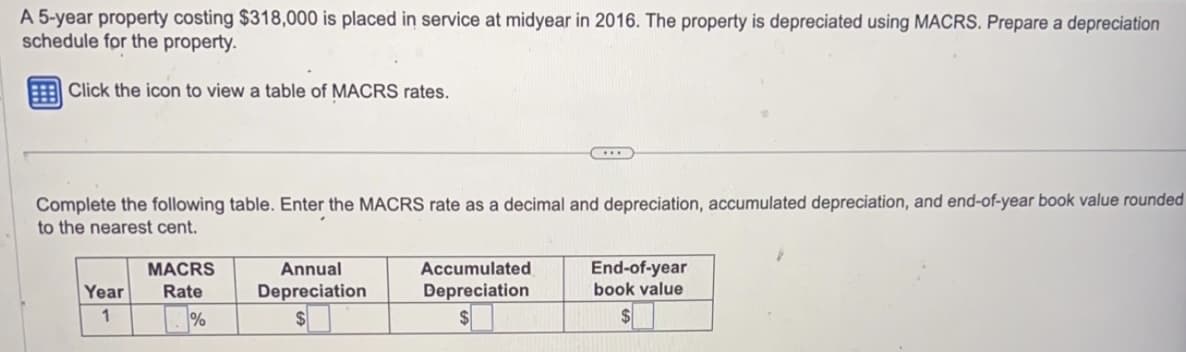

A 5-year property costing $318,000 is placed in service at midyear in 2016. The property is depreciated using MACRS. Prepare a depreciation schedule for the property. Click the icon to view a table of MACRS rates. Complete the following table. Enter the MACRS rate as a decimal and depreciation, accumulated depreciation, and end-of-year book value rounded to the nearest cent. Year 1 MACRS Rate % Annual Depreciation Accumulated Depreciation End-of-year book value $

A 5-year property costing $318,000 is placed in service at midyear in 2016. The property is depreciated using MACRS. Prepare a depreciation schedule for the property. Click the icon to view a table of MACRS rates. Complete the following table. Enter the MACRS rate as a decimal and depreciation, accumulated depreciation, and end-of-year book value rounded to the nearest cent. Year 1 MACRS Rate % Annual Depreciation Accumulated Depreciation End-of-year book value $

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 30CE

Related questions

Question

Transcribed Image Text:A 5-year property costing $318,000 is placed in service at midyear in 2016. The property is depreciated using MACRS. Prepare a depreciation

schedule for the property.

Click the icon to view a table of MACRS rates.

Complete the following table. Enter the MACRS rate as a decimal and depreciation, accumulated depreciation, and end-of-year book value rounded

to the nearest cent.

Year

1

MACRS

Rate

%

Annual

Depreciation

...

Accumulated

Depreciation

$

End-of-year

book value

$

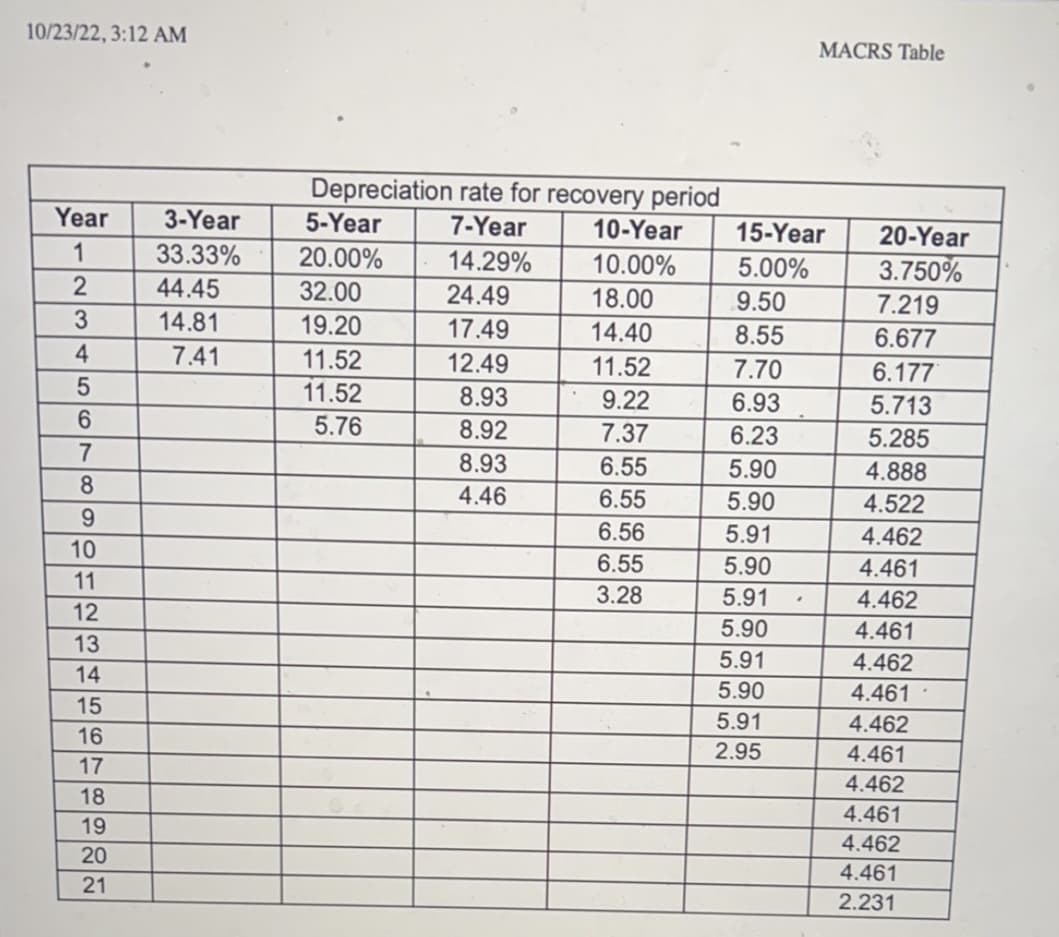

Transcribed Image Text:10/23/22, 3:12 AM

Year 3-Year

1

33.33%

2

3

4

5

6

7

8

9012345673222

11

18

44.45

14.81

7.41

Depreciation rate for recovery period

7-Year

14.29%

5-Year

20.00%

32.00

19.20

11.52

11.52

5.76

24.49

17.49

12.49

8.93

8.92

8.93

4.46

10-Year 15-Year

10.00%

5.00%

9.50

8.55

7.70

6.93

6.23

18.00

14.40

11.52

9.22

7.37

6.55

6.55

6.56

6.55

3.28

5.90

5.90

5.91

5.90

5.91

5.90

5.91

5.90

5.91

2.95

MACRS Table

"

20-Year

3.750%

7.219

6.677

6.177

5.713

5.285

4.888

4.522

4.462

4.461

4.462

4.461

4.462

4.461

4.462

4.461

4.462

4.461

4.462

4.461

2.231

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT