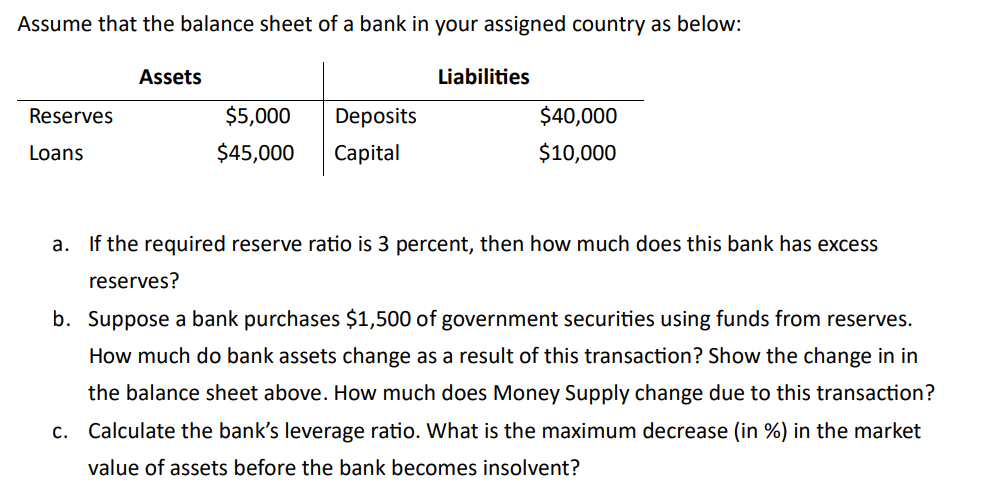

Assume that the balance sheet of a bank in your assigned country as below: Reserves Loans Assets $5,000 $45,000 Deposits Capital Liabilities $40,000 $10,000 a. If the required reserve ratio is 3 percent, then how much does this bank has excess reserves? b. Suppose a bank purchases $1,500 of government securities using funds from reserves. How much do bank assets change as a result of this transaction? Show the change in in the balance sheet above. How much does Money Supply change due to this transaction? c. Calculate the bank's leverage ratio. What is the maximum decrease (in %) in the market value of assets before the bank becomes insolvent?

Assume that the balance sheet of a bank in your assigned country as below: Reserves Loans Assets $5,000 $45,000 Deposits Capital Liabilities $40,000 $10,000 a. If the required reserve ratio is 3 percent, then how much does this bank has excess reserves? b. Suppose a bank purchases $1,500 of government securities using funds from reserves. How much do bank assets change as a result of this transaction? Show the change in in the balance sheet above. How much does Money Supply change due to this transaction? c. Calculate the bank's leverage ratio. What is the maximum decrease (in %) in the market value of assets before the bank becomes insolvent?

Essentials of Economics (MindTap Course List)

8th Edition

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter21: The Monetary System

Section: Chapter Questions

Problem 10PA

Related questions

Question

Assume that the balance sheet of a bank in your assigned country as below:

Assets Liabilities

Reserves $5,000 Deposits $40,000

Loans $45,000 Capital $10,000

a. If the

reserves?

b. Suppose a bank purchases $1,500 of government securities using funds from reserves.

How much do bank assets change as a result of this transaction? Show the change in

the balance sheet above. How much does Money Supply change due to this transaction?

c. Calculate the bank’s leverage ratio. What is the maximum decrease (in %) in the market

value of assets before the bank becomes insolvent?

Transcribed Image Text:Assume that the balance sheet of a bank in your assigned country as below:

Reserves

Loans

Assets

$5,000

$45,000

Deposits

Capital

Liabilities

$40,000

$10,000

a.

If the required reserve ratio is 3 percent, then how much does this bank has excess

reserves?

b. Suppose a bank purchases $1,500 of government securities using funds from reserves.

How much do bank assets change as a result of this transaction? Show the change in in

the balance sheet above. How much does Money Supply change due to this transaction?

c. Calculate the bank's leverage ratio. What is the maximum decrease (in %) in the market

value of assets before the bank becomes insolvent?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning