Assume that the social security tax rate is 0% and the Medicare tax rate is 1.5%. In the folowing summary of data for a payrol period. some amounts have been intentionally omited: Eamings 1. At regular rate 2. At overtime rate 3.Total eamings so0.000 Deductions: 4. Social security tax 5. Medicare tax 6. Federal income tax withheld 37.500 9.390 130.000 7. Medical insurance 21.910 8. Union dues 2. Total deductions 205.810 10. Net amount paid 420.300 Accounts debited: 11. Factory Wages 287.000 12. Sales Salaries 13. Office Salaries 100.000 Required: a. Detemine the amounts omitted in lines (1), (3). (3), and (12). b. On December 19, jourmalize the entry to record the payrol acorual c. On December 20, joumalice the entry to record the payment of the payroll Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations Every line on a joumal page is used for debit or oredit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered

Assume that the social security tax rate is 0% and the Medicare tax rate is 1.5%. In the folowing summary of data for a payrol period. some amounts have been intentionally omited: Eamings 1. At regular rate 2. At overtime rate 3.Total eamings so0.000 Deductions: 4. Social security tax 5. Medicare tax 6. Federal income tax withheld 37.500 9.390 130.000 7. Medical insurance 21.910 8. Union dues 2. Total deductions 205.810 10. Net amount paid 420.300 Accounts debited: 11. Factory Wages 287.000 12. Sales Salaries 13. Office Salaries 100.000 Required: a. Detemine the amounts omitted in lines (1), (3). (3), and (12). b. On December 19, jourmalize the entry to record the payrol acorual c. On December 20, joumalice the entry to record the payment of the payroll Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations Every line on a joumal page is used for debit or oredit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 2PB

Related questions

Question

.

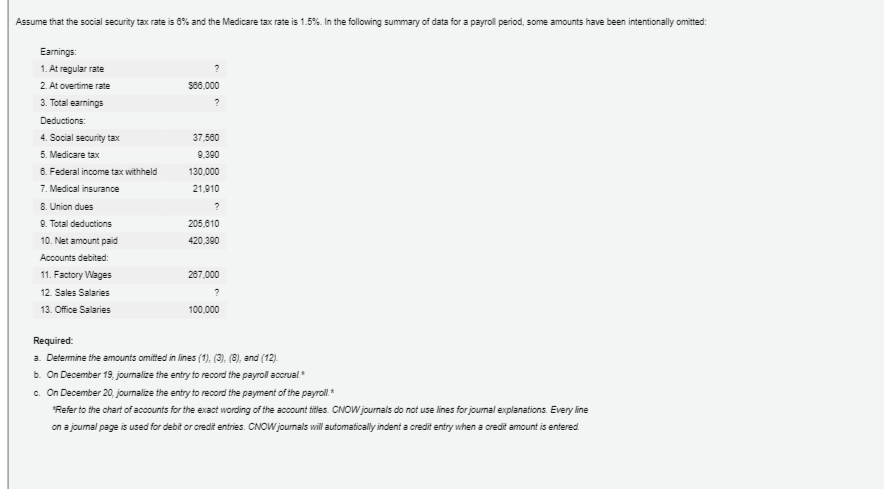

Transcribed Image Text:Assume that the social security tax rate is 6% and the Medicare tax rate is 1.5%. In the following summary of data for a payroll period, some amounts have been intentionally omitted:

Earnings:

1. At regular rate

2. At overtime rate

S88,000

3. Total earnings

Deductions:

4. Social security tax

37.500

5. Medicare tax

9,390

6. Federal income tax withheld

7. Medical insurance

130,000

21,910

8. Union dues

9. Total deductions

205,010

10. Net amount paid

420,390

Accounts debited:

11. Factory Wages

267,000

12. Sales Salaries

13. Office Salaries

100,000

Required:

a. Detemine the amounts omitted in lines (1), (3), (3), and (12).

b. On December 19, jourmalize the entry to record the payrol accrual

c. On December 20, journalize the entry to record the payment of the payroll.*

"Refer to the chart of accounts for the evact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line

on a joumal page is used for debit or oredit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College