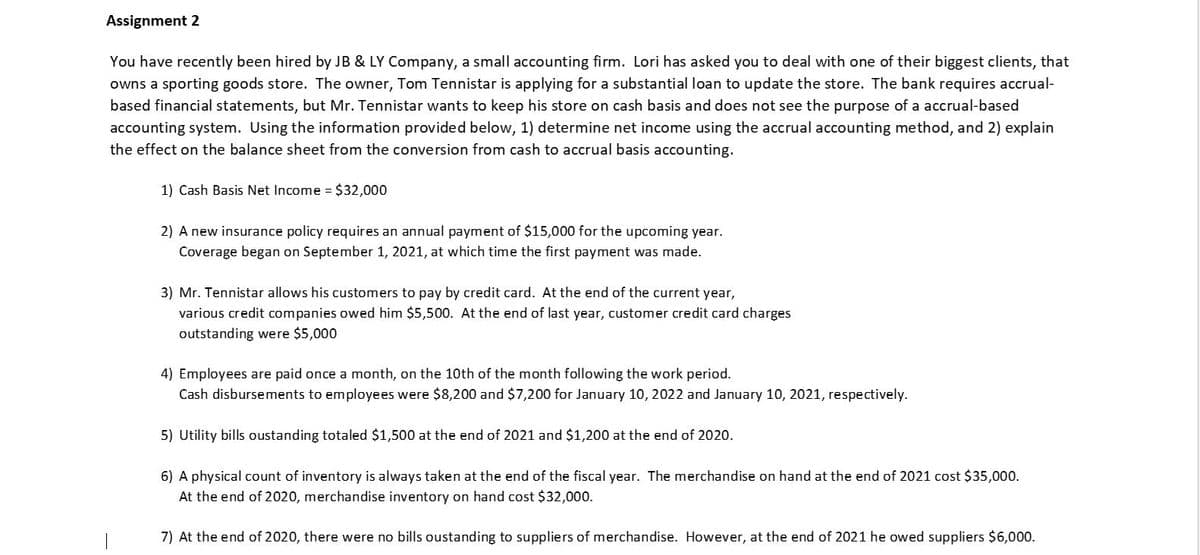

Assignment 2 You have recently been hired by JB & LY Company, a small accounting firm. Lori has asked you to deal with one of their biggest clients, that owns a sporting goods store. The owner, Tom Tennistar is applying for a substantial loan to update the store. The bank requires accrual- based financial statements, but Mr. Tennistar wants to keep his store on cash basis and does not see the purpose of a accrual-based accounting system. Using the information provided below, 1) determine net income using the accrual accounting method, and 2) explain the effect on the balance sheet from the conversion from cash to accrual basis accounting. 1) Cash Basis Net Income $32,000 2) A new insurance policy requires an annual payment of $15,000 for the upcoming year. Coverage began on September 1, 2021, at which time the first payment was made. 3) Mr. Tennistar allows his customers to pay by credit card. At the end of the current year, various credit companies owed him $5,500. At the end of last year, customer credit card charges outstanding were $5,000 4) Employees are paid once a month, on the 10th of the month following the work period. Cash disbursements to employees were $8,200 and $7,200 for January 10, 2022 and January 10, 2021, respectively. 5) Utility bills oustanding totaled $1,500 at the end of 2021 and $1,200 at the end of 2020. 6) A physical count of inventory is always taken at the end of the fiscal year. The merchandise on hand at the end of 2021 cost $35,000. At the end of 2020, merchandise inventory on hand cost $32,000. 7) At the end of 2020, there were no bills oustanding to suppliers of merchandise. However, at the end of 2021 he owed suppliers $6,000.

Assignment 2 You have recently been hired by JB & LY Company, a small accounting firm. Lori has asked you to deal with one of their biggest clients, that owns a sporting goods store. The owner, Tom Tennistar is applying for a substantial loan to update the store. The bank requires accrual- based financial statements, but Mr. Tennistar wants to keep his store on cash basis and does not see the purpose of a accrual-based accounting system. Using the information provided below, 1) determine net income using the accrual accounting method, and 2) explain the effect on the balance sheet from the conversion from cash to accrual basis accounting. 1) Cash Basis Net Income $32,000 2) A new insurance policy requires an annual payment of $15,000 for the upcoming year. Coverage began on September 1, 2021, at which time the first payment was made. 3) Mr. Tennistar allows his customers to pay by credit card. At the end of the current year, various credit companies owed him $5,500. At the end of last year, customer credit card charges outstanding were $5,000 4) Employees are paid once a month, on the 10th of the month following the work period. Cash disbursements to employees were $8,200 and $7,200 for January 10, 2022 and January 10, 2021, respectively. 5) Utility bills oustanding totaled $1,500 at the end of 2021 and $1,200 at the end of 2020. 6) A physical count of inventory is always taken at the end of the fiscal year. The merchandise on hand at the end of 2021 cost $35,000. At the end of 2020, merchandise inventory on hand cost $32,000. 7) At the end of 2020, there were no bills oustanding to suppliers of merchandise. However, at the end of 2021 he owed suppliers $6,000.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter1: Starting A Proprietorship: Changes That Affect The Accounting Equation

Section1.3: How Transactions Change Owner’s Equity In An Accounting Equation

Problem 1WT

Related questions

Question

100%

Transcribed Image Text:Assignment 2

You have recently been hired by JB & LY Company, a small accounting firm. Lori has asked you to deal with one of their biggest clients, that

owns a sporting goods store. The owner, Tom Tennistar is applying for a substantial loan to update the store. The bank requires accrual-

based financial statements, but Mr. Tennistar wants to keep his store on cash basis and does not see the purpose of a accrual-based

accounting system. Using the information provided below, 1) determine net income using the accrual accounting method, and 2) explain

the effect on the balance sheet from the conversion from cash to accrual basis accounting.

1) Cash Basis Net Income = $32,000

2) A new insurance policy requires an annual payment of $15,000 for the upcoming year.

Coverage began on September 1, 2021, at which time the first payment was made.

3) Mr. Tennistar allows his customers to pay by credit card. At the end of the current year,

various credit companies owed him $5,500. At the end of last year, customer credit card charges

outstanding were $5,000

4) Employees are paid once a month, on the 10th of the month following the work period.

Cash disbursements to employees were $8,200 and $7,200 for January 10, 2022 and January 10, 2021, respectively.

5) Utility bills oustanding totaled $1,500 at the end of 2021 and $1,200 at the end of 2020.

6) A physical count of inventory is always taken at the end of the fiscal year. The merchandise on hand at the end of 2021 cost $35,000.

At the end of 2020, merchandise inventory on hand cost $32,000.

7) At the end of 2020, there were no bills oustanding to suppliers of merchandise. However, at the end of 2021 he owed suppliers $6,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College