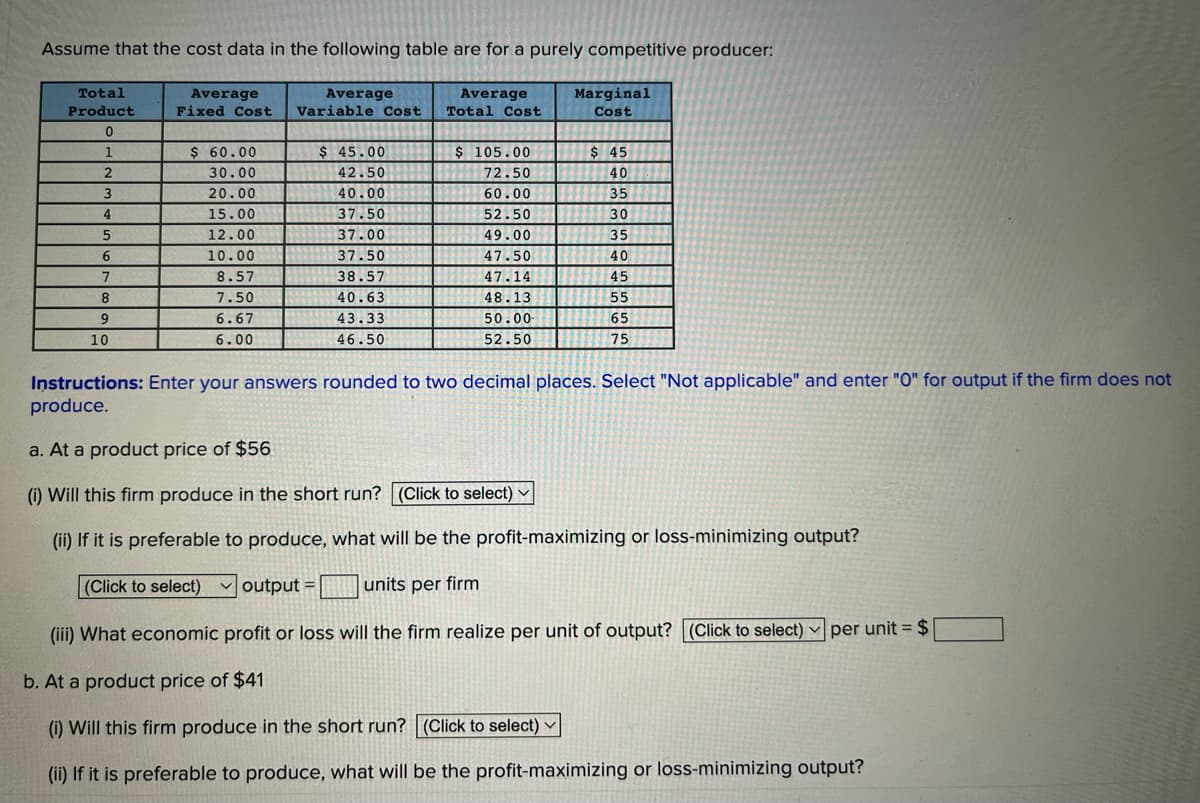

Assume that the cost data in the following table are for a purely competitive producer: Total Marginal Average Fixed Cost Average Variable Cost Average Total Cost Product Cost $ 60.00 $ 45.00 $ 105.00 $ 45 30.00 42.50 72.50 40 3 20.00 40.00 60.00 35 4 15.00 37.50 52.50 30 12.00 37.00 49.00 35 6. 10.00 37.50 47.50 40 8.57 38.57 47.14 45 8 7.50 40.63 48.13 55 6.67 43.33 50.00 65 10 6.00 46.50 52.50 75 Instructions: Enter your answers rounded to two decimal places. Select "Not applicable" and enter "O" for output if the fi produce. a. At a product price of $56 (i) Will this firm produce in the short run? (Click to select) ♥ (ii) If it is preferable to produce, what will be the profit-maximizing or loss-minimizing output? |(Click to select) output = | units per firm (iii) What economic profit or loss will the firm realize per unit of output? (Click to select) v per unit = $ b. At a product price of $41 (i) Will this firm produce in the short run? (Click to select) ▼ (ii) If it is preferable to produce, what will be the profit-maximizing or loss-minimizing output?

Assume that the cost data in the following table are for a purely competitive producer: Total Marginal Average Fixed Cost Average Variable Cost Average Total Cost Product Cost $ 60.00 $ 45.00 $ 105.00 $ 45 30.00 42.50 72.50 40 3 20.00 40.00 60.00 35 4 15.00 37.50 52.50 30 12.00 37.00 49.00 35 6. 10.00 37.50 47.50 40 8.57 38.57 47.14 45 8 7.50 40.63 48.13 55 6.67 43.33 50.00 65 10 6.00 46.50 52.50 75 Instructions: Enter your answers rounded to two decimal places. Select "Not applicable" and enter "O" for output if the fi produce. a. At a product price of $56 (i) Will this firm produce in the short run? (Click to select) ♥ (ii) If it is preferable to produce, what will be the profit-maximizing or loss-minimizing output? |(Click to select) output = | units per firm (iii) What economic profit or loss will the firm realize per unit of output? (Click to select) v per unit = $ b. At a product price of $41 (i) Will this firm produce in the short run? (Click to select) ▼ (ii) If it is preferable to produce, what will be the profit-maximizing or loss-minimizing output?

Chapter11: The Firm: Production And Costs

Section: Chapter Questions

Problem 3P

Related questions

Question

Question 16

Transcribed Image Text:Assume that the cost data in the following table are for a purely competitive producer:

Total

Marginal

Average

Fixed Cost

Average

Variable Cost

Average

Product

Total Cost

Cost

1111

$ 105.00

1

$ 60.00

$ 45.00

$ 45

30.00

42.50

72.50

40

3

20.00

40.00

60.00

35

15.00

37.50

52.50

30

12.00

37.00

49.00

35

6.

10.00

37.50

47.50

40

8.57

38.57

47.14

45

8

7.50

40.63

48.13

55

9

6.67

43.33

50.00

65

10

6.00

46.50

52.50

75

Instructions: Enter your answers rounded to two decimal places. Select "Not applicable" and enter "0" for output if the firm does not

produce.

a. At a product price of $56

(i) Will this firm produce in the short run? (Click to select) ▼

(ii) If it is preferable to produce, what will be the profit-maximizing or loss-minimizing output?

(Click to select) v output =

units per firm

(iii) What economic profit or loss will the firm realize per unit of output? (Click to select)

per unit = $

b. At a product price of $41

(i) Will this firm produce in the short run? (Click to select)

(ii) If it is preferable to produce, what will be the profit-maximizing or loss-minimizing output?

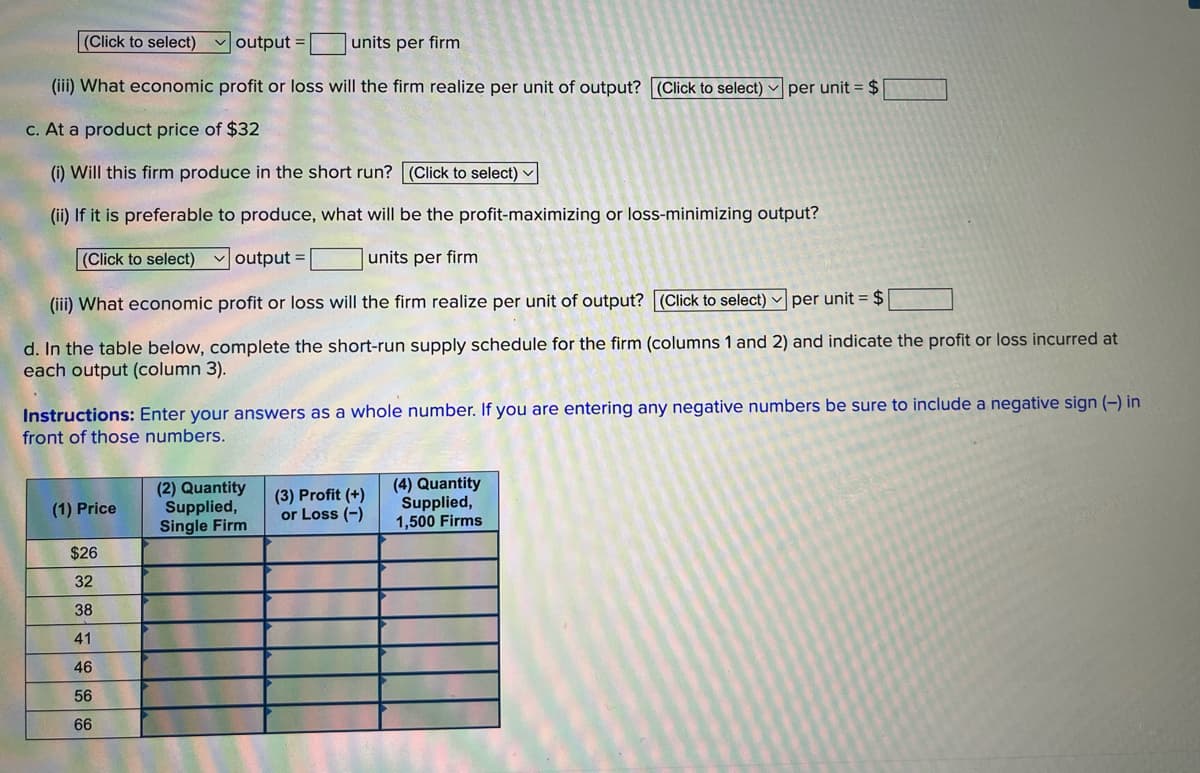

Transcribed Image Text:(Click to select) output =

units per firm

(iii) What economic profit or loss will the firm realize per unit of output? (Click to select) per unit = $

C. At a product price of $32

(i) Will this firm produce in the short run? (Click to select) ▼

(ii) If it is preferable to produce, what will be the profit-maximizing or loss-minimizing output?

(Click to select)

v output =

units per firm

(iii) What economic profit or loss will the firm realize per unit of output? (Click to select) v per unit = $

d. In the table below, complete the short-run supply schedule for the firm (columns 1 and 2) and indicate the profit or loss incurred at

each output (column 3).

Instructions: Enter your answers as a whole number. If you are entering any negative numbers be sure to include a negative sign (-) in

front of those numbers.

(2) Quantity

Supplied,

Single Firm

(3) Profit (+)

or Loss (-)

(4) Quantity

Supplied,

1,500 Firms

(1) Price

$26

32

38

41

46

56

66

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc