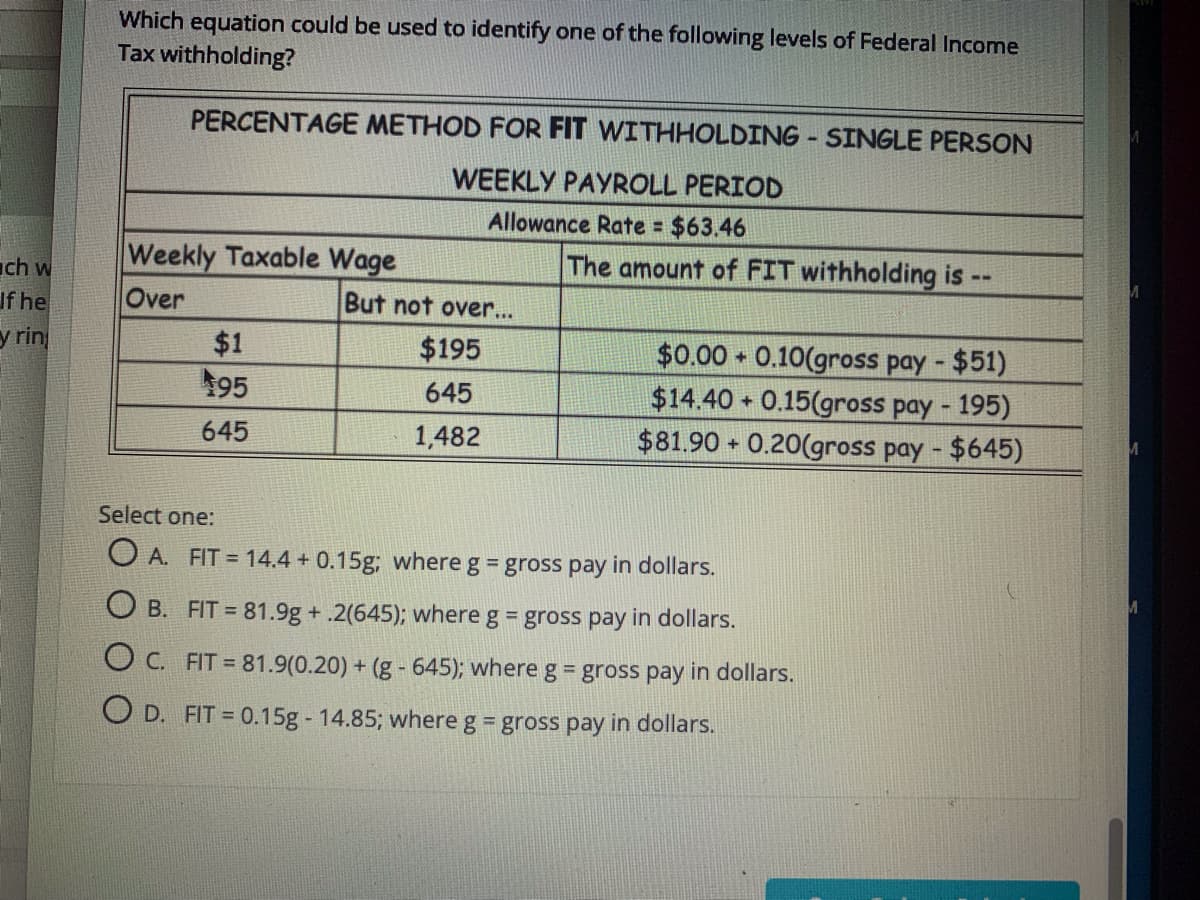

Which equation could be used to identify one of the following levels of Federal Income Tax withholding? PERCENTAGE METHOD FOR FIT WITHHOLDING - SINGLE PERSON WEEKLY PAYROLL PERIOD Allowance Rate $63.46 %3D Weekly Taxable Wage The amount of FIT withholding is -- Over But not over... $0.00 0.10(gross pay - $51) $1 195 $195 645 $14.40 + 0.15(gross paY - 195)

Which equation could be used to identify one of the following levels of Federal Income Tax withholding? PERCENTAGE METHOD FOR FIT WITHHOLDING - SINGLE PERSON WEEKLY PAYROLL PERIOD Allowance Rate $63.46 %3D Weekly Taxable Wage The amount of FIT withholding is -- Over But not over... $0.00 0.10(gross pay - $51) $1 195 $195 645 $14.40 + 0.15(gross paY - 195)

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 10PA: Lemur Corp. is going to pay three employees a year-end bonus. The amount of the year-end bonus and...

Related questions

Question

Transcribed Image Text:Which equation could be used to identify one of the following levels of Federal Income

Tax withholding?

PERCENTAGE METHOD FOR FIT WITHHOLDING - SINGLE PERSON

WEEKLY PAYROLL PERIOD

Allowance Rate =

$63.46

Weekly Taxable Wage

Over

The amount of FIT withholding is --

ch w

If he

But not over...

y rin

$1

$0.00 0.10(gross pay - $51)

$14.40 + 0.15(gross pay - 195)

$81.90 0.20(gross pay - $645)

$195

195

645

645

1,482

Select one:

O A. FIT = 14.4 + 0.15g; where g = gross pay in dollars.

O B. FIT = 81.9g +.2(645); where g = gross pay in dollars.

O C. FIT = 81.9(0.20) + (g - 645); where g = gross pay in dollars.

O D. FIT = 0.15g 14.85; where g = gross pay in dollars.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning