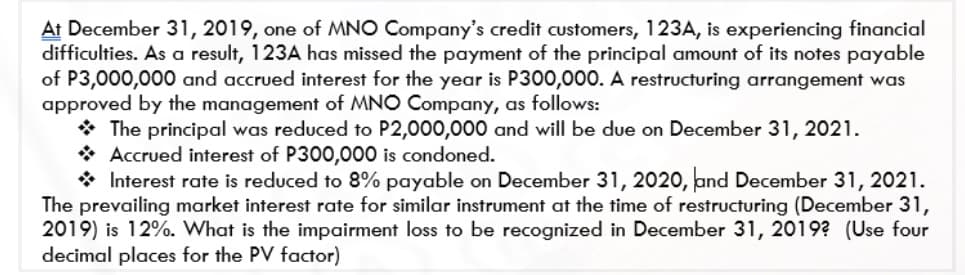

At December 31, 2019, one of MNO Company's credit customers, 123A, is experiencing financial difficulties. As a result, 123A has missed the payment of the principal amount of its notes payable of P3,000,000 and accrued interest for the year is P300,000. A restructuring arrangement was approved by the management of MNO Company, as follows: * The principal was reduced to P2,000,000 and will be due on December 31, 2021. * Accrued interest of P300,000 is condoned. * Interest rate is reduced to 8% payable on December 31, 2020, and December 31, 2021. The prevailing market interest rate for similar instrument at the time of restructuring (December 31, 2019) is 12%. What is the impairment loss to be recognized in December 31, 2019? (Use four decimal places for the PV factor)

At December 31, 2019, one of MNO Company's credit customers, 123A, is experiencing financial difficulties. As a result, 123A has missed the payment of the principal amount of its notes payable of P3,000,000 and accrued interest for the year is P300,000. A restructuring arrangement was approved by the management of MNO Company, as follows: * The principal was reduced to P2,000,000 and will be due on December 31, 2021. * Accrued interest of P300,000 is condoned. * Interest rate is reduced to 8% payable on December 31, 2020, and December 31, 2021. The prevailing market interest rate for similar instrument at the time of restructuring (December 31, 2019) is 12%. What is the impairment loss to be recognized in December 31, 2019? (Use four decimal places for the PV factor)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 30E

Related questions

Question

The prevailing market interest rate for similar instrument at the time of restructuring (December 31, 2019) is 12%. What is the impairment loss to be recognize din December 31, 2019? (Use four decimal places for the PV factor)

Transcribed Image Text:At December 31, 2019, one of MNO Company's credit customers, 123A, is experiencing financial

difficulties. As a result, 123A has missed the payment of the principal amount of its notes payable

of P3,000,000 and accrued interest for the year is P300,000. A restructuring arrangement was

approved by the management of MNO Company, as follows:

* The principal was reduced to P2,000,000 and will be due on December 31, 2021.

* Accrued interest of P300,000 is condoned.

* Interest rate is reduced to 8% payable on December 31, 2020, and December 31, 2021.

The prevailing market interest rate for similar instrument at the time of restructuring (December 31,

2019) is 12%. What is the impairment loss to be recognized in December 31, 2019? (Use four

decimal places for the PV factor)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT