Baird Company began operations on January 1, Year 1, by issuing common stock for $34,000 cash. During Year 1, Baird eceived $53,100 cash from revenue and incurred costs that required $38,100 of cash payments. lem 10-26A (Algo) Part b e a GAAP-based income statement and balance sheet for Baird Company for Year 1, under the following independent scen rd is in the car rental business. The $38.100 was paid to purchase automobiles. The automobiles were purchased on Janua

Baird Company began operations on January 1, Year 1, by issuing common stock for $34,000 cash. During Year 1, Baird eceived $53,100 cash from revenue and incurred costs that required $38,100 of cash payments. lem 10-26A (Algo) Part b e a GAAP-based income statement and balance sheet for Baird Company for Year 1, under the following independent scen rd is in the car rental business. The $38.100 was paid to purchase automobiles. The automobiles were purchased on Janua

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13P: Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and...

Related questions

Question

100%

Transcribed Image Text:of 3

Book

Print

erences

Mc

Graw

Hill

Q

A

N

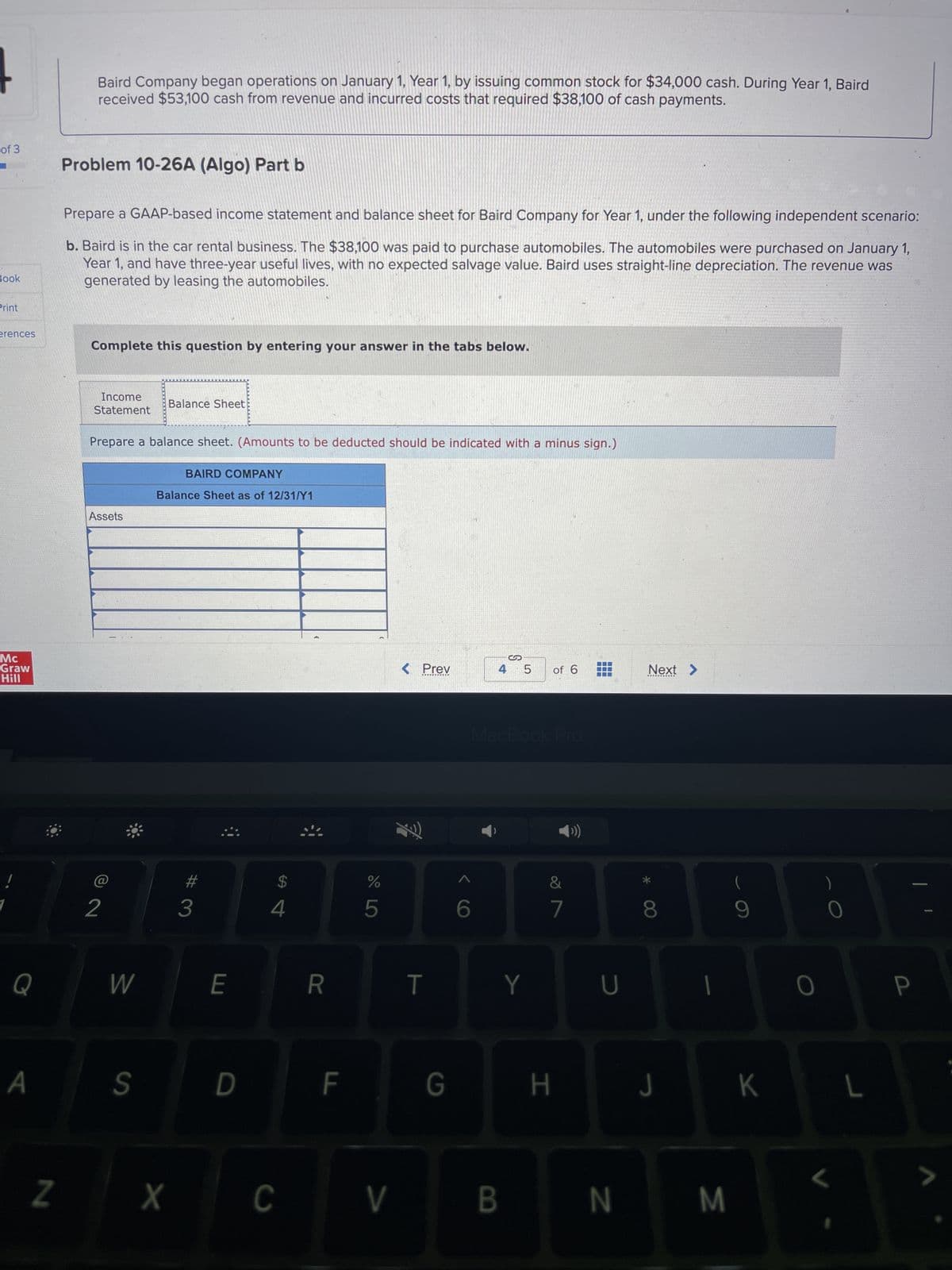

Baird Company began operations on January 1, Year 1, by issuing common stock for $34,000 cash. During Year 1, Baird

received $53,100 cash from revenue and incurred costs that required $38,100 of cash payments.

Problem 10-26A (Algo) Part b

Prepare a GAAP-based income statement and balance sheet for Baird Company for Year 1, under the following independent scenario:

b. Baird is in the car rental business. The $38,100 was paid to purchase automobiles. The automobiles were purchased on January 1,

Year 1, and have three-year useful lives, with no expected salvage value. Baird uses straight-line depreciation. The revenue was

generated by leasing the automobiles.

Complete this question by entering your answer in the tabs below.

Income

Statement

Prepare a balance sheet. (Amounts to be deducted should be indicated with a minus sign.)

Assets

2

W

Balance Sheet

S

BAIRD COMPANY

Balance Sheet as of 12/31/Y1

X

3

E

D

$

4

C

R

F

do LO

%

5

V

< Prev

T

G

6

S

4 5 of 6

MacBook Pro

B

Y

&

7

H

¯¯

U

N

Next >

8

J

M

9

K

0

L

P

>

Transcribed Image Text:mework i

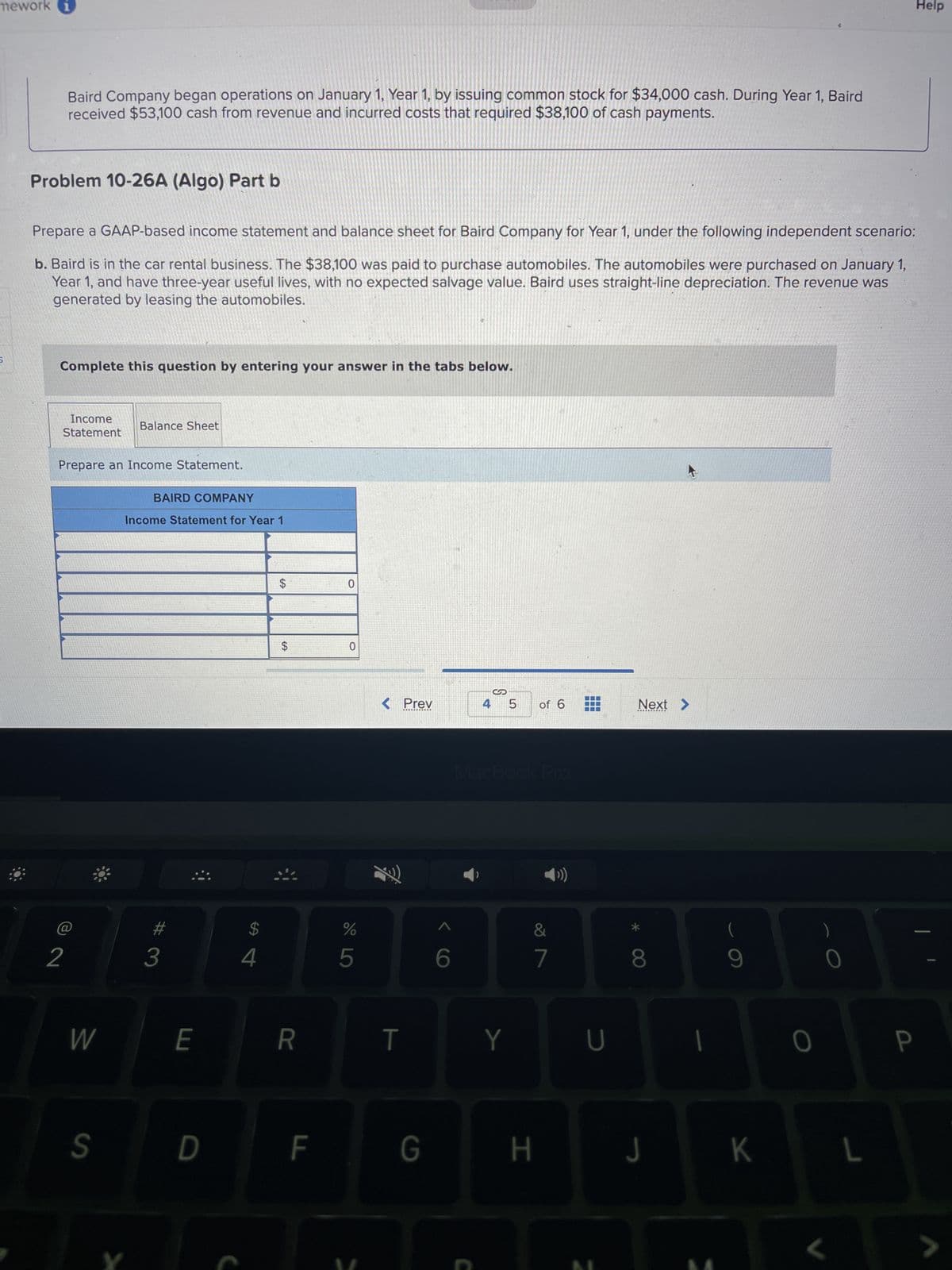

Baird Company began operations on January 1, Year 1, by issuing common stock for $34,000 cash. During Year 1, Baird

received $53,100 cash from revenue and incurred costs that required $38,100 of cash payments.

Problem 10-26A (Algo) Part b

Prepare a GAAP-based income statement and balance sheet for Baird Company for Year 1, under the following independent scenario:

b. Baird is in the car rental business. The $38,100 was paid to purchase automobiles. The automobiles were purchased on January 1,

Year 1, and have three-year useful lives, with no expected salvage value. Baird uses straight-line depreciation. The revenue was

generated by leasing the automobiles.

Complete this question by entering your answer in the tabs below.

Income

Statement

2

Prepare an Income Statement.

W

Balance Sheet

S

BAIRD COMPANY

Income Statement for Year 1

7

3

E

D

4

$

$

R

D

F

0

0

%

5

< Prev

T

G

6

S

4 5 of 6

MacBook Pro

Y

&

7

H

U

Next >

*

8

J

1

(

9

K

O

0

L

P

Help

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,