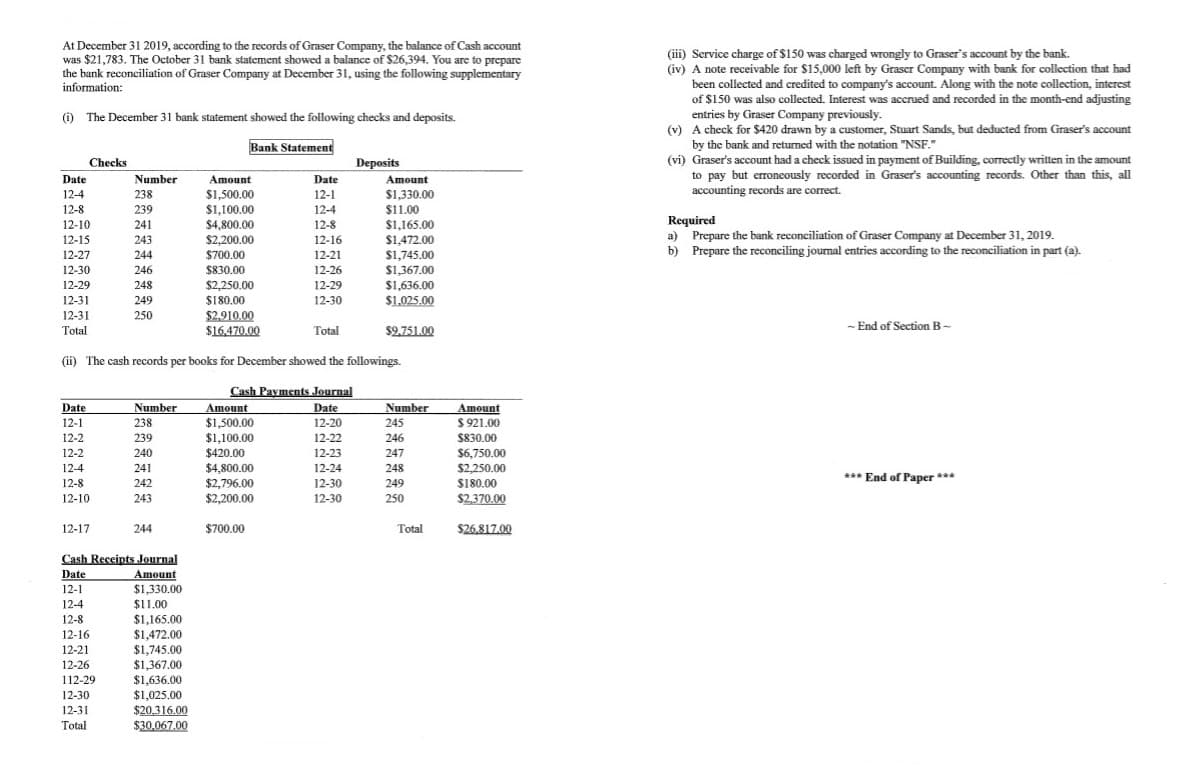

At December 31 2019, according to the records of Graser Company, the balance of Cash account was $21,783. The October 31 bank statement showed a balance of $26,394. You are to prepare the bank reconciliation of Graser Company at December 31, using the following supplementary information: (iii) Service charge of $150 was charged wrongly to Graser's account by the bank. (iv) A note receivable for $15,000 left by Graser Company with bank for collection that had been collected and credited to company's account. Along with the note collection, interest of $150 was also collected. Interest was accrued and recorded in the month-end adjusting entries by Graser Company previously. (v) A check for $420 drawn by a customer, Stuart Sands, but deducted from Graser's account (i) The December 31 bank statement showed the following checks and deposits. Bank Statement by the bank and returned with the notation "NSF." (vi) Graser's account had a check issued in payment of Building, correctly written in the amount to pay but erroncously recorded in Graser's accounting records. Other than this, all accounting records are correct. Checks Deposits Date Number Amount Date Amount 12-4 238 $1,500.00 $1,100.00 $4,800.00 $2,200.00 $700.00 $830.00 $2,250.00 $180.00 12-1 $1,330.00 12-8 239 12-4 $11.00 Required a) Prepare the bank reconciliation of Graser Company at December 31, 2019. b) Prepare the reconciling journal entries according to the reconciliation in part (a). $1,165.00 $1,472.00 $1,745.00 12-10 241 12-8 12-16 12-21 12-26 12-29 12-30 12-15 243 12-27 12-30 244 $1,367.00 246 $1,636.00 $1,025.00 12-29 248 12-31 249 12-31 250 $2,910.00 $16470.00 - End of Section B- Total Total $9,751.00 The cash records per books for December showed the followings. (ii) Cash Payments Journal Date Number 238 Date 12-20 Number Amount Amount $1,500.00 $1,100.00 $420.00 $4,800.00 $2,796.00 $2,200.00 $ 921.00 12-1 245 12-22 12-23 12-24 12-2 239 246 $830.00 $6,750.00 $2,250.00 S180.00 $2,370.00 12-2 240 247 12-4 241 248 *** End of Paper *** 12-8 242 12-30 249 12-10 243 12-30 250 12-17 244 $700.00 Total $26,817.00 Cash Receints Jlournal Amount $1.330.00 $11.00 $1,165.00 $1,472.00 $1,745.00 $1,367.00 $1,636.00 $1,025.00 $20.316.00 $30.067.00 Date 12-1 12-4 12-8 12-16 12-21 12-26 112-29 12-30 12-31 Total

At December 31 2019, according to the records of Graser Company, the balance of Cash account was $21,783. The October 31 bank statement showed a balance of $26,394. You are to prepare the bank reconciliation of Graser Company at December 31, using the following supplementary information: (iii) Service charge of $150 was charged wrongly to Graser's account by the bank. (iv) A note receivable for $15,000 left by Graser Company with bank for collection that had been collected and credited to company's account. Along with the note collection, interest of $150 was also collected. Interest was accrued and recorded in the month-end adjusting entries by Graser Company previously. (v) A check for $420 drawn by a customer, Stuart Sands, but deducted from Graser's account (i) The December 31 bank statement showed the following checks and deposits. Bank Statement by the bank and returned with the notation "NSF." (vi) Graser's account had a check issued in payment of Building, correctly written in the amount to pay but erroncously recorded in Graser's accounting records. Other than this, all accounting records are correct. Checks Deposits Date Number Amount Date Amount 12-4 238 $1,500.00 $1,100.00 $4,800.00 $2,200.00 $700.00 $830.00 $2,250.00 $180.00 12-1 $1,330.00 12-8 239 12-4 $11.00 Required a) Prepare the bank reconciliation of Graser Company at December 31, 2019. b) Prepare the reconciling journal entries according to the reconciliation in part (a). $1,165.00 $1,472.00 $1,745.00 12-10 241 12-8 12-16 12-21 12-26 12-29 12-30 12-15 243 12-27 12-30 244 $1,367.00 246 $1,636.00 $1,025.00 12-29 248 12-31 249 12-31 250 $2,910.00 $16470.00 - End of Section B- Total Total $9,751.00 The cash records per books for December showed the followings. (ii) Cash Payments Journal Date Number 238 Date 12-20 Number Amount Amount $1,500.00 $1,100.00 $420.00 $4,800.00 $2,796.00 $2,200.00 $ 921.00 12-1 245 12-22 12-23 12-24 12-2 239 246 $830.00 $6,750.00 $2,250.00 S180.00 $2,370.00 12-2 240 247 12-4 241 248 *** End of Paper *** 12-8 242 12-30 249 12-10 243 12-30 250 12-17 244 $700.00 Total $26,817.00 Cash Receints Jlournal Amount $1.330.00 $11.00 $1,165.00 $1,472.00 $1,745.00 $1,367.00 $1,636.00 $1,025.00 $20.316.00 $30.067.00 Date 12-1 12-4 12-8 12-16 12-21 12-26 112-29 12-30 12-31 Total

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter11: Current Liabilities And Payroll

Section: Chapter Questions

Problem 3CPP

Related questions

Question

Transcribed Image Text:At December 31 2019, according to the records of Graser Company, the balance of Cash account

was $21,783. The October 31 bank statement showed a balance of $26,394. You are to prepare

the bank reconciliation of Graser Company at December 31, using the following supplementary

information:

(iii) Service charge of $150 was charged wrongly to Graser's account by the bank.

(iv) A note receivable for $15,000 left by Graser Company with bank for collection that had

been collected and credited to company's account. Along with the note collection, interest

of $150 was also collected. Interest was accrued and recorded in the month-end adjusting

entries by Graser Company previously.

(v) A check for $420 drawn by a customer, Stuart Sands, but deducted from Graser's account

(i) The December 31 bank statement showed the following checks and deposits.

Bank Statement

by the bank and returned with the notation "NSF."

(vi) Graser's account had a check issued in payment of Building, correctly written in the amount

to pay but erroncously recorded in Graser's accounting records. Other than this, all

accounting records are correct.

Checks

Deposits

Date

Number

Amount

Date

Amount

12-4

238

$1,500.00

$1,100.00

$4,800.00

$2,200.00

$700.00

$830.00

$2,250.00

$180.00

12-1

$1,330.00

12-8

239

12-4

$11.00

Required

a) Prepare the bank reconciliation of Graser Company at December 31, 2019.

b) Prepare the reconciling journal entries according to the reconciliation in part (a).

$1,165.00

$1,472.00

$1,745.00

12-10

241

12-8

12-16

12-21

12-26

12-29

12-30

12-15

243

12-27

12-30

244

$1,367.00

246

$1,636.00

$1,025.00

12-29

248

12-31

249

12-31

250

$2,910.00

$16470.00

- End of Section B-

Total

Total

$9,751.00

The cash records per books for December showed the followings.

(ii)

Cash Payments Journal

Date

Number

238

Date

12-20

Number

Amount

Amount

$1,500.00

$1,100.00

$420.00

$4,800.00

$2,796.00

$2,200.00

$ 921.00

12-1

245

12-22

12-23

12-24

12-2

239

246

$830.00

$6,750.00

$2,250.00

S180.00

$2,370.00

12-2

240

247

12-4

241

248

*** End of Paper ***

12-8

242

12-30

249

12-10

243

12-30

250

12-17

244

$700.00

Total

$26,817.00

Cash Receints Jlournal

Amount

$1.330.00

$11.00

$1,165.00

$1,472.00

$1,745.00

$1,367.00

$1,636.00

$1,025.00

$20.316.00

$30.067.00

Date

12-1

12-4

12-8

12-16

12-21

12-26

112-29

12-30

12-31

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning