b. Compare the liquidity, solvency, and profitability of the two companies.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.5P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

Transcribed Image Text:QUESTION 8

P18-5A

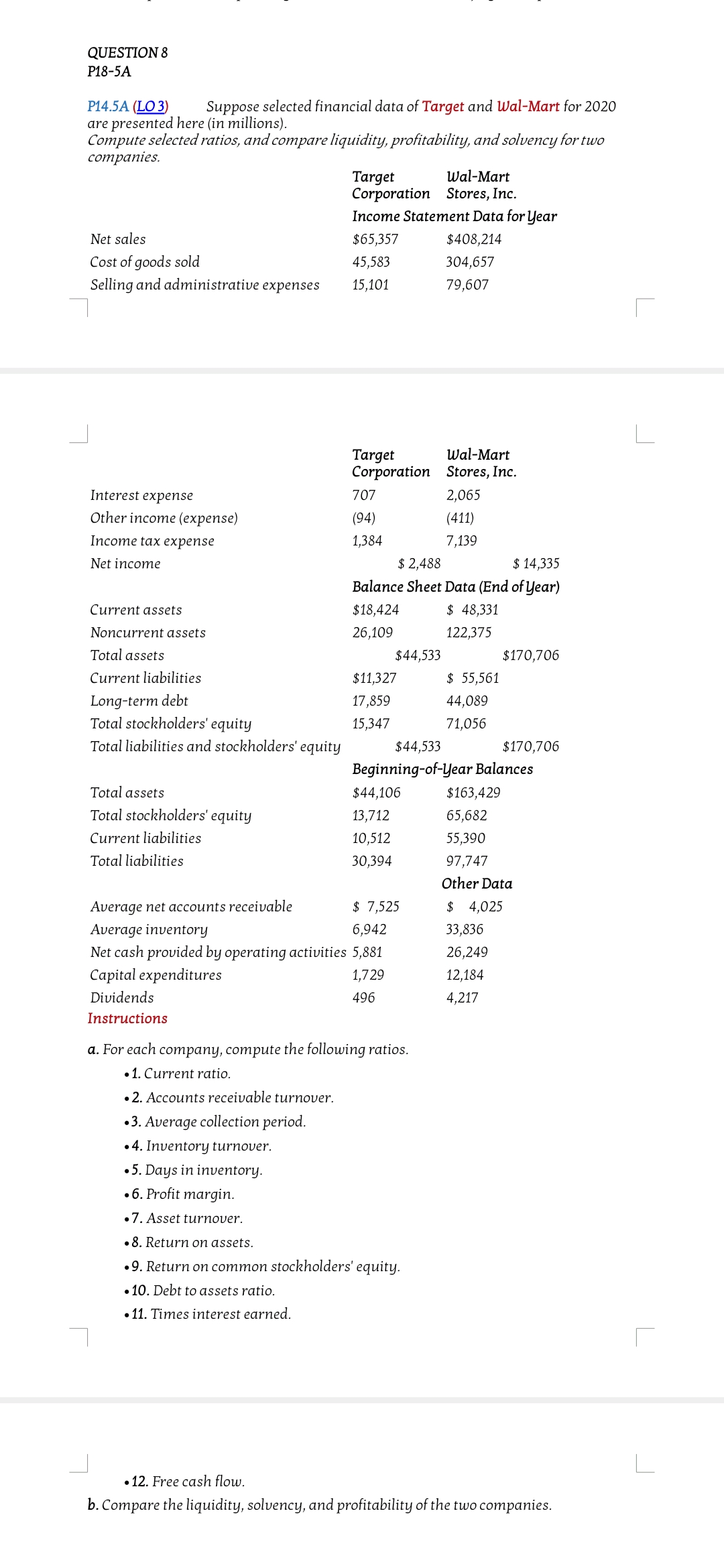

P14.5A (LO 3)

are presented here (in millions).

Compute selected ratios, and compare liquidity, profitability, and solvency for two

сотрanies.

Suppose selected financial data of Target and Wal-Mart for 2020

Wal-Mart

Target

Corporation Stores, Inc.

Income Statement Data for Year

Net sales

$65,357

$408,214

Cost of goods sold

45,583

304,657

Selling and administrative expenses

15,101

79,607

L

Wal-Mart

Target

Corporation Stores, Inc.

Interest expense

707

2,065

Other income (expense)

(94)

(411)

Income tax eхрense

1,384

7,139

$ 2,488

Balance Sheet Data (End of Year)

Net income

$ 14,335

Current assets

$18,424

$ 48,331

Noncurrent assets

26,109

122,375

Total assets

$44,533

$170,706

Current liabilities

$11,327

$ 55,561

Long-term debt

Total stockholders' equity

17,859

44,089

15,347

71,056

Total liabilities and stockholders' equity

$44,533

$170,706

Beginning-of-Year Balances

Total assets

$44,106

$163,429

Total stockholders' equity

13,712

65,682

Current liabilities

10,512

55,390

Total liabilities

30,394

97,747

Other Data

Average net accounts receivable

$ 7,525

$ 4,025

Average inventory

6,942

33,836

Net cash provided by operating activities 5,881

26,249

Capital expenditures

1,729

12,184

Dividends

496

4,217

Instructions

a. For each company, compute the following ratios.

•1. Current ratio.

• 2. Accounts receivable turnover.

•3. Average collection period.

•4. Inventory turnover.

•5. Days in inventory.

•6. Profit margin.

•7. Asset turnover.

•8. Return on assets.

•9. Return on common stockholders' equity.

• 10. Debt to assets ratio.

• 11. Times interest earned.

L

• 12. Free cash flow.

b. Compare the liquidity, solvency, and profitability of the two companies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning