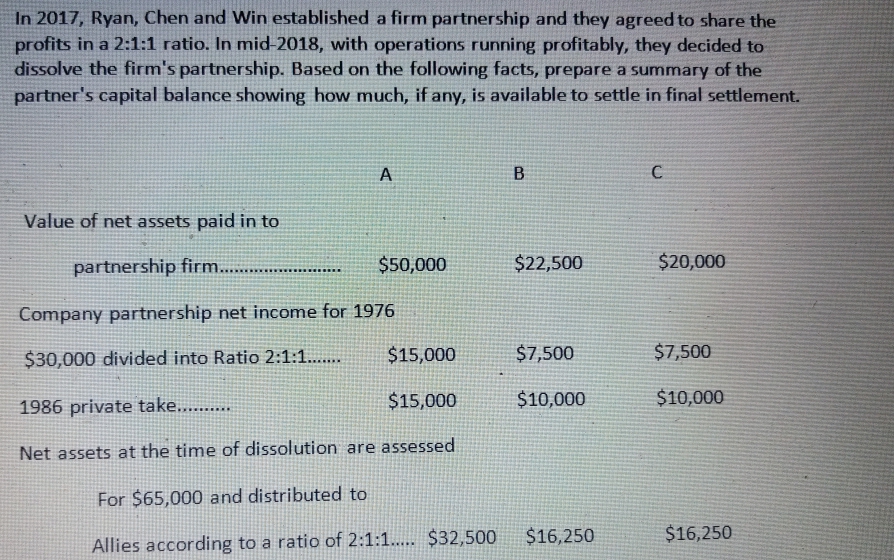

In 2017, Ryan, Chen and Win established a firm partnership and they agreed to share the profits in a 2:1:1 ratio. In mid-2018, with operations running profitably, they decided to dissolve the firm's partnership. Based on the following facts, prepare a summary of the partner's capital balance showing how much, if any, is available to settle in final settlement. A B. Value of net assets paid in to partnership firm... $50,000 $22,500 $20,000 Company partnership net income for 1976 $30,000 divided into Ratio 2:1:1...... $15,000 $7,500 $7,500 $15,000 $10,000 $10,000 1986 private take...... Net assets at the time of dissolution are assessed For $65,000 and distributed to $16,250 $16,250 Allies according to a ratio of 2:1:1... $32,500

In 2017, Ryan, Chen and Win established a firm partnership and they agreed to share the profits in a 2:1:1 ratio. In mid-2018, with operations running profitably, they decided to dissolve the firm's partnership. Based on the following facts, prepare a summary of the partner's capital balance showing how much, if any, is available to settle in final settlement. A B. Value of net assets paid in to partnership firm... $50,000 $22,500 $20,000 Company partnership net income for 1976 $30,000 divided into Ratio 2:1:1...... $15,000 $7,500 $7,500 $15,000 $10,000 $10,000 1986 private take...... Net assets at the time of dissolution are assessed For $65,000 and distributed to $16,250 $16,250 Allies according to a ratio of 2:1:1... $32,500

Chapter11: Investor Losses

Section: Chapter Questions

Problem 49P

Related questions

Question

Transcribed Image Text:In 2017, Ryan, Chen and Win established a firm partnership and they agreed to share the

profits in a 2:1:1 ratio. In mid-2018, with operations running profitably, they decided to

dissolve the firm's partnership. Based on the following facts, prepare a summary of the

partner's capital balance showing how much, if any, is available to settle in final settlement.

A

B

Value of net assets paid in to

partnership firm...

$50,000

$22,500

$20,000

Company partnership net income for 1976

$30,000 divided into Ratio 2:1:1..

$15,000

$7,500

$7,500

1986 private take...

$15,000

$10,000

$10,000

Net assets at the time of dissolution are assessed

For $65,000 and distributed to

$16,250

$16,250

Allies according to a ratio of 2:1:1..... $32,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT