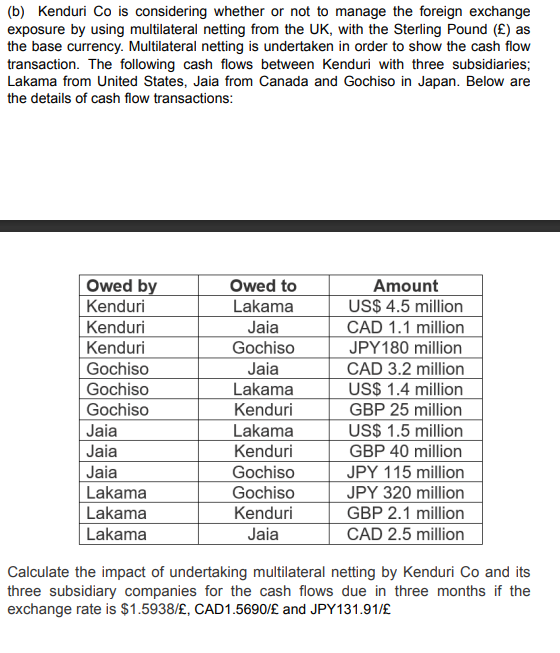

(b) Kenduri Co is considering whether or not to manage the foreign exchange exposure by using multilateral netting from the UK, with the Sterling Pound (£) as the base currency. Multilateral netting is undertaken in order to show the cash flow transaction. The following cash flows between Kenduri with three subsidiaries; Lakama from United States, Jaia from Canada and Gochiso in Japan. Below are the details of cash flow transactions: Qwed by Owed to Amount

(b) Kenduri Co is considering whether or not to manage the foreign exchange exposure by using multilateral netting from the UK, with the Sterling Pound (£) as the base currency. Multilateral netting is undertaken in order to show the cash flow transaction. The following cash flows between Kenduri with three subsidiaries; Lakama from United States, Jaia from Canada and Gochiso in Japan. Below are the details of cash flow transactions: Qwed by Owed to Amount

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter24: Recording International And Internet Sales

Section: Chapter Questions

Problem 1ANFS

Related questions

Question

Transcribed Image Text:(b) Kenduri Co is considering whether or not to manage the foreign exchange

exposure by using multilateral netting from the UK, with the Sterling Pound (£) as

the base currency. Multilateral netting is undertaken in order to show the cash flow

transaction. The following cash flows between Kenduri with three subsidiaries;

Lakama from United States, Jaia from Canada and Gochiso in Japan. Below are

the details of cash flow transactions:

Owed by

Kenduri

Owed to

Lakama

Jaia

Amount

US$ 4.5 million

CAD 1.1 million

Kenduri

Kenduri

Gochiso

JPY 180 million

Gochiso

Jaia

CAD 3.2 million

Gochiso

Lakama

US$ 1.4 million

Gochiso

Kenduri

GBP 25 million

Jaia

Lakama

US$ 1.5 million

Jaia

Kenduri

GBP 40 million

Jaia

Gochiso

JPY 115 million

Lakama

Gochiso

JPY 320 million

Lakama

GBP 2.1 million

Kenduri

Jaia

Lakama

CAD 2.5 million

Calculate the impact of undertaking multilateral netting by Kenduri Co and its

three subsidiary companies for the cash flows due in three months if the

exchange rate is $1.5938/£, CAD1.5690/£ and JPY131.91/£

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage