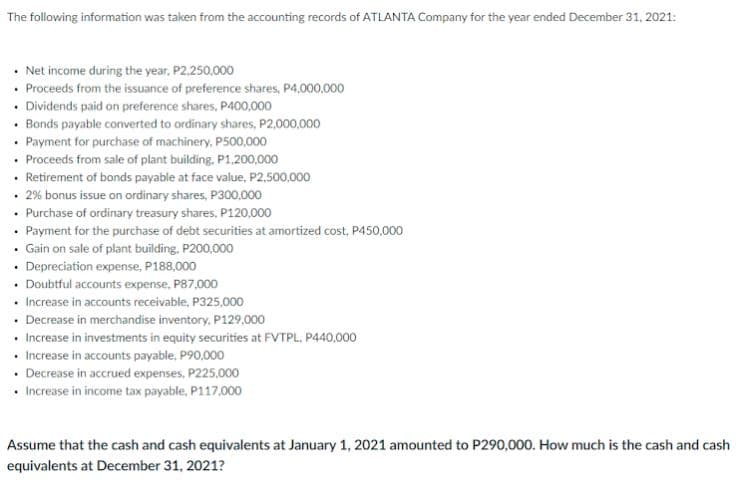

The following information was taken from the accounting records of ATLANTA Company for the year ended December 31, 2021: • Net income during the year, P2,250,000 • Proceeds from the issuance of preference shares, P4,000,000 • Dividends paid on preference shares, P400,000 • Bonds payable converted to ordinary shares, P2,000,000 • Payment for purchase of machinery, P500,000 • Proceeds from sale of plant building, P1,200,000 • Retirement of bonds payable at face value, P2,500,000 • 2% bonus issue on ordinary shares, P300,000 • Purchase of ordinary treasury shares, P120,000 • Payment for the purchase of debt securities at amortized cost, P450,000 Gain on sale of plant building, P200,000 • Depreciation expense, P188,000 • Doubtful accounts expense, P87,000 • Increase in accounts receivable, P325,000 • Decrease in merchandise inventory, P129,000 • Increase in investments in equity securities at FVTPL, P440,000 • Increase in accounts payable, P90,000 • Decrease in accrued expenses, P225,000 • Increase in income tax payable, P117,000 Assume that the cash and cash equivalents at January 1, 2021 amounted to P290,000. How much is the cash and cash equivalents at December 31, 2021?

The following information was taken from the accounting records of ATLANTA Company for the year ended December 31, 2021: • Net income during the year, P2,250,000 • Proceeds from the issuance of preference shares, P4,000,000 • Dividends paid on preference shares, P400,000 • Bonds payable converted to ordinary shares, P2,000,000 • Payment for purchase of machinery, P500,000 • Proceeds from sale of plant building, P1,200,000 • Retirement of bonds payable at face value, P2,500,000 • 2% bonus issue on ordinary shares, P300,000 • Purchase of ordinary treasury shares, P120,000 • Payment for the purchase of debt securities at amortized cost, P450,000 Gain on sale of plant building, P200,000 • Depreciation expense, P188,000 • Doubtful accounts expense, P87,000 • Increase in accounts receivable, P325,000 • Decrease in merchandise inventory, P129,000 • Increase in investments in equity securities at FVTPL, P440,000 • Increase in accounts payable, P90,000 • Decrease in accrued expenses, P225,000 • Increase in income tax payable, P117,000 Assume that the cash and cash equivalents at January 1, 2021 amounted to P290,000. How much is the cash and cash equivalents at December 31, 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:The following information was taken from the accounting records of ATLANTA Company for the year ended December 31, 2021:

• Net income during the year, P2.250,000

• Proceeds from the issuance of preference shares, P4,000,000

• Dividends paid on preference shares, P400,000

• Bonds payable converted to ordinary shares, P2,000,000

• Payment for purchase of machinery, P500,000

• Proceeds from sale of plant building. P1,200,000

• Retirement of bonds payable at face value, P2,500,000

• 2% bonus issue on ordinary shares, P300,000

• Purchase of ordinary treasury shares, P120,000

• Payment for the purchase of debt securities at amortized cost, P450,000

• Gain on sale of plant building, P200,000

• Depreciation expense, P188,000

• Doubtful accounts expense, P87,000

• Increase in accounts receivable, P325,000

• Decrease in merchandise inventory, P129,000

• Increase in investments in equity securities at FVTPL, P440,000

• Increase in accounts payable, P90,000

• Decrease in accrued expenses, P225,000

• Increase in income tax payable, P117,000

Assume that the cash and cash equivalents at January 1, 2021 amounted to P290,000. How much is the cash and cash

equivalents at December 31, 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning