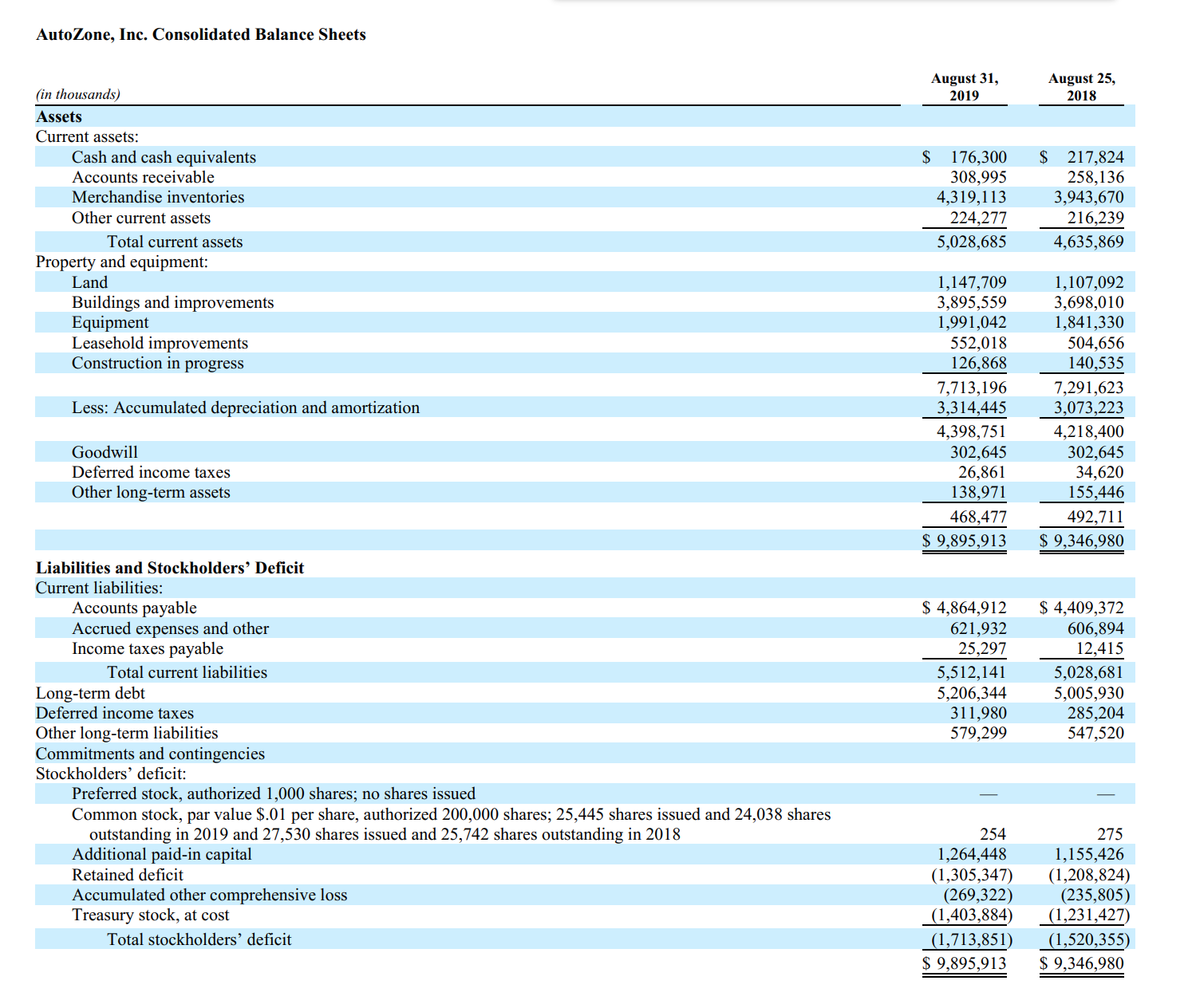

AutoZone, Inc. Consolidated Balance Sheets August 31, 2019 August 25, 2018 (in thousands) Assets Current assets: Cash and cash equivalents $ 176,300 308,995 4,319,113 224,277 $ 217,824 258,136 3,943,670 216,239 4,635,869 Accounts receivable Merchandise inventories Other current assets Total current assets 5,028,685 Property and equipment: Land Buildings and improvements Equipment Leasehold improvements Construction in progress 1,147,709 3,895,559 1,991,042 552,018 126,868 1,107,092 3,698,010 1,841,330 504,656 140,535 7,713,196 3,314,445 7,291,623 3,073,223 Less: Accumulated depreciation and amortization 4,398,751 302,645 26,861 138,971 4,218,400 302,645 34,620 155,446 Goodwill Deferred income taxes Other long-term assets 468,477 492,711 $ 9,895,913 $ 9,346,980 Liabilities and Stockholders' Deficit Current liabilities: Accounts payable Accrued expenses and other Income taxes payable $ 4,864,912 621,932 25,297 $ 4,409,372 606,894 12,415 Total current liabilities Long-term debt Deferred income taxes Other long-term liabilities Commitments and contingencies 5,512,141 5,206,344 311,980 579,299 5,028,681 5,005,930 285,204 547,520 Stockholders' deficit: Preferred stock, authorized 1,000 shares; no shares issued Common stock, par value $.01 per share, authorized 200,000 shares; 25,445 shares issued and 24,038 shares outstanding in 2019 and 27,530 shares issued and 25,742 shares outstanding in 2018 Additional paid-in capital 254 275 1,264,448 (1,305,347) (269,322) (1,403,884) 1,155,426 (1,208,824) (235,805) (1,231,427) Retained deficit Accumulated other comprehensive loss Treasury stock, at cost (1,713,851) $ 9,895,913 Total stockholders' deficit (1,520,355) $ 9,346,980 AutoZone, Inc. Consolidated Statements of Cash Flows Year Ended August 31, 2019 August 25, 2018 August 26, 2017 (in thousands) (53 weeks) (52 weeks) (52 weeks) Cash flows from operating activities: Net income $ 1,617,221 $ 1,337,536 $ 1,280,869 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization of property and equipment and intangibles Amortization of debt origination fees 369,957 8,162 35,051 43,255 345,084 8,393 (124,261) 43,674 (11,596) 130,263 193,162 323,051 8,369 74,902 38,244 (17,761) Deferred income taxes Share-based compensation expense Pension plan contributions Pension termination charges (refund) Asset impairment Changes in operating assets and liabilities: Accounts receivable (6,796) (48,512) (394,147) 464,176 7,534 (188,782) 319,609 (6,438) 26,114 7,795 (236,807) 82,614 (3,659) 12,995 Merchandise inventories Accounts payable and accrued expenses Income taxes payable (10,489) 50,635 Other, net Net cash provided by operating activities 2,128,513 2,080,292 1,570,612 Cash flows from investing activities: Capital expenditures Proceeds from sale of assets (496,050) (521,788) 35,279 (104,536) 69,644 (459) (553,832) Purchase of marketable debt securities (55,538) 53,140 6,602 (85,711) 82,993 2,951 Proceeds from sale of marketable debt securities Proceeds (payments) from disposal of capital assets and other, net Net cash used in investing activities (491,846) (521,860) (553,599) Cash flows from financing activities: Net (payments of) proceeds from commercial paper Proceeds from issuance of debt (295,300) 750,000 (250,000) 188,819 (2,004,896) (53,307) (9,404) 170,200 Repayment of debt Net proceeds from sale of common stock Purchase of treasury stock Payments of capital lease obligations Other, net (250,000) 89,715 (1,592,013) (49,004) (1,052) (42,400) 600,000 (400,000) 54,686 (1,071,649) (47,604) (7,362) Net cash used in financing activities (914,329) (1,674,088) (4,103) (41,524) 217,824 (1,632,154) (1,724) Effect of exchange rate changes on cash Net (decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 852 (75,446) 293,270 103,536 189,734 2$ 176,300 217,824 293,270 Supplemental cash flow information: Interest paid, net of interest cost capitalized 153,371 163,965 135,331 Income taxes paid 2$ 383,871 $ 427,161 $ 579,925 Assets acquired through capital lease $ 147,699 98,782 84,011

AutoZone, Inc. Consolidated Balance Sheets August 31, 2019 August 25, 2018 (in thousands) Assets Current assets: Cash and cash equivalents $ 176,300 308,995 4,319,113 224,277 $ 217,824 258,136 3,943,670 216,239 4,635,869 Accounts receivable Merchandise inventories Other current assets Total current assets 5,028,685 Property and equipment: Land Buildings and improvements Equipment Leasehold improvements Construction in progress 1,147,709 3,895,559 1,991,042 552,018 126,868 1,107,092 3,698,010 1,841,330 504,656 140,535 7,713,196 3,314,445 7,291,623 3,073,223 Less: Accumulated depreciation and amortization 4,398,751 302,645 26,861 138,971 4,218,400 302,645 34,620 155,446 Goodwill Deferred income taxes Other long-term assets 468,477 492,711 $ 9,895,913 $ 9,346,980 Liabilities and Stockholders' Deficit Current liabilities: Accounts payable Accrued expenses and other Income taxes payable $ 4,864,912 621,932 25,297 $ 4,409,372 606,894 12,415 Total current liabilities Long-term debt Deferred income taxes Other long-term liabilities Commitments and contingencies 5,512,141 5,206,344 311,980 579,299 5,028,681 5,005,930 285,204 547,520 Stockholders' deficit: Preferred stock, authorized 1,000 shares; no shares issued Common stock, par value $.01 per share, authorized 200,000 shares; 25,445 shares issued and 24,038 shares outstanding in 2019 and 27,530 shares issued and 25,742 shares outstanding in 2018 Additional paid-in capital 254 275 1,264,448 (1,305,347) (269,322) (1,403,884) 1,155,426 (1,208,824) (235,805) (1,231,427) Retained deficit Accumulated other comprehensive loss Treasury stock, at cost (1,713,851) $ 9,895,913 Total stockholders' deficit (1,520,355) $ 9,346,980 AutoZone, Inc. Consolidated Statements of Cash Flows Year Ended August 31, 2019 August 25, 2018 August 26, 2017 (in thousands) (53 weeks) (52 weeks) (52 weeks) Cash flows from operating activities: Net income $ 1,617,221 $ 1,337,536 $ 1,280,869 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization of property and equipment and intangibles Amortization of debt origination fees 369,957 8,162 35,051 43,255 345,084 8,393 (124,261) 43,674 (11,596) 130,263 193,162 323,051 8,369 74,902 38,244 (17,761) Deferred income taxes Share-based compensation expense Pension plan contributions Pension termination charges (refund) Asset impairment Changes in operating assets and liabilities: Accounts receivable (6,796) (48,512) (394,147) 464,176 7,534 (188,782) 319,609 (6,438) 26,114 7,795 (236,807) 82,614 (3,659) 12,995 Merchandise inventories Accounts payable and accrued expenses Income taxes payable (10,489) 50,635 Other, net Net cash provided by operating activities 2,128,513 2,080,292 1,570,612 Cash flows from investing activities: Capital expenditures Proceeds from sale of assets (496,050) (521,788) 35,279 (104,536) 69,644 (459) (553,832) Purchase of marketable debt securities (55,538) 53,140 6,602 (85,711) 82,993 2,951 Proceeds from sale of marketable debt securities Proceeds (payments) from disposal of capital assets and other, net Net cash used in investing activities (491,846) (521,860) (553,599) Cash flows from financing activities: Net (payments of) proceeds from commercial paper Proceeds from issuance of debt (295,300) 750,000 (250,000) 188,819 (2,004,896) (53,307) (9,404) 170,200 Repayment of debt Net proceeds from sale of common stock Purchase of treasury stock Payments of capital lease obligations Other, net (250,000) 89,715 (1,592,013) (49,004) (1,052) (42,400) 600,000 (400,000) 54,686 (1,071,649) (47,604) (7,362) Net cash used in financing activities (914,329) (1,674,088) (4,103) (41,524) 217,824 (1,632,154) (1,724) Effect of exchange rate changes on cash Net (decrease) increase in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year 852 (75,446) 293,270 103,536 189,734 2$ 176,300 217,824 293,270 Supplemental cash flow information: Interest paid, net of interest cost capitalized 153,371 163,965 135,331 Income taxes paid 2$ 383,871 $ 427,161 $ 579,925 Assets acquired through capital lease $ 147,699 98,782 84,011

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 24CE

Related questions

Question

what is the return in assets for each year?

Transcribed Image Text:AutoZone, Inc. Consolidated Balance Sheets

August 31,

2019

August 25,

2018

(in thousands)

Assets

Current assets:

Cash and cash equivalents

$ 176,300

308,995

4,319,113

224,277

$ 217,824

258,136

3,943,670

216,239

4,635,869

Accounts receivable

Merchandise inventories

Other current assets

Total current assets

5,028,685

Property and equipment:

Land

Buildings and improvements

Equipment

Leasehold improvements

Construction in progress

1,147,709

3,895,559

1,991,042

552,018

126,868

1,107,092

3,698,010

1,841,330

504,656

140,535

7,713,196

3,314,445

7,291,623

3,073,223

Less: Accumulated depreciation and amortization

4,398,751

302,645

26,861

138,971

4,218,400

302,645

34,620

155,446

Goodwill

Deferred income taxes

Other long-term assets

468,477

492,711

$ 9,895,913

$ 9,346,980

Liabilities and Stockholders' Deficit

Current liabilities:

Accounts payable

Accrued expenses and other

Income taxes payable

$ 4,864,912

621,932

25,297

$ 4,409,372

606,894

12,415

Total current liabilities

Long-term debt

Deferred income taxes

Other long-term liabilities

Commitments and contingencies

5,512,141

5,206,344

311,980

579,299

5,028,681

5,005,930

285,204

547,520

Stockholders' deficit:

Preferred stock, authorized 1,000 shares; no shares issued

Common stock, par value $.01 per share, authorized 200,000 shares; 25,445 shares issued and 24,038 shares

outstanding in 2019 and 27,530 shares issued and 25,742 shares outstanding in 2018

Additional paid-in capital

254

275

1,264,448

(1,305,347)

(269,322)

(1,403,884)

1,155,426

(1,208,824)

(235,805)

(1,231,427)

Retained deficit

Accumulated other comprehensive loss

Treasury stock, at cost

(1,713,851)

$ 9,895,913

Total stockholders' deficit

(1,520,355)

$ 9,346,980

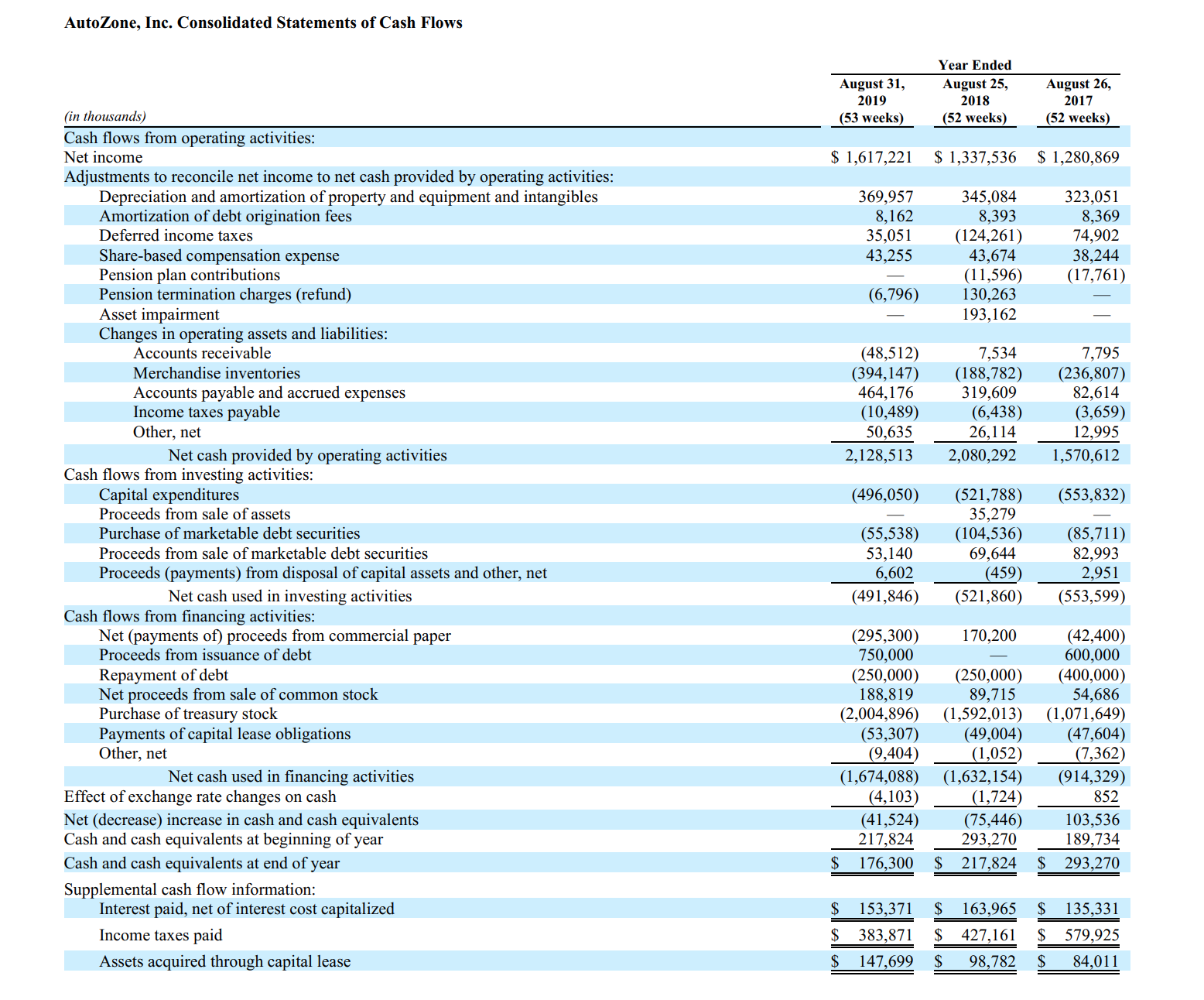

Transcribed Image Text:AutoZone, Inc. Consolidated Statements of Cash Flows

Year Ended

August 31,

2019

August 25,

2018

August 26,

2017

(in thousands)

(53 weeks)

(52 weeks)

(52 weeks)

Cash flows from operating activities:

Net income

$ 1,617,221

$ 1,337,536

$ 1,280,869

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization of property and equipment and intangibles

Amortization of debt origination fees

369,957

8,162

35,051

43,255

345,084

8,393

(124,261)

43,674

(11,596)

130,263

193,162

323,051

8,369

74,902

38,244

(17,761)

Deferred income taxes

Share-based compensation expense

Pension plan contributions

Pension termination charges (refund)

Asset impairment

Changes in operating assets and liabilities:

Accounts receivable

(6,796)

(48,512)

(394,147)

464,176

7,534

(188,782)

319,609

(6,438)

26,114

7,795

(236,807)

82,614

(3,659)

12,995

Merchandise inventories

Accounts payable and accrued expenses

Income taxes payable

(10,489)

50,635

Other, net

Net cash provided by operating activities

2,128,513

2,080,292

1,570,612

Cash flows from investing activities:

Capital expenditures

Proceeds from sale of assets

(496,050)

(521,788)

35,279

(104,536)

69,644

(459)

(553,832)

Purchase of marketable debt securities

(55,538)

53,140

6,602

(85,711)

82,993

2,951

Proceeds from sale of marketable debt securities

Proceeds (payments) from disposal of capital assets and other, net

Net cash used in investing activities

(491,846)

(521,860)

(553,599)

Cash flows from financing activities:

Net (payments of) proceeds from commercial paper

Proceeds from issuance of debt

(295,300)

750,000

(250,000)

188,819

(2,004,896)

(53,307)

(9,404)

170,200

Repayment of debt

Net proceeds from sale of common stock

Purchase of treasury stock

Payments of capital lease obligations

Other, net

(250,000)

89,715

(1,592,013)

(49,004)

(1,052)

(42,400)

600,000

(400,000)

54,686

(1,071,649)

(47,604)

(7,362)

Net cash used in financing activities

(914,329)

(1,674,088)

(4,103)

(41,524)

217,824

(1,632,154)

(1,724)

Effect of exchange rate changes on cash

Net (decrease) increase in cash and cash equivalents

Cash and cash equivalents at beginning of year

Cash and cash equivalents at end of year

852

(75,446)

293,270

103,536

189,734

2$

176,300

217,824

293,270

Supplemental cash flow information:

Interest paid, net of interest cost capitalized

153,371

163,965

135,331

Income taxes paid

2$

383,871

$ 427,161

$

579,925

Assets acquired through capital lease

$ 147,699

98,782

84,011

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning