Average Payment Period Average Collection Period Cash Conversion Period

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 14GI

Related questions

Question

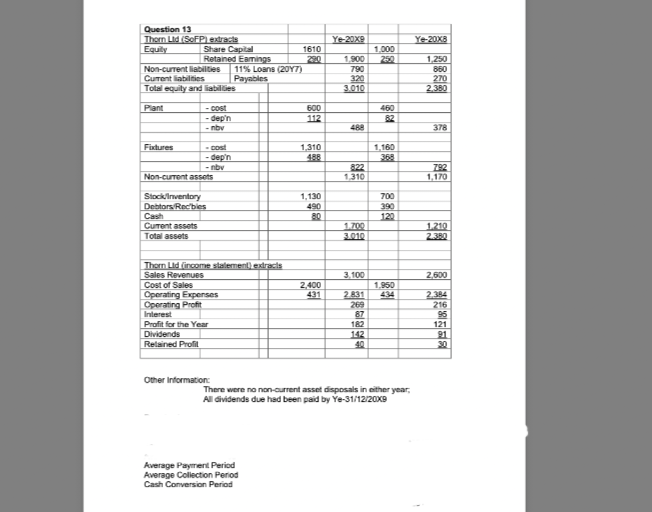

Transcribed Image Text:Question 13

Thorn Ltd (SoFP) extracts

Equity

Share Capital

Retained Earnings

Non-current liabilities

Current liabilities

Total equity and liabilities

Plant

Fixtures

-cost

-dep'n

-nov

-cost

-dep'n

- nbv

Non-current assets

Stock /Inventory

Debtors Recibles

Cash

Current assets

Total assets

Dividends

Relained Profil

Thorn Ltd (income statement) extracts

Sales Revenues

Cost of Sales

Operating Expenses

Operating Profit

Interest

Profit for the Year

11% Loans (2017)

Payables

Other Information:

1610

Average Payment Period

Average Collection Period

Cash Conversion Period

600

112

1,310

488

1,130

490

80

2,400

431

Ye-20x9

1,900

790

320

3.010

488

822

1,310

1.700

3.010

3,100

2.831

269

87

182

142

40

1,000

460

1,160

368

700

390

120

28

1,950

There were no non-current asset disposals in either year,

All dividends due had been paid by Ye-31/12/20X9

Ye-20X8

1,250

860

270

2.380

378

792

1,170

1.210

2.380

2,600

2.384

216

95

121

91

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning