common Stock ($65,000)Paid in Capital ($700,000)Pip’s industry anticipates an 8% return on investments of P/E/P before accumulated depreciation andPip generated a $120,000 profit in 2021. Pip would like to be paid for 4 years of excess earnings.REQUIRED:a. Calculate the Goodwillb. Calculate the pricec. Record the purchase of the Pip Paw Patrol on the books of the BUYER, assume they issued100,000 shares of $2 par value common stock and paid $40,000 in legal and accounting fees and$50,000 in stock issuance costs to their broker.d. Record the sale of the company on the books of the seller.

- Pip’s Paw Patrol had the following account Balances on Dec 31, 2021:BOOK Value FMVCurrent Assets $225,000 $250,000Land $320,000 $350,000Building $450,000 $650,000Accum Dep ($50,000)Equipment $195,000 $50,000Accum Dep ($100,000)Current Liabilities ($75,000) ($75,000)Bonds Payable ($200,000) ($300,000)Common Stock ($65,000)Paid in Capital ($700,000)Pip’s industry anticipates an 8% return on investments of P/E/P before accumulated depreciation andPip generated a $120,000 profit in 2021. Pip would like to be paid for 4 years of excess earnings.REQUIRED:a. Calculate the Goodwillb. Calculate the pricePip’s Paw Patrol had the following account Balances on Dec 31, 2021:BOOK Value FMVCurrent Assets $225,000 $250,000Land $320,000 $350,000Building $450,000 $650,000Accum Dep ($50,000)Equipment $195,000 $50,000Accum Dep ($100,000)Current Liabilities ($75,000) ($75,000)Bonds Payable ($200,000) ($300,000)Common Stock ($65,000)Paid in Capital ($700,000)Pip’s industry anticipates an 8% return on investments of P/E/P before accumulated depreciation andPip generated a $120,000 profit in 2021. Pip would like to be paid for 4 years of excess earnings.REQUIRED:c. Record the purchase of the Pip Paw Patrol on the books of the BUYER, assume they issued100,000 shares of $2 par value common stock and paid $40,000 in legal and accounting fees and$50,000 in stock issuance costs to their broker.d. Record the sale of the company on the books of the sellerHansel Corporation’s condensed balance sheets appear below: 20X3 20X2 20X1 Assets: Current assets $ 55,000 $ 56,500 $ 70,000 Plant & equipment, net 495,000 410,000 440,000 Intangible assets, net 20,000 27,500 40,000 Total assets $ 570,000 $ 494,000 $ 550,000 Liabilities & Stockholders’ Equity: Current liabilities $ 40,000 $ 35,000 $ 32,500 Long-term liabilities 395,000 310,000 375,000 Stockholders’ equity 135,000 149,000 142,500 Total liabilities & equity $ 570,000 $ 494,000 $ 550,000 In a trend balance sheet for 20X3, long-term liabilities are expressed as Multiple Choice 69.3% 100.0% 105.3% 127.4%