Assume that the money multiplier m deposit ratio, e is the excess reserve ratio and r is the required reserve ratio. 1+c)/(r+e+c). Where c is the currency a) With examples, explain what will cause an increase in the ratios c, e and r b) Explain the implications of an increase in each of the ratios on the ability of the central bank to increase money supply by increasing the monetary base. Page 1 of 2 c) Assume that consumers trust in the banking sector improves because of more transparent banking practices. How will this affect the money multiplier and the central bank's monetary control?

Assume that the money multiplier m deposit ratio, e is the excess reserve ratio and r is the required reserve ratio. 1+c)/(r+e+c). Where c is the currency a) With examples, explain what will cause an increase in the ratios c, e and r b) Explain the implications of an increase in each of the ratios on the ability of the central bank to increase money supply by increasing the monetary base. Page 1 of 2 c) Assume that consumers trust in the banking sector improves because of more transparent banking practices. How will this affect the money multiplier and the central bank's monetary control?

Chapter25: Money Creation

Section: Chapter Questions

Problem 8SQP

Related questions

Question

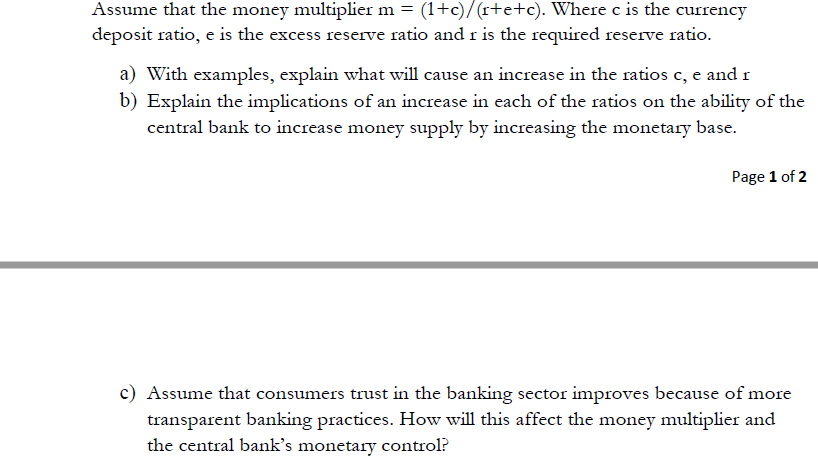

Transcribed Image Text:Assume that the money multiplier m = (1+c)/(r+e+c). Where c is the currency

deposit ratio, e is the excess reserve ratio and r is the required reserve ratio.

a) With examples, explain what will cause an increase in the ratios c, e and r

b) Explain the implications of an increase in each of the ratios on the ability of the

central bank to increase money supply by increasing the monetary base.

Page 1 of 2

c) Assume that consumers trust in the banking sector improves because of more

transparent banking practices. How will this affect the money multiplier and

the central bank's monetary control?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning