Assume that the CAPM assumptions hold. Consider the following statements: i. A stock with a beta below zero will tend to move in the same direction as the market but will tend move less aggressively in that direction than the market does. ii. Alpha measures the additional risk we take on top of the risk of the market portfolio. Select one: Oa. Only statement ii. b. Both statements are correct. Oc. Only statement i. Od. Both statements are false.

Assume that the CAPM assumptions hold. Consider the following statements: i. A stock with a beta below zero will tend to move in the same direction as the market but will tend move less aggressively in that direction than the market does. ii. Alpha measures the additional risk we take on top of the risk of the market portfolio. Select one: Oa. Only statement ii. b. Both statements are correct. Oc. Only statement i. Od. Both statements are false.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter25: Portfolio Theory And Asset Pricing Models

Section: Chapter Questions

Problem 4MC: You have been hired at the investment firm of Bowers Noon. One of its clients doesnt understand the...

Related questions

Question

G 2

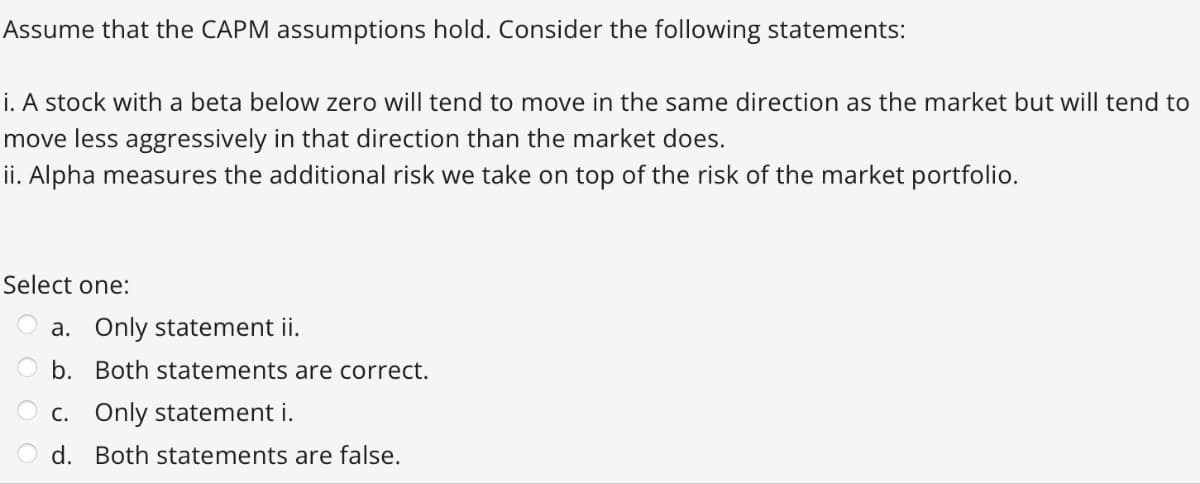

Transcribed Image Text:Assume that the CAPM assumptions hold. Consider the following statements:

i. A stock with a beta below zero will tend to move in the same direction as the market but will tend to

move less aggressively in that direction than the market does.

ii. Alpha measures the additional risk we take on top of the risk of the market portfolio.

Select one:

Oa. Only statement ii.

b. Both statements are correct.

Oc. Only statement i.

Od. Both statements are false.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT