(b) On December 31, 2018, Ramey Associates owned the following Sccurities, held as a long term investment. The securities are not held for influence or control of the investee. Common Stock Share Cost Hurst co. 1.000 TK.60,000 Pine co. 3,000 ТК.45,000 Scott co. 500 TК. 30,000 On December 31,2010,the total fair value of the securities was equal to its cost.In 2019,the following transactions occurred. July 1 Received Tk. 2 per share semiannual cash dividend on pine co. common stock. Aug 1 Received $0.50 per share cash dividend on Hurst co. common stock. Sep. 1 Sold 1,500 shares of Pine Co. common stock for cash at TK.17 Oct. 1 Sold 200 shares of Hurst co. common stock for cash at TK.58 Nov. 1 Received $1 per cash dividend on scott co. common stock. 31 Received $1 per share semiannual cash dividend on pine o. common stock. At December 31,the fair valucs per share of the common stocks were:Hurst co. TK.62,Pinc co.TK.14 and Scott Co.TΚ. 59 Instructions i)Journalize the 2019 transactions and post to the account stock Investments. ii)Prepare the adjusting entry at December 31.2019 to show securities at fair value.

(b) On December 31, 2018, Ramey Associates owned the following Sccurities, held as a long term investment. The securities are not held for influence or control of the investee. Common Stock Share Cost Hurst co. 1.000 TK.60,000 Pine co. 3,000 ТК.45,000 Scott co. 500 TК. 30,000 On December 31,2010,the total fair value of the securities was equal to its cost.In 2019,the following transactions occurred. July 1 Received Tk. 2 per share semiannual cash dividend on pine co. common stock. Aug 1 Received $0.50 per share cash dividend on Hurst co. common stock. Sep. 1 Sold 1,500 shares of Pine Co. common stock for cash at TK.17 Oct. 1 Sold 200 shares of Hurst co. common stock for cash at TK.58 Nov. 1 Received $1 per cash dividend on scott co. common stock. 31 Received $1 per share semiannual cash dividend on pine o. common stock. At December 31,the fair valucs per share of the common stocks were:Hurst co. TK.62,Pinc co.TK.14 and Scott Co.TΚ. 59 Instructions i)Journalize the 2019 transactions and post to the account stock Investments. ii)Prepare the adjusting entry at December 31.2019 to show securities at fair value.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

Please answer my questions in within 2 hours

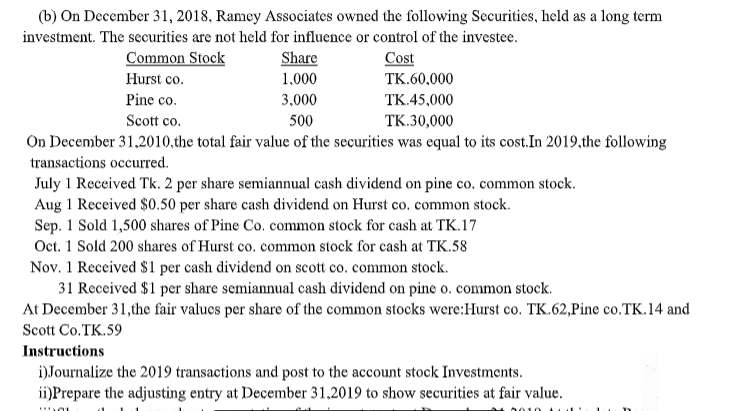

Transcribed Image Text:(b) On December 31, 2018, Ramey Associates owned the following Securities, held as a long term

investment. The securities are not held for influence or control of the investee.

Common Stock

Share

Cost

Hurst co.

1,000

TК.60,000

Pine co.

3,000

TK.45,000

Scott co.

500

TК.30,000

On December 31,2010,the total fair value of the securities was equal to its cost.In 2019,the following

transactions occurred.

July 1 Received Tk. 2 per share semiannual cash dividend on pine co. common stock.

Aug 1 Received $0.50 per share cash dividend on Hurst co. common stock.

Sep. 1 Sold 1,500 shares of Pine Co. common stock for cash at TK.17

Oct. 1 Sold 200 shares of Hurst co. common stock for cash at TK.58

Nov. 1 Received $1 per cash dividend on scott co. common stock.

31 Received $1 per share semiannual cash dividend on pine o. common stock.

At December 31,the fair valucs per share of the common stocks were:Hurst co. TK.62,Pine co.TK.14 and

Scott Co.TK.59

Instructions

i) Journalize the 2019 transactions and post to the account stock Investments.

ii)Prepare the adjusting entry at December 31.2019 to show securities at fair value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning