average cost inventory valuation system. Yakal makes a physical count at the end of each month determine monthly ending inventory value. By examining various documents, the following dat gathered: Ending inventory at July 31 Total cost of units available for sale in July Cost of goods sold during July Cost of beginning inventory, July 1 Gross profit on sales for July 60, P4.0

average cost inventory valuation system. Yakal makes a physical count at the end of each month determine monthly ending inventory value. By examining various documents, the following dat gathered: Ending inventory at July 31 Total cost of units available for sale in July Cost of goods sold during July Cost of beginning inventory, July 1 Gross profit on sales for July 60, P4.0

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 11RE: Jessie Stores uses the periodic system of calculating inventory. The following information is...

Related questions

Topic Video

Question

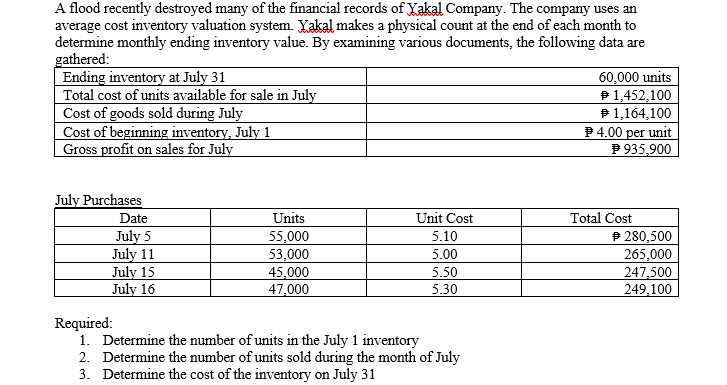

Transcribed Image Text:A flood recently destroyed many of the financial records of Yakal Company. The company uses an

average cost inventory valuation system. Yakal makes a physical count at the end of each month to

determine monthly ending inventory value. By examining various documents, the following data are

gathered:

Ending inventory at July 31

Total cost of units available for sale in July

Cost of goods sold during July

Cost of beginning inventory, July 1

Gross profit on sales for July

60,000 units

P1,452,100

P 1,164,100

P4.00 per unit

P 935,900

July Purchases

Unit Cost

Units

55,000

53,000

45,000

47,000

Total Cost

$ 280,500

265,000

247,500

249,100

Date

July 5

July 11

July 15

July 16

5.10

5.00

5.50

5.30

Required:

1. Determine the number of units in the July 1 inventory

2. Determine the number of units sold during the month of July

3. Determine the cost of the inventory on July 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College