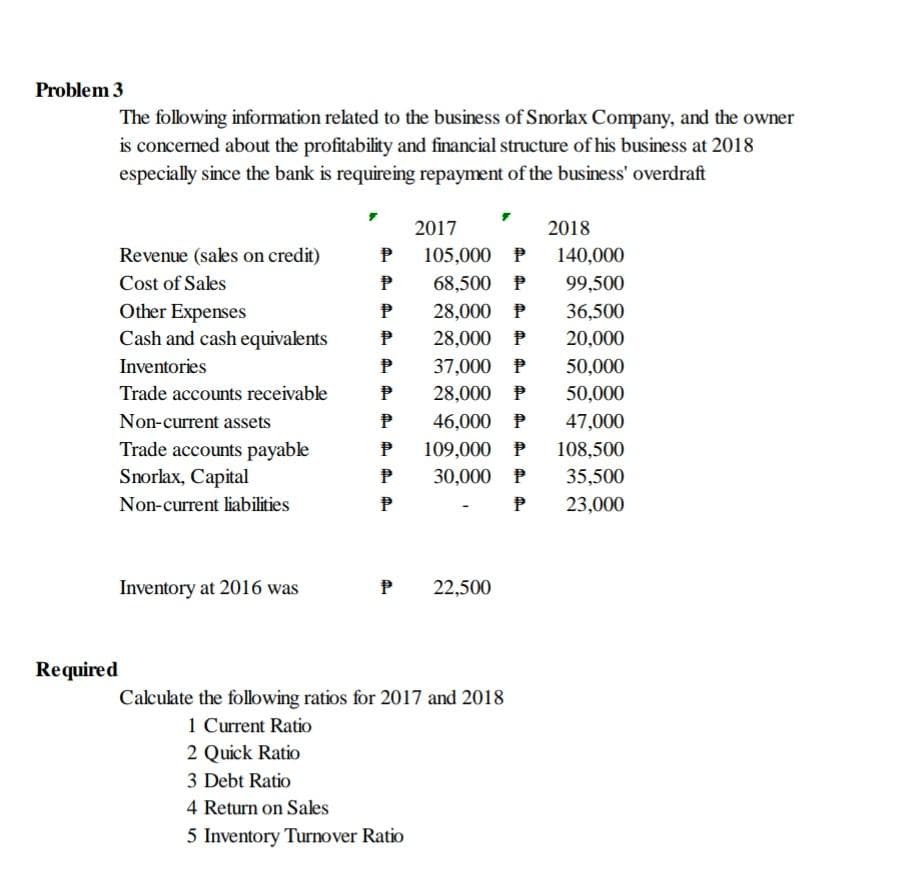

Problem 3 Required The following information related to the business of Snorlax Company, and the owner is concerned about the profitability and financial structure of his business at 2018 especially since the bank is requireing repayment of the business' overdraft 2017 2018 Revenue (sales on credit) P 105,000 P 140,000 Cost of Sales P 68,500 P 99,500 Other Expenses P 28,000 P 36,500 Cash and cash equivalents P 28,000 P 20,000 Inventories P 37,000 P 50,000 Trade accounts receivable P 28,000 P 50,000 Non-current assets P 46,000 P 47,000 P 109,000 P 108,500 Trade accounts payable Snorlax, Capital P 30,000 P 35,500 Non-current liabilities P P 23,000 Inventory at 2016 was P 22,500 Calculate the following ratios for 2017 and 2018 1 Current Ratio 2 Quick Ratio 3 Debt Ratio 4 Return on Sales 5 Inventory Turnover Ratio

Problem 3 Required The following information related to the business of Snorlax Company, and the owner is concerned about the profitability and financial structure of his business at 2018 especially since the bank is requireing repayment of the business' overdraft 2017 2018 Revenue (sales on credit) P 105,000 P 140,000 Cost of Sales P 68,500 P 99,500 Other Expenses P 28,000 P 36,500 Cash and cash equivalents P 28,000 P 20,000 Inventories P 37,000 P 50,000 Trade accounts receivable P 28,000 P 50,000 Non-current assets P 46,000 P 47,000 P 109,000 P 108,500 Trade accounts payable Snorlax, Capital P 30,000 P 35,500 Non-current liabilities P P 23,000 Inventory at 2016 was P 22,500 Calculate the following ratios for 2017 and 2018 1 Current Ratio 2 Quick Ratio 3 Debt Ratio 4 Return on Sales 5 Inventory Turnover Ratio

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 64.1C

Related questions

Question

Please do all ratios otherwise I downvote the answer

Transcribed Image Text:Problem 3

Required

The following information related to the business of Snorlax Company, and the owner

is concerned about the profitability and financial structure of his business at 2018

especially since the bank is requireing repayment of the business' overdraft

2017

2018

Revenue (sales on credit)

P

105,000 P

140,000

99,500

Cost of Sales

P

68,500 P

Other Expenses

P

28,000 P

36,500

Cash and cash equivalents

P

28,000 P

20,000

Inventories

P

37,000 P

50,000

Trade accounts receivable

P

28,000 P

50,000

Non-current assets

P

46,000 P

47,000

P

109,000 P

108,500

Trade accounts payable

Snorlax, Capital

P

30,000 P

35,500

Non-current liabilities

P

P

23,000

Inventory at 2016 was

P 22,500

Calculate the following ratios for 2017 and 2018

1 Current Ratio

2 Quick Ratio

3 Debt Ratio

4 Return on Sales

5 Inventory Turnover Ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning