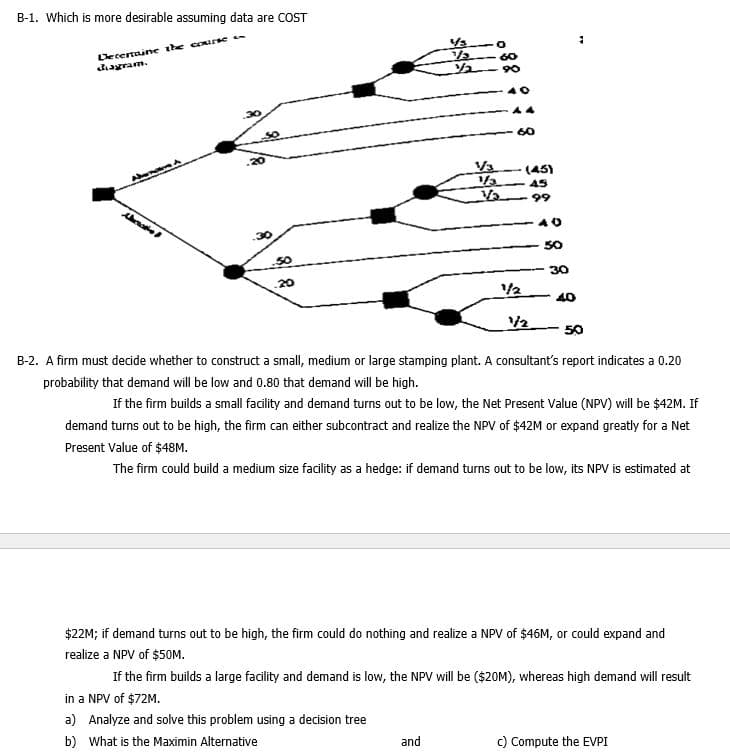

B-1. Which is more desirable assuming data are COST Decertaine the course dagram. 90 60 (45) 45 99 so 50 30 20 /2 40 50 B-2. A firm must decide whether to construct a small, medium or large stamping plant. A consultant's report indicates a 0.20 probability that demand will be low and 0.80 that demand will be high. If the firm builds a small facility and demand turns out to be low, the Net Present Value (NPV) will be $42M. If demand turns out to be high, the firm can either subcontract and realize the NPV of $42M or expand greatly for a Net Present Value of $48M. The firm could build a medium size facility as a hedge: if demand turns out to be low, its NPV is estimated at $22M; if demand turns out to be high, the firm could do nothing and realize a NPV of $46M, or could expand and realize a NPV of $50OM. If the firm builds a large facility and demand is low, the NPV will be ($20M), whereas high demand will result in a NPV of $72M. a) Analyze and solve this problem using a decision tree b) What is the Maximin Alternative and c) Compute the EVPI

B-1. Which is more desirable assuming data are COST Decertaine the course dagram. 90 60 (45) 45 99 so 50 30 20 /2 40 50 B-2. A firm must decide whether to construct a small, medium or large stamping plant. A consultant's report indicates a 0.20 probability that demand will be low and 0.80 that demand will be high. If the firm builds a small facility and demand turns out to be low, the Net Present Value (NPV) will be $42M. If demand turns out to be high, the firm can either subcontract and realize the NPV of $42M or expand greatly for a Net Present Value of $48M. The firm could build a medium size facility as a hedge: if demand turns out to be low, its NPV is estimated at $22M; if demand turns out to be high, the firm could do nothing and realize a NPV of $46M, or could expand and realize a NPV of $50OM. If the firm builds a large facility and demand is low, the NPV will be ($20M), whereas high demand will result in a NPV of $72M. a) Analyze and solve this problem using a decision tree b) What is the Maximin Alternative and c) Compute the EVPI

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter11: Simulation Models

Section: Chapter Questions

Problem 68P

Related questions

Question

Transcribed Image Text:B-1. Which is more desirable assuming data are COST

Decenaine the cousen

dagram.

60

90

60

1/3

(45)

45

99

40

50

50

30

20

/2

40

50

B-2. A firm must decide whether to construct a small, medium or large stamping plant. A consultant's report indicates a 0.20

probability that demand will be low and 0.80 that demand will be high.

If the firm builds a small facility and demand turns out to be low, the Net Present Value (NPV) will be $42M. If

demand turns out to be high, the firm can either subcontract and realize the NPV of $42M or expand greatly for a Net

Present Value of $48M.

The firm could build a medium size facility as a hedge: if demand turns out to be low, its NPV is estimated at

$22M; if demand turns out to be high, the firm could do nothing and realize a NPV of $46M, or could expand and

realize a NPV of $50M.

If the firm builds a large facility and demand is low, the NPV will be ($20M), whereas high demand will result

in a NPV of $72M.

a) Analyze and solve this problem using a decision tree

b) What is the Maximin Alternative

and

c) Compute the EVPI

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,