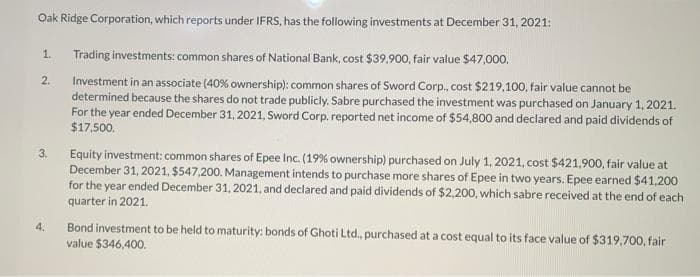

Oak Ridge Corporation, which reports under IFRS, has the following investments at December 31, 2021: Trading investments: common shares of National Bank, cost $39,900, fair value $47,000. 1. 2. Investment in an associate (40% ownership): common shares of Sword Corp., cost $219,100, fair value cannot be determined because the shares do not trade publicly. Sabre purchased the investment was purchased on January 1, 2021. For the year ended December 31, 2021, Sword Corp. reported net income of $54,800 and declared and paid dividends of $17,500. 3. Equity investment: common shares of Epee Inc. (19% ownership) purchased on July 1, 2021, cost $421,900, fair value at December 31, 2021. $547,200. Management intends to purchase more shares of Epee in two years. Epee earned $41,200 for the year ended December 31, 2021, and declared and paid dividends of $2,200, which sabre received at the end of each quarter in 2021. 4. Bond investment to be held to maturity: bonds of Ghoti Ltd., purchased at a cost equal to its face value of $319,700, fair value $346,400.

Oak Ridge Corporation, which reports under IFRS, has the following investments at December 31, 2021: Trading investments: common shares of National Bank, cost $39,900, fair value $47,000. 1. 2. Investment in an associate (40% ownership): common shares of Sword Corp., cost $219,100, fair value cannot be determined because the shares do not trade publicly. Sabre purchased the investment was purchased on January 1, 2021. For the year ended December 31, 2021, Sword Corp. reported net income of $54,800 and declared and paid dividends of $17,500. 3. Equity investment: common shares of Epee Inc. (19% ownership) purchased on July 1, 2021, cost $421,900, fair value at December 31, 2021. $547,200. Management intends to purchase more shares of Epee in two years. Epee earned $41,200 for the year ended December 31, 2021, and declared and paid dividends of $2,200, which sabre received at the end of each quarter in 2021. 4. Bond investment to be held to maturity: bonds of Ghoti Ltd., purchased at a cost equal to its face value of $319,700, fair value $346,400.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.1C: Leverage Cook Corporation issued financial statements at December 31, 2019, that include the...

Related questions

Question

Transcribed Image Text:%24

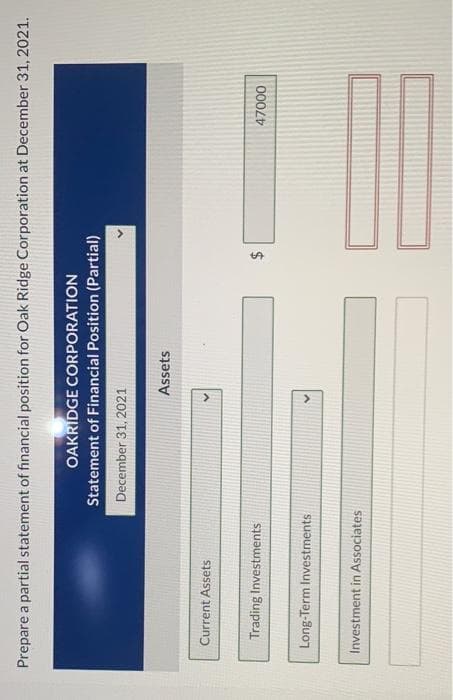

Prepare a partial statement of financial position for Oak Ridge Corporation at December 31, 2021.

OAKRIDGE CORPORATION

Statement of Financial Position (Partial)

December 31, 2021

Assets

Current Assets

Trading Investments

000L

Long-Term Investments

Investment in Associates

Transcribed Image Text:Oak Ridge Corporation, which reports under IFRS, has the following investments at December 31, 2021:

Trading investments: common shares of National Bank, cost $39,900, fair value $47,000.

1.

2.

Investment in an associate (40% ownership): common shares of Sword Corp., cost $219,100, fair value cannot be

determined because the shares do not trade publicly. Sabre purchased the investment was purchased on January 1, 2021.

For the year ended December 31, 2021, Sword Corp. reported net income of $54,800 and declared and paid dividends of

$17,500.

3.

Equity investment: common shares of Epee Inc. (19% ownership) purchased on July 1, 2021, cost $421,900, fair value at

December 31, 2021, $547,200. Management intends to purchase more shares of Epee in two years. Epee earned $41,200

for the year ended December 31, 2021, and declared and paid dividends of $2,200, which sabre received at the end of each

quarter in 2021.

4.

Bond investment to be held to maturity: bonds of Ghoti Ltd., purchased at a cost equal to its face value of $319,700, fair

value $346,400.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning