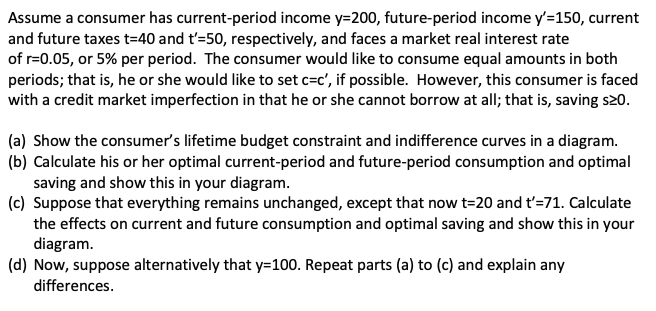

Assume a consumer has current-period income y=200, future-period income y'=150, current and future taxes t=40 and t'=50, respectively, and faces a market real interest rate of r=0.05, or 5% per period. The consumer would like to consume equal amounts in both periods; that is, he or she would like to set c=c', if possible. However, this consumer is faced with a credit market imperfection in that he or she cannot borrow at all; that is, saving s20. (a) Show the consumer's lifetime budget constraint and indifference curves in a diagram. (b) Calculate his or her optimal current-period and future-period consumption and optimal saving and show this in your diagram. (c) Suppose that everything remains unchanged, except that now t=20 and t'=71. Calculate the effects on current and future consumption and optimal saving and show this in your diagram. (d) Now, suppose alternatively that y=100. Repeat parts (a) to (c) and explain any differences.

Assume a consumer has current-period income y=200, future-period income y'=150, current and future taxes t=40 and t'=50, respectively, and faces a market real interest rate of r=0.05, or 5% per period. The consumer would like to consume equal amounts in both periods; that is, he or she would like to set c=c', if possible. However, this consumer is faced with a credit market imperfection in that he or she cannot borrow at all; that is, saving s20. (a) Show the consumer's lifetime budget constraint and indifference curves in a diagram. (b) Calculate his or her optimal current-period and future-period consumption and optimal saving and show this in your diagram. (c) Suppose that everything remains unchanged, except that now t=20 and t'=71. Calculate the effects on current and future consumption and optimal saving and show this in your diagram. (d) Now, suppose alternatively that y=100. Repeat parts (a) to (c) and explain any differences.

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.7P

Related questions

Question

Transcribed Image Text:Assume a consumer has current-period income y=200, future-period income y'=150, current

and future taxes t=40 and t'=50, respectively, and faces a market real interest rate

of r=0.05, or 5% per period. The consumer would like to consume equal amounts in both

periods; that is, he or she would like to set c=c', if possible. However, this consumer is faced

with a credit market imperfection in that he or she cannot borrow at all; that is, saving s20.

(a) Show the consumer's lifetime budget constraint and indifference curves in a diagram.

(b) Calculate his or her optimal current-period and future-period consumption and optimal

saving and show this in your diagram.

(c) Suppose that everything remains unchanged, except that now t=20 and t'=71. Calculate

the effects on current and future consumption and optimal saving and show this in your

diagram.

(d) Now, suppose alternatively that y=100. Repeat parts (a) to (c) and explain any

differences.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc