(Assume that selling and administrative expenses are associated with goods sold.) Levine sells its products for $216 per unit. Required a. Prepare income statements based on absorption costing for Year 2 and Year 3. b. Since Levine sold the same number of units in Year 2 and Year 3, why did net income increase in Year 3? d. Determine the costs of ending inventory for Year 3.

(Assume that selling and administrative expenses are associated with goods sold.) Levine sells its products for $216 per unit. Required a. Prepare income statements based on absorption costing for Year 2 and Year 3. b. Since Levine sold the same number of units in Year 2 and Year 3, why did net income increase in Year 3? d. Determine the costs of ending inventory for Year 3.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 29P: Jellison Company had the following operating data for its first two years of operations: Jellison...

Related questions

Question

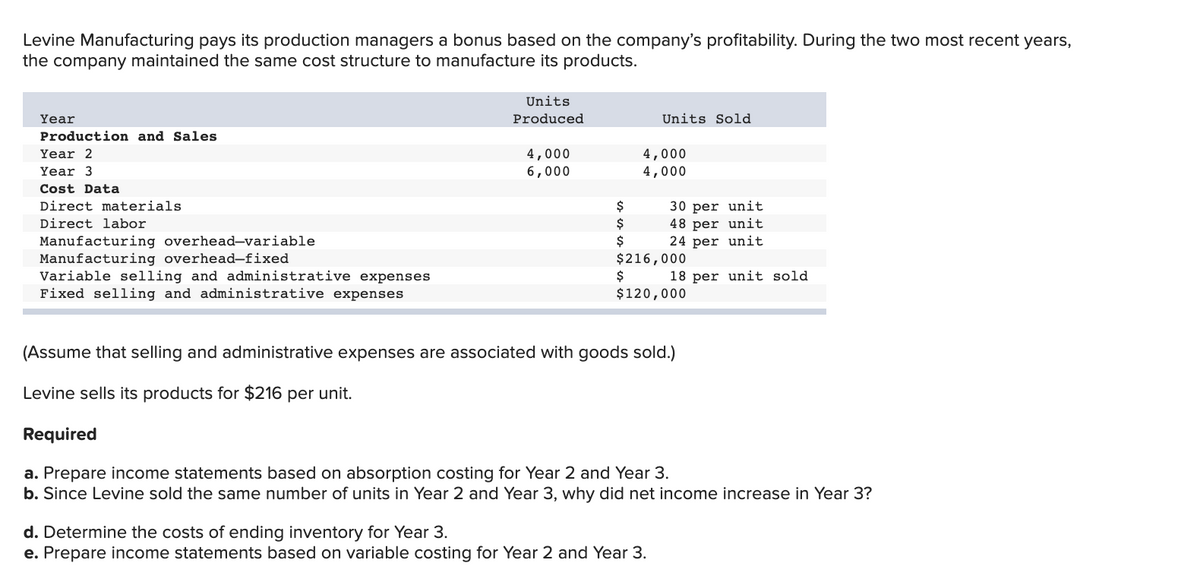

Transcribed Image Text:Levine Manufacturing pays its production managers a bonus based on the company's profitability. During the two most recent years,

the company maintained the same cost structure to manufacture its products.

Units

Year

Produced

Units Sold

Production and Sales

Year 2

4,000

4,000

4,000

Year 3

6,000

Cost Data

30 per unit

48 per unit

24 per unit

Direct materials

$

Direct labor

$

Manufacturing overhead-variable

Manufacturing overhead-fixed

Variable selling and administrative expenses

Fixed selling and administrative expenses

$216,000

$

18 per unit sold

$120,000

(Assume that selling and

expenses are

with goods sold.)

Levine sells its products for $216 per unit.

Required

a. Prepare income statements based on absorption costing for Year 2 and Year 3.

b. Since Levine sold the same number of units in Year 2 and Year 3, why did net income increase in Year 3?

d. Determine the costs of ending inventory for Year 3.

e. Prepare income statements based on variable costing for Year 2 and Year 3.

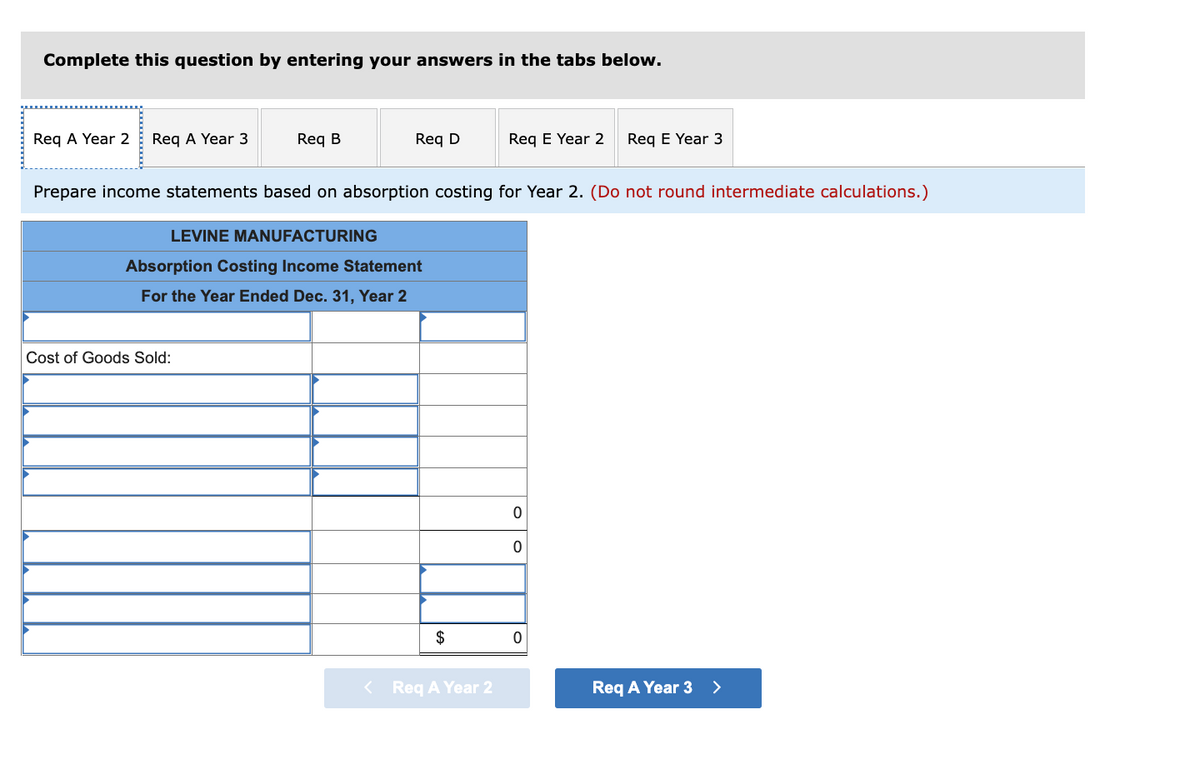

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req A Year 2

Req A Year 3

Req B

Req D

Req E Year 2

Reg E Year 3

Prepare income statements based on absorption costing for Year 2. (Do not round intermediate calculations.)

LEVINE MANUFACTURING

Absorption Costing Income Statement

For the Year Ended Dec. 31, Year 2

Cost of Goods Sold:

$

< Req A Year 2

Req A Year 3

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning