At December 31, the cash balance per books was $13,985.20, and the cash balance per the bank state- ment was $19,239.10. The bank did not make any errors, but Langer Company made two errors. 8-44 CHAPTER 8 Fraud, Internal Control, and Cash a. Adjusted balance per books $16,043.20 Instructions a. Using the steps in the reconciliation procedure described in the chapter, prepare a bank reconcilia- tion at December 31, 2020. b. Prepare the adjusting entries based on the reconciliation. (Hint: The correction of any errors per- taining to recording checks should be made to Accounts Payable. The correction of any errors relat- ing to recording cash receipts should be made to Accounts Receivable.)

At December 31, the cash balance per books was $13,985.20, and the cash balance per the bank state- ment was $19,239.10. The bank did not make any errors, but Langer Company made two errors. 8-44 CHAPTER 8 Fraud, Internal Control, and Cash a. Adjusted balance per books $16,043.20 Instructions a. Using the steps in the reconciliation procedure described in the chapter, prepare a bank reconcilia- tion at December 31, 2020. b. Prepare the adjusting entries based on the reconciliation. (Hint: The correction of any errors per- taining to recording checks should be made to Accounts Payable. The correction of any errors relat- ing to recording cash receipts should be made to Accounts Receivable.)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter6: Cash And Internal Control

Section: Chapter Questions

Problem 6.4E

Related questions

Question

P8.5

Transcribed Image Text:At December 31, the cash balance per books was $13,985.20, and the cash balance per the bank state-

ment was $19,239.10. The bank did not make any errors, but Langer Company made two errors.

8-44 CHAPTER 8 Fraud, Internal Control, and Cash

a. Adjusted balance per books

$16,043.20

Instructions

a. Using the steps in the reconciliation procedure described in the chapter, prepare a bank reconcilia-

tion at December 31, 2020.

b. Prepare the adjusting entries based on the reconciliation. (Hint: The correction of any errors per-

taining to recording checks should be made to Accounts Payable. The correction of any errors relat-

ing to recording cash receipts should be made to Accounts Receivable.)

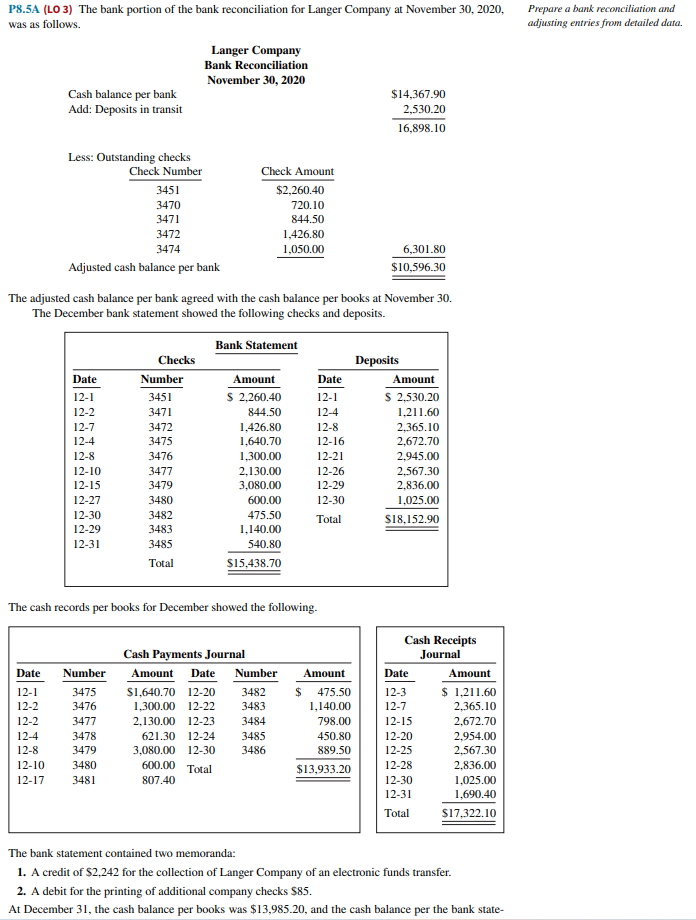

Transcribed Image Text:P8.5A (LO 3) The bank portion of the bank reconciliation for Langer Company at November 30, 2020,

was as follows.

Cash balance per bank

Add: Deposits in transit

Date

12-1

12-2

12-2

12-4

Less: Outstanding checks

Check Number

12-8

12-10

3451

3470

3471

3472

3474

Adjusted cash balance per bank

Date

12-1

12-2

12-7

12-4

12-8

12-10

12-15

12-27

12-30

12-29

12-31

Number

3475

3476

3477

3478

3479

3480

12-17 3481

Langer Company

Bank Reconciliation

November 30, 2020

The adjusted cash balance per bank agreed with the cash balance per books at November 30.

The December bank statement showed the following checks and deposits.

Bank Statement

Checks

Number

3451

3471

3472

3475

3476

3477

3479

3480

3482

3483

3485

Total

Check Amount

$2,260.40

720.10

844.50

1,426.80

1,050.00

The cash records per books for December showed the following.

Amount

$ 2,260.40

844.50

1,426.80

1,640.70

600.00 Total

807.40

1,300.00

2,130.00

3,080.00

600.00

475.50

1,140.00

540.80

$15,438.70

2,130.00 12-23

3484

621.30 12-24 3485

3,080.00 12-30 3486

Date

12-1

12-4

12-8

12-16

12-21

12-26

12-29

12-30

Total

Cash Payments Journal

Amount Date Number Amount

$1,640.70 12-20 3482 $ 475.50

1,300.00 12-22

3483

1,140.00

$14,367.90

2,530.20

16,898.10

798.00

450.80

889.50

$13,933.20

6,301.80

$10,596.30

Deposits

Amount

$ 2,530.20

1,211.60

2,365.10

2,672.70

2,945.00

2.567.30

2,836.00

1,025.00

$18,152.90

Cash Receipts

Journal

Date

12-3

12-7

12-15

12-20

12-25

12-28

12-30

12-31

Total

Amount

$ 1,211.60

2,365.10

2,672.70

2,954.00

2,567.30

2,836.00

1,025.00

1,690.40

$17,322.10

The bank statement contained two memoranda:

1. A credit of $2,242 for the collection of Langer Company of an electronic funds transfer.

2. A debit for the printing of additional company checks $85.

At December 31, the cash balance per books was $13,985.20, and the cash balance per the bank state-

Prepare a bank reconciliation and

adjusting entries from detailed data.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College