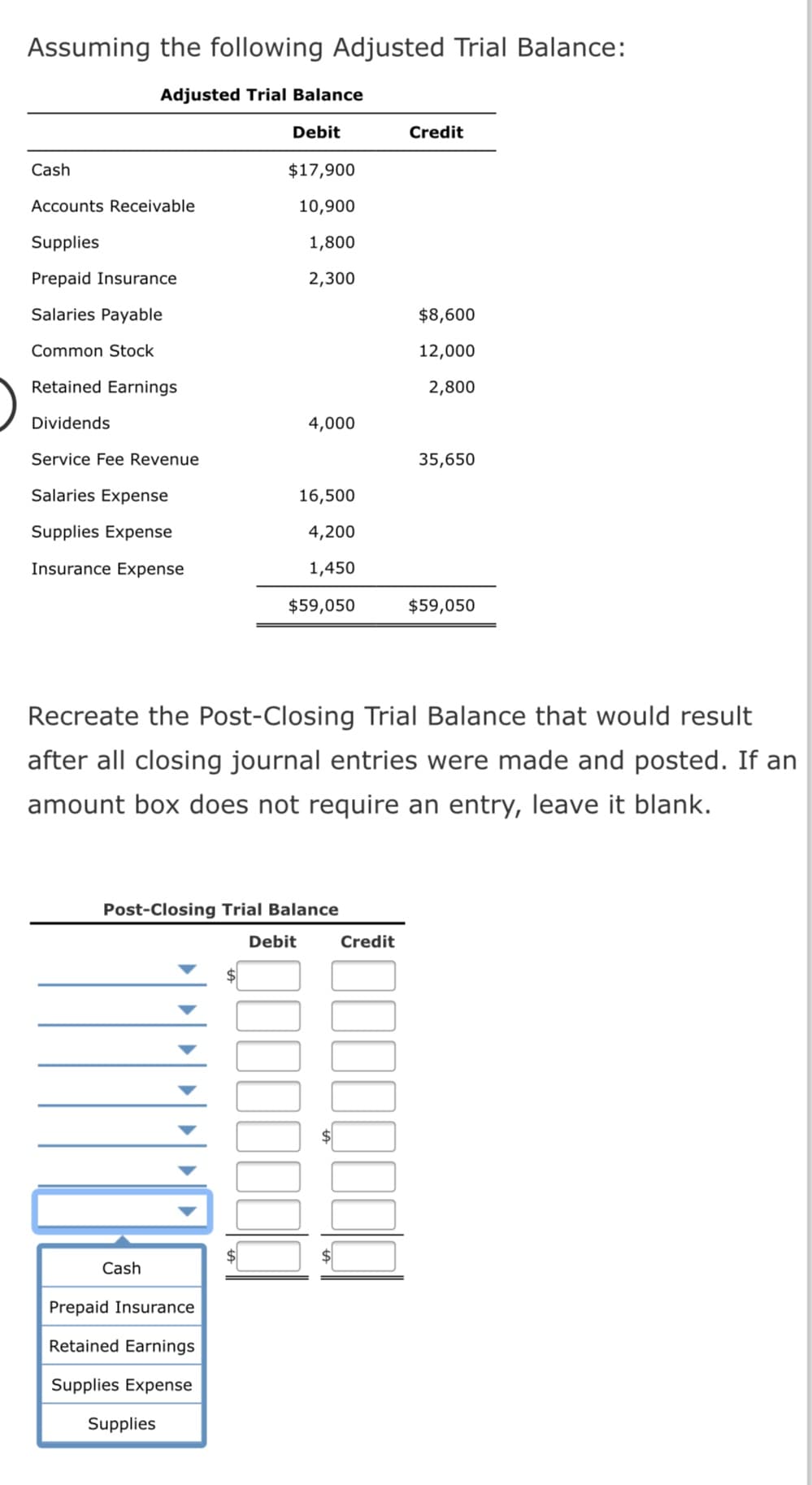

Assuming the following Adjusted Trial Balance: Adjusted Trial Balance Debit Credit Cash $17,900 Accounts Receivable 10,900 Supplies 1,800 Prepaid Insurance 2,300 Salaries Payable $8,600 Common Stock 12,000 Retained Earnings 2,800 Dividends 4,000 Service Fee Revenue 35,650 Salaries Expense 16,500 Supplies Expense 4,200 Insurance Expense 1,450 $59,050 $59,050 Recreate the Post-Closing Trial Balance that would result after all closing journal entries were made and posted. If an amount box does not require an entry, leave it blank. Post-Closing Trial Balance Debit Credit Cash Prepaid Insurance Retained Earnings Supplies Expense Supplies

Assuming the following Adjusted Trial Balance: Adjusted Trial Balance Debit Credit Cash $17,900 Accounts Receivable 10,900 Supplies 1,800 Prepaid Insurance 2,300 Salaries Payable $8,600 Common Stock 12,000 Retained Earnings 2,800 Dividends 4,000 Service Fee Revenue 35,650 Salaries Expense 16,500 Supplies Expense 4,200 Insurance Expense 1,450 $59,050 $59,050 Recreate the Post-Closing Trial Balance that would result after all closing journal entries were made and posted. If an amount box does not require an entry, leave it blank. Post-Closing Trial Balance Debit Credit Cash Prepaid Insurance Retained Earnings Supplies Expense Supplies

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter5: Adjusting Entries And The Work Sheet

Section: Chapter Questions

Problem 7SEB: ANALY SIS OF ADJUSTING ENTRY FOR INSURANCE Analyze each situation and indicate the correct dollar...

Related questions

Question

Transcribed Image Text:Assuming the following Adjusted Trial Balance:

Adjusted Trial Balance

Debit

Credit

Cash

$17,900

Accounts Receivable

10,900

Supplies

1,800

Prepaid Insurance

2,300

Salaries Payable

$8,600

Common Stock

12,000

Retained Earnings

2,800

Dividends

4,000

Service Fee Revenue

35,650

Salaries Expense

16,500

Supplies Expense

4,200

Insurance Expense

1,450

$59,050

$59,050

Recreate the Post-Closing Trial Balance that would result

after all closing journal entries were made and posted. If an

amount box does not require an entry, leave it blank.

Post-Closing Trial Balance

Debit

Credit

Cash

Prepaid Insurance

Retained Earnings

Supplies Expense

Supplies

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,