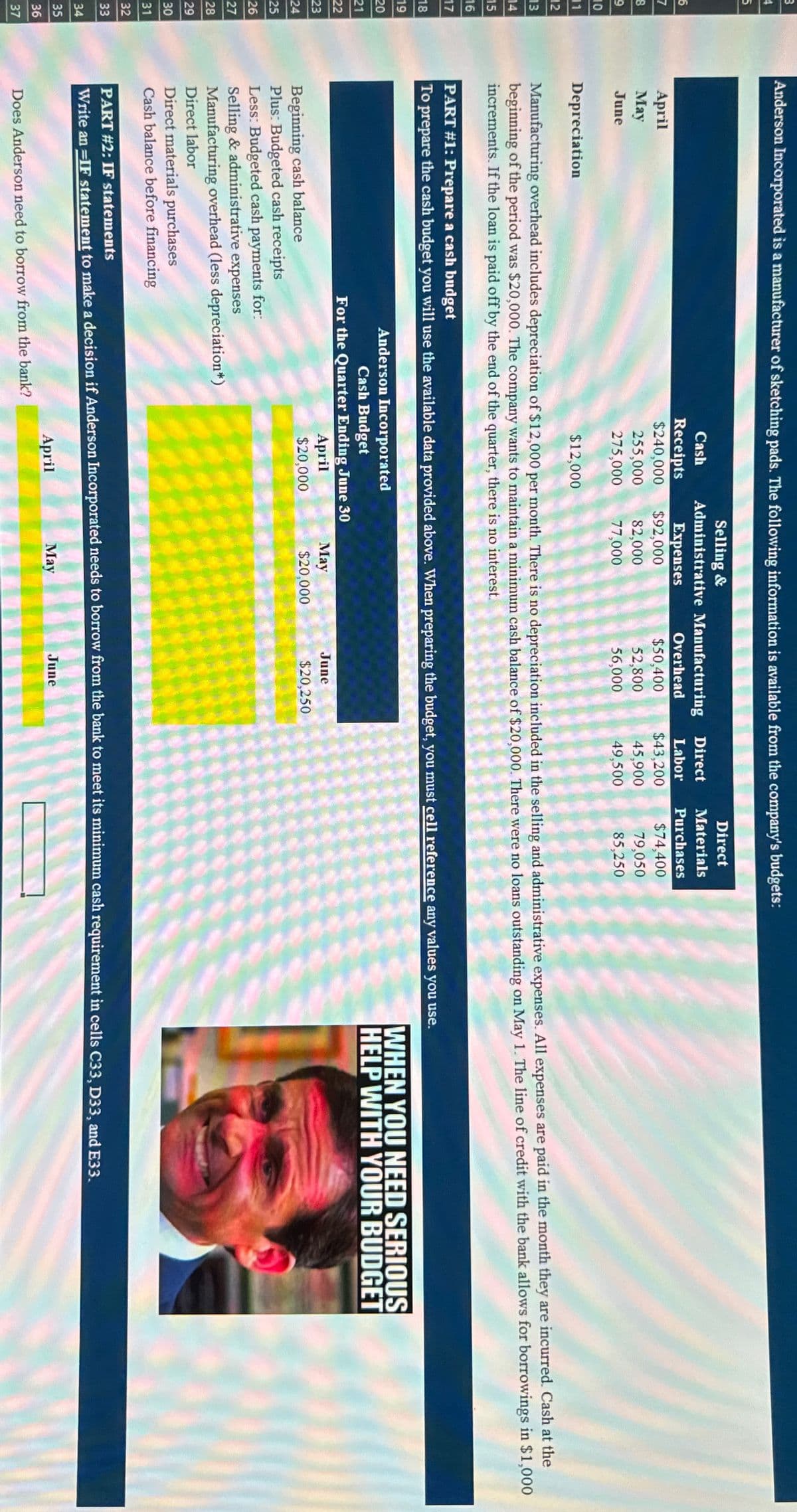

B 4 Anderson Incorporated is a manufacturer of sketching pads. The following information is available from the company's budgets: 5 Selling & Direct Cash Administrative Manufacturing Direct Materials 6 7 April 8 May 9 June 10 11 Depreciation 12 Receipts Expenses Overhead Labor Purchases $240,000 $92,000 $50,400 $43,200 $74,400 255,000 275,000 77,000 82,000 52,800 45,900 79,050 56,000 49,500 85,250 $12,000 13 14 15 Manufacturing overhead includes depreciation of $12,000 per month. There is no depreciation included in the selling and administrative expenses. All expenses are paid in the month they are incurred. Cash at the beginning of the period was $20,000. The company wants to maintain a minimum cash balance of $20,000. There were no loans outstanding on May 1. The line of credit with the bank allows for borrowings in $1,000 increments. If the loan is paid off by the end of the quarter, there is no interest. PART #1: Prepare a cash budget To prepare the cash budget you will use the available data provided above. When preparing the budget, you must cell reference any values you use. 16 17 18 19 20 21 22 23 24 25 Beginning cash balance Plus: Budgeted cash receipts 26 Less: Budgeted cash payments for: Anderson Incorporated Cash Budget For the Quarter Ending June 30 April $20,000 May $20,000 June $20,250 WHEN YOU NEED SERIOUS HELP WITH YOUR BUDGET 27 28 29 Direct labor 30 Selling & administrative expenses Manufacturing overhead (less depreciation*) Direct materials purchases 31 Cash balance before financing 32 33 PART #2: IF statements 34 Write an =IF statement to make a decision if Anderson Incorporated needs to borrow from the bank to meet its minimum cash requirement in cells C33, D33, and E33. 35 April May June 36 37 Does Anderson need to borrow from the bank?

B 4 Anderson Incorporated is a manufacturer of sketching pads. The following information is available from the company's budgets: 5 Selling & Direct Cash Administrative Manufacturing Direct Materials 6 7 April 8 May 9 June 10 11 Depreciation 12 Receipts Expenses Overhead Labor Purchases $240,000 $92,000 $50,400 $43,200 $74,400 255,000 275,000 77,000 82,000 52,800 45,900 79,050 56,000 49,500 85,250 $12,000 13 14 15 Manufacturing overhead includes depreciation of $12,000 per month. There is no depreciation included in the selling and administrative expenses. All expenses are paid in the month they are incurred. Cash at the beginning of the period was $20,000. The company wants to maintain a minimum cash balance of $20,000. There were no loans outstanding on May 1. The line of credit with the bank allows for borrowings in $1,000 increments. If the loan is paid off by the end of the quarter, there is no interest. PART #1: Prepare a cash budget To prepare the cash budget you will use the available data provided above. When preparing the budget, you must cell reference any values you use. 16 17 18 19 20 21 22 23 24 25 Beginning cash balance Plus: Budgeted cash receipts 26 Less: Budgeted cash payments for: Anderson Incorporated Cash Budget For the Quarter Ending June 30 April $20,000 May $20,000 June $20,250 WHEN YOU NEED SERIOUS HELP WITH YOUR BUDGET 27 28 29 Direct labor 30 Selling & administrative expenses Manufacturing overhead (less depreciation*) Direct materials purchases 31 Cash balance before financing 32 33 PART #2: IF statements 34 Write an =IF statement to make a decision if Anderson Incorporated needs to borrow from the bank to meet its minimum cash requirement in cells C33, D33, and E33. 35 April May June 36 37 Does Anderson need to borrow from the bank?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 7CE: Refer to Cornerstone Exercise 8.6. Required: 1. Calculate the total budgeted cost of units produced...

Related questions

Question

Transcribed Image Text:B

4

Anderson Incorporated is a manufacturer of sketching pads. The following information is available from the company's budgets:

5

Selling &

Direct

Cash

Administrative Manufacturing

Direct

Materials

6

7

April

8

May

9

June

10

11

Depreciation

12

Receipts

Expenses

Overhead

Labor

Purchases

$240,000

$92,000

$50,400

$43,200

$74,400

255,000

275,000 77,000

82,000

52,800

45,900

79,050

56,000

49,500

85,250

$12,000

13

14

15

Manufacturing overhead includes depreciation of $12,000 per month. There is no depreciation included in the selling and administrative expenses. All expenses are paid in the month they are incurred. Cash at the

beginning of the period was $20,000. The company wants to maintain a minimum cash balance of $20,000. There were no loans outstanding on May 1. The line of credit with the bank allows for borrowings in $1,000

increments. If the loan is paid off by the end of the quarter, there is no interest.

PART #1: Prepare a cash budget

To prepare the cash budget you will use the available data provided above. When preparing the budget, you must cell reference any values you use.

16

17

18

19

20

21

22

23

24

25

Beginning cash balance

Plus: Budgeted cash receipts

26

Less: Budgeted cash payments for:

Anderson Incorporated

Cash Budget

For the Quarter Ending June 30

April

$20,000

May

$20,000

June

$20,250

WHEN YOU NEED SERIOUS

HELP WITH YOUR BUDGET

27

28

29

Direct labor

30

Selling & administrative expenses

Manufacturing overhead (less depreciation*)

Direct materials purchases

31

Cash balance before financing

32

33

PART #2: IF statements

34

Write an =IF statement to make a decision if Anderson Incorporated needs to borrow from the bank to meet its minimum cash requirement in cells C33, D33, and E33.

35

April

May

June

36

37

Does Anderson need to borrow from the bank?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College