Velasco Corporation should report cash equivalents in its December 31, 2019 statement of financial position at

Velasco Corporation should report cash equivalents in its December 31, 2019 statement of financial position at

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 15DQ

Related questions

Question

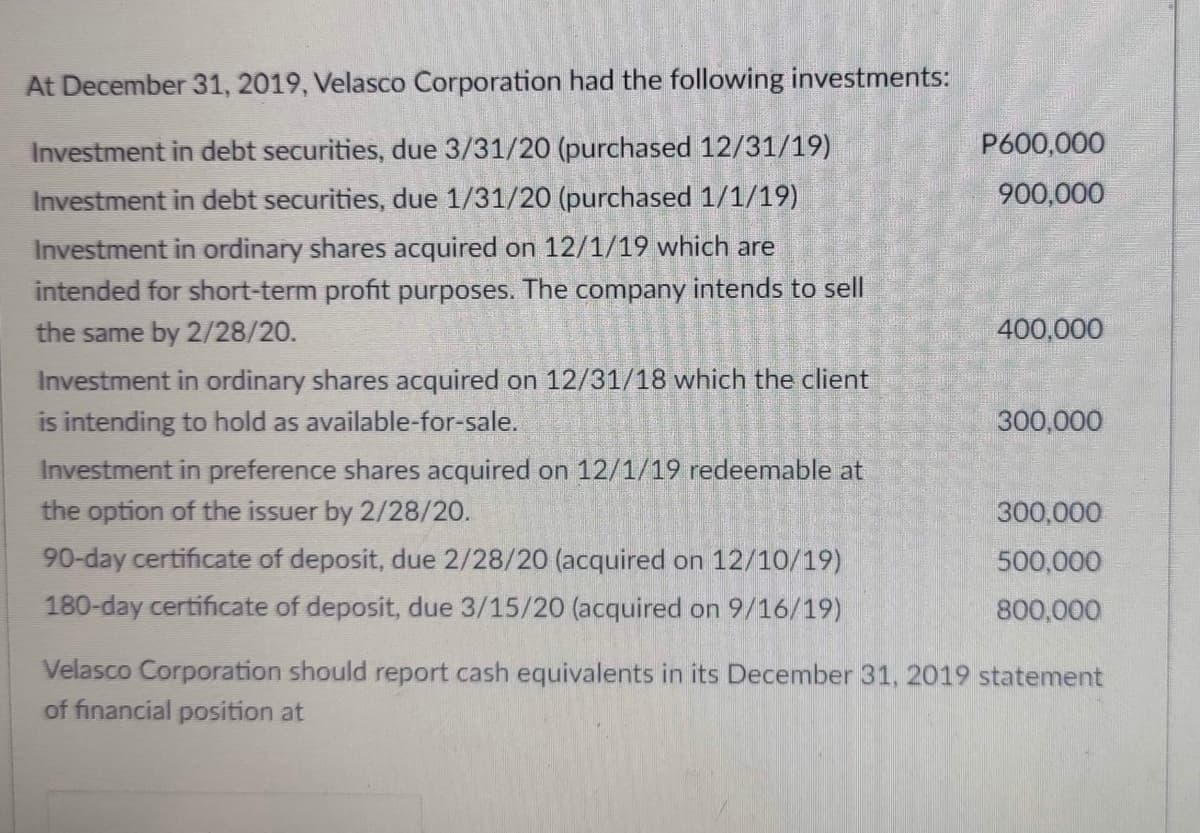

At December 31, 2019, Velasco Corporation had the following investments:

Investment in debt securities, due 3/31/20 (purchased 12/31/19) P600,000 Investment in debt securities, due 1/31/20 (purchased 1/1/19) 900,000

Investment in ordinary shares acquired on 12/1/19 which are intended for short-term profit purposes. The company intends to sell the same by 2/28/20. 400,000 Investment in ordinary shares acquired on 12/31/18 which the client is intending to hold as available-for-sale. 300,000 Investment in preference shares acquired on 12/1/19 redeemable at the option of the issuer by 2/28/20. 300.000

90-day certificate of deposit, due 2/28/20 (acquired on 12/10/19) 500,000

180-day certificate of deposit, due 3/15/20 (acquired on 9/16/19) 800,000

Velasco Corporation should report cash equivalents in its December 31, 2019 statement of financial position at

Transcribed Image Text:At December 31, 2019, Velasco Corporation had the following investments:

Investment in debt securities, due 3/31/20 (purchased 12/31/19)

P600,000

Investment in debt securities, due 1/31/20 (purchased 1/1/19)

900,000

Investment in ordinary shares acquired on 12/1/19 which are

intended for short-term profit purposes. The company intends to sell

the same by 2/28/20.

400,000

Investment in ordinary shares acquired on 12/31/18 which the client

is intending to hold as available-for-sale.

300,000

Investment in preference shares acquired on 12/1/19 redeemable at

the option of the issuer by 2/28/20.

300,000

90-day certificate of deposit, due 2/28/20 (acquired on 12/10/19)

500,000

180-day certificate of deposit, due 3/15/20 (acquired on 9/16/19)

800,000

Velasco Corporation should report cash equivalents in its December 31, 2019 statement

of financial position at

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning