awalhi Company uses machine-hours (MHs) to allocate their manufacturing overhead (MOH hod. The company recognized the cost of unused (idle) capacity of $600 on the income statem owing information, how much was the company's estimated MHs for planned production last y Estimated MOH cost (all fixed) Estimated MHs for planned production Estimated MHs at capacity POHR using the traditional method POHR at capacity ? MHs ? MHs $ 12 per MH $ 10 per MH

awalhi Company uses machine-hours (MHs) to allocate their manufacturing overhead (MOH hod. The company recognized the cost of unused (idle) capacity of $600 on the income statem owing information, how much was the company's estimated MHs for planned production last y Estimated MOH cost (all fixed) Estimated MHs for planned production Estimated MHs at capacity POHR using the traditional method POHR at capacity ? MHs ? MHs $ 12 per MH $ 10 per MH

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 7EA: A company estimates its manufacturing overhead will be $750,000 for the next year. What is the...

Related questions

Question

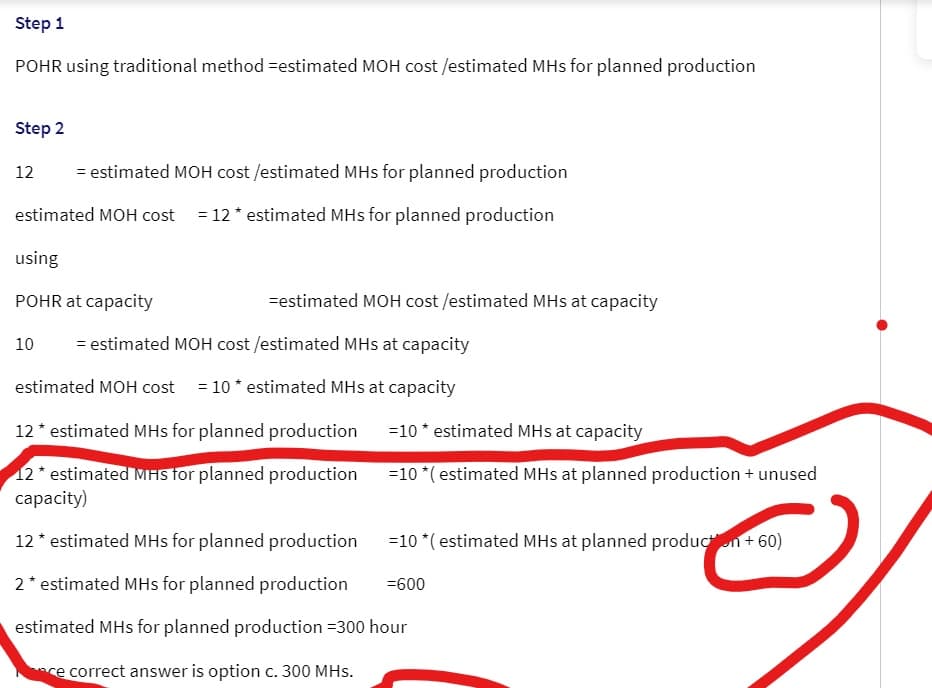

I dont understand the part that I highlight with red. Also, form where the 60 amount is coming from

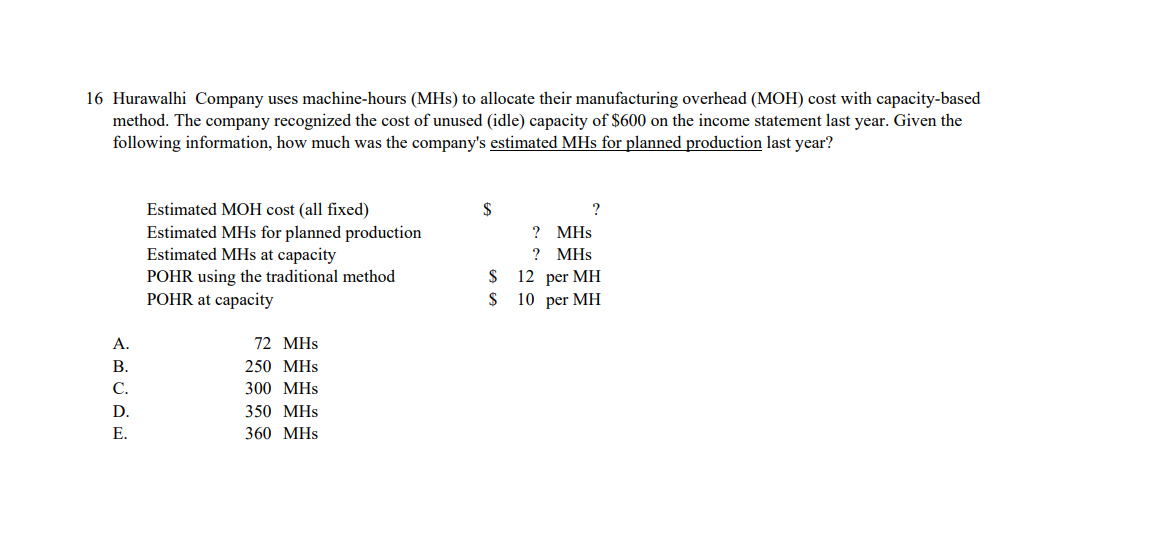

Transcribed Image Text:16 Hurawalhi Company uses machine-hours (MHs) to allocate their manufacturing overhead (MOH) cost with capacity-based

method. The company recognized the cost of unused (idle) capacity of $600 on the income statement last year. Given the

following information, how much was the company's estimated MHs for planned production last year?

Estimated MOH cost (all fixed)

$

Estimated MHs for planned production

Estimated MHs at capacity

? MHs

? MHs

$ 12 per MH

$ 10 per MH

POHR using the traditional method

POHR at capacity

А.

72 MHs

В.

250 MHs

С.

300 MHs

D.

350 МHs

E.

360 MHs

Transcribed Image Text:Step 1

POHR using traditional method =estimated MOH cost /estimated MHs for planned production

Step 2

12

= estimated MOH cost /estimated MHs for planned production

estimated MOH cost = 12* estimated MHs for planned production

using

POHR at capacity

=estimated MOH cost /estimated MHs at capacity

10

= estimated MOH cost /estimated MHs at capacity

estimated MOH cost = 10 * estimated MHs at capacity

12 * estimated MHs for planned production

=10 * estimated MHs at capacity

12* estimated MAS for planned production

сарacity)

=10 *( estimated MHs at planned production + unused

12 * estimated MHs for planned production

=10 *( estimated MHs at planned producton + 60)

2* estimated MHs for planned production

=600

estimated MHs for planned production =300 hour

ce correct answer is option c. 300 MHs.

Expert Solution

Step 1

The company currently uses capacity based machine hrs to allocate their manufacturing overhead

The rate for capacity based machine hrs is $ 10 , and income statement shows and unused capacity of $ 600

Therefore the unused capacity in machine hours = 60 Hours ($ 600/10)

Capacity based machine hours = Planned machine hrs + unused capacity in machine hours

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,