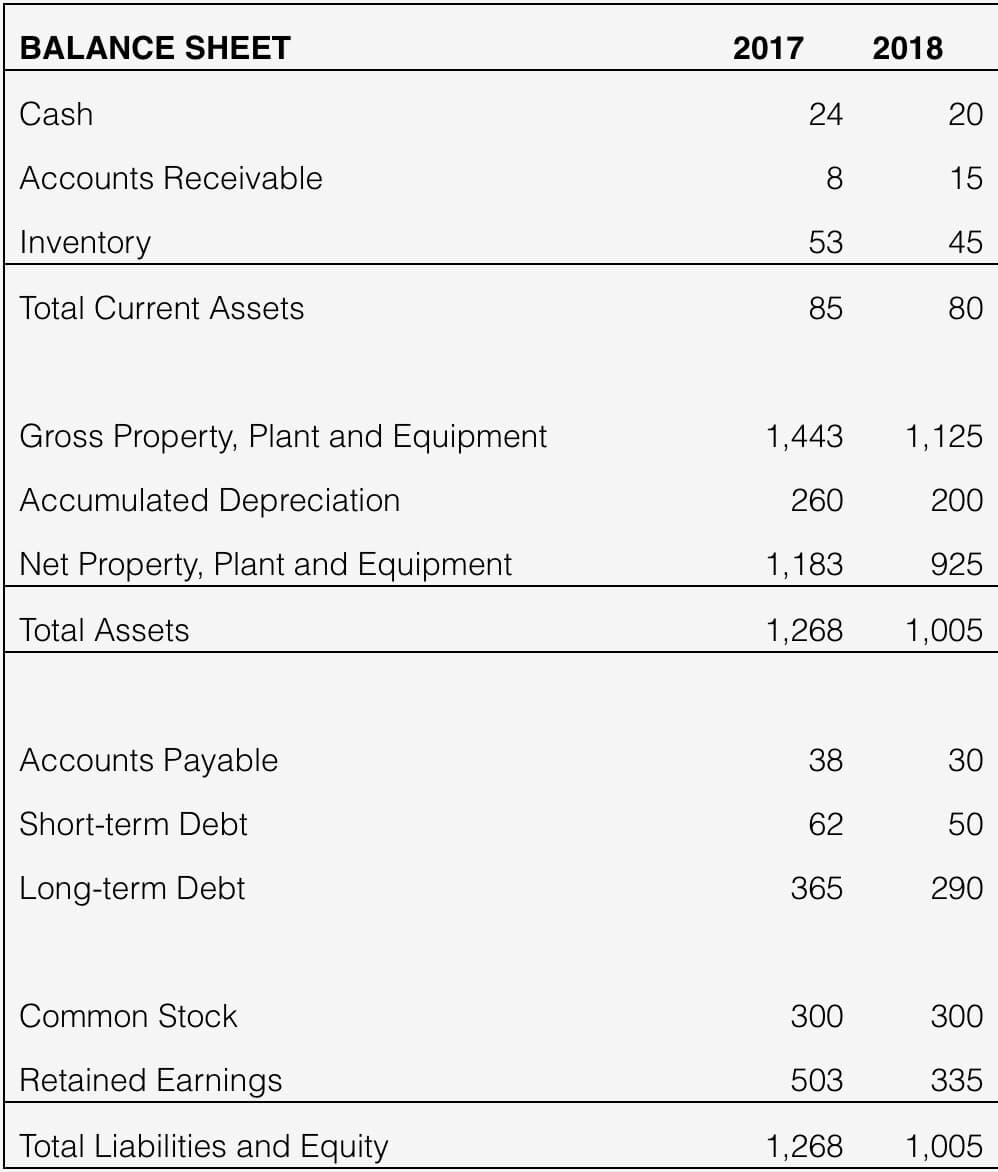

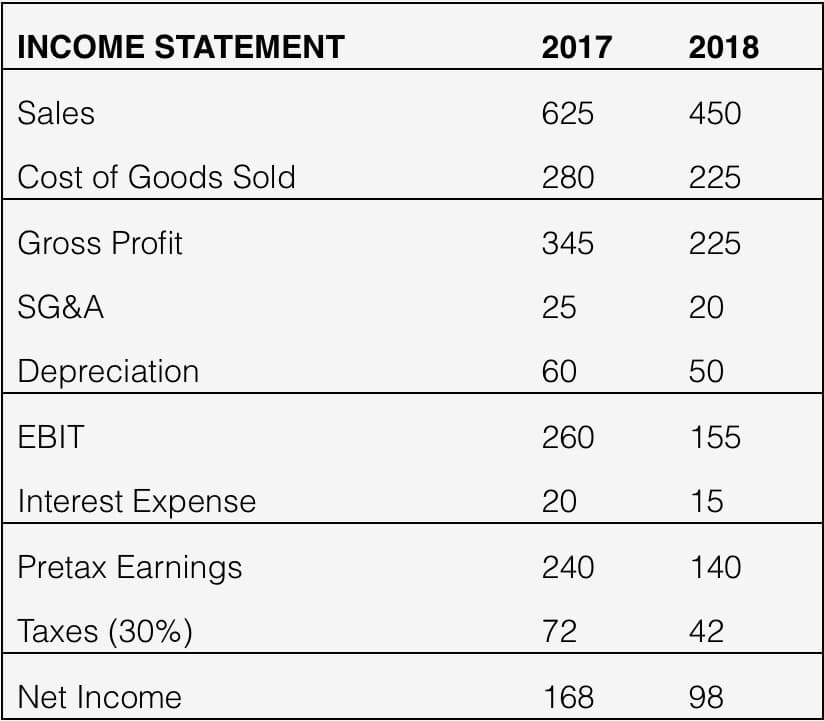

BALANCE SHEET 2017 2018 Cash 24 20 Accounts Receivable 8 15 Inventory 53 45 Total Current Assets 85 80 Gross Property, Plant and Equipment 1,443 1,125 Accumulated Depreciation 260 200 Net Property, Plant and Equipment 1,183 925 Total Assets 1,268 1,005 Accounts Payable 38 30 Short-term Debt 62 50 Long-term Debt 365 290 Common Stock 300 300 Retained Earnings 503 335 Total Liabilities and Equity 1,268 1,005

Q: Balance Sheet At December 31, 2012 Assets Liabilities and Equity $ 72 $60 Cash Accounts Receivable…

A: The question is based on the concept of accounting ratios. As per Bartleby guidelines we are allowed…

Q: 2011 30,000 S 2012 28,000 Assets Cash 2$ Marketable Securities 12,000 12,400 Accounts receivable…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Cash flow from assets. Use the data from the following financial statements in tthe popup window,…

A: Cash flow statement shows the cash outflows and inflows from different activities and it does not…

Q: Use the following Information to answer this question. Windswept, Inc. 2017 Income Statement ($ in…

A: The question is related to Cash Coverage Ratio for the year 2017. The Cash Coverage is calculated…

Q: DUX COMPANY Comparative Balance Sheets December 31, 2021 and 2020 ($ in thousands) 2021 2020…

A: A cash flow statement is a financial statement that shows all the inflows and outflows of cash.

Q: Statement of Financial Position For the Year-ended December 31 2014 2013 Cash 400,000 180,000…

A: Accounting ratios can be referred to as the financial measures which are used to assess the…

Q: LaAnn Sands wants to conduct revenue breakeven analyses of Salza Technology Corporation for 2013.…

A: Cash Flow Statement: It is a financial statement prepared by a company to report their cash…

Q: 2017 750 Cterory 2016 300 Accounts payable Accounts receivable Accruals Cash 900 825 450 300 1,500…

A: Total Assets= Total Liabilities and Equity Total Liabilities and Equity- Accruals…

Q: Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment…

A: Uses and Sources of Cash - Uses are those cash that the company has used to purchase or repay the…

Q: LaAnn Sands wants to conduct revenue breakeven analyses of Salza Technology Corporation for 2013.…

A: Statement of cash flows: It is one of the financial statement that shows the cash and cash…

Q: What is the firm’s 2018 current ratio? Round your answer to two decimal places. The 2018 current…

A: Rosnan Industries 2018 Ratio Analysis A - Current Asset Ratio is 1.95 times (770/395) B - Total…

Q: 2018 2017 Assets Cash 90,800 48,400 Accounts receivable 92,800 33,000 Inventories…

A: Statement of cash flows is one of the financial statement of the business. It shows all cash inflows…

Q: (Ratio Computations and Analysis) Prior Company’s condensed financial statements provide the…

A: Hello, since the student has posted multiple questions, we will answer only requirement (a). Thank…

Q: Use the common-size financial statements found here: ommon-Size Balance Sheet 2016 Cash and…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: How does the owner finance the business in terms of debt and equity?

A: Capital structure refers to the blend that is used by an organization to finance its overall…

Q: Bailey Corporation’s financial statements (dollars and shares are in‘millions) are provided here.…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Balance Sheet as of December 31, 2013 and 2014 ASSETS 2014 2013 LIABILITIES 2014 2013 Current assets…

A: Ratio analysis is used to evaluate and analyze the financial viability of the company by the…

Q: Kinder Company Balance Sheet December 31 2020 2019 Cash $ 40,208 $ 11,424 Accounts…

A: Indirect method of cash flow statement involves a reconciliation from profit before tax, adjusting…

Q: PC 35 A Comparative Balance Sheet 2018 2017…

A: Cash flows from operating activities: It is a section of Statement of cash flow that explains the…

Q: Lan & Chen Technologies: Income Statements for Year Ending December 31…

A: Hey, since there are multiple sub-part questions posted, we will answer the first three questions.…

Q: ABC Coffee 2018 and 2019 Balance Sheet 2018 2019 2018 2019…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: 2017 2016 Current assets Cash and cash equivalents S330 $360 Accounts receivable (net) 570 500…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: Prepaid Expenses 9,000.00 Total Current Assets…

A: Accounts reccivables ratio here will be calculated on the basis of average reccivables. Accounts…

Q: Simon Company's year-end balance sheets follow. At December 31 2017 2016 2015 Assets $ 25,796 $…

A: Days Sales Uncollected: The days' sales uncollected ratio is a liquidity measure that creditors and…

Q: How to convert a balance sheet to a common size balance sheet

A: Common-sized financial statements: Common-sized financial statements are useful for the analysts in…

Q: Balance Sheet (Millions of $) Assets 2018 Cash and securities $3,000 Accounts…

A: Income statement is a statement which records the revenue and expenses of an undertaking for a…

Q: he following information to answer this question. Windswept, Inc. 2017 Income Statement ($ in…

A: Quick ratio = Quick Assets / Current liabilities

Q: IKIBAN INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 Assets…

A: Cash flow statement: It is prepared to show the cash flow of the organization by analyzing the total…

Q: LaAnn Sands wants to conduct revenue breakeven analyses of Salza Technology Corporation for 2013.…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Liberty Corporation reported the following figures: Account 2016 2015 Cash and cash equivalents $ 2…

A: Vertical analysis of Balance sheet , shows all the assets as a percentage of total assets =…

Q: Kinder Company Balance Sheet December 31 2020 2019 Cash $ 40,208 $ 11,424 Accounts…

A: Direct method shows the operating cash inflows and operating cash outflows.

Q: Balance Sheet (Millions of $) Assets 2018 Cash and securities $3,000 Accounts…

A: Operating margin percentage measures the company's operating profit as a percentage of sales.…

Q: Balance Sheets At December 31 2018 2017 2018 2017 Assets: $ 24,640 $ 23,040 32,180 73,125 55,900…

A: Cash Flow Statement is the part of Financial Statement which shows the net increase/decrease in Cash…

Q: Using a spreadsheet to prepare the statement of cash flows—indirect method The 2018 comparative…

A:

Q: December 31. 2017 2016 Cash $ 176,700 $ 45,000 Accounts receivable 118,900 78,400 Investments 69,900…

A: The movement of money in and out of a business is referred to as cash flow. The cash flow statement…

Q: Balance Sheet Year 2014 & 2015 (amounts in $) 2014 2015 Cash 140 210 Accounts receivable 340 380…

A: Option "A" is the Correct Answer. i.e 0.83

Q: Use the following excerpts from Zowleski Company's financial information. Dec. 31, Dec. 31, 2018…

A: A cash flow statement shows the amount of net decrease or net increase in the cash balance during…

Q: Computing the cash effect Rouse Exercise Equipment, Inc. reported the following financial statements…

A: a.

Q: FBC statement of financial position (R millions) 2018 2017 Cash and equivalents R149 R83…

A: 1. The calculation is:

Q: The Maness Corporation's financial statements are shown below, along with the changes in the balance…

A: Statement of cash flows:Statement of cash flow is a financial statement that shows the cash and cash…

Q: Windswept, Inc. 2017 Income Statement ($ in millions) Net sales $ 11,000 Cost of goods sold…

A: Dividend is the declared portion of the net profit which is distributed among the shareholder and it…

Q: Lloyd Lumber Company: Balance Sheets at Beginning and End of 2015 ($ million) Change Jan. 1 Dec. 31…

A: a] Jan-01 Dec-31 Source Use Cash $ 7 $ 15 $ 8…

Step by step

Solved in 3 steps

- INCOME STATEMENT Year ended June 30 2022 2021 $'000 $'000Revenue 22450 18675Cost of sales 8475 8055Gross Profit 13975 10620Distribution costs 4245 3120Administrative expenses 1276 2134Selling expenses…Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).

- Solve for fy22 sales and depreciation a on the 2022 income statement. remember to reference the growth rate provided by Paul.of 0.141 FY21 FY22 Sales $24884886 Blank Cost of Goods Sold $19659044 Other Expenses $2735335 Depreciation $995395 Blank Taxable Income $1493092 Taxes (21%) $313549 Net Income $1179543 Dividends $500,000 Add. to Retained Earnings $679543Comparative income statement for Deep Sea Company for 2016 and 2015 are given below: 2016 (in $) 2015 (in $) Revenue 1123420 876530 Cost of Goods Sold 635780 458790 Gross Profit 487640 417740 Selling and General Expenses 156870 110980 Operating Profit 330770 306760 Intrest Expense 45890 40980 Income Before tax 284880 265780 Income tax expense 97650 82340 Net profit 187230 183440 Answer the next set of questions based on the above data. 7A. The Net profit percerntage to revenue is ___________ . 25.15% 16.67% 12.15% 20.55% 7B. The Gross profit…Comparative income statement for Deep Sea Company for 2016 and 2015 are given below 2016 ( in $) 2015 ( in $) Revenue 1123420 876530 Cost of Goods Sold 635780 458790 Gross Profit 487640 417740 Selling and general Expense 156870 110980 Operating Profit 330770 306760 Interest Expense 45890 40980 Income Before Tax 284880 265780 Income Tax expenses 97650 82340 Net Profit 187230 183440 Prepare the common size income statement of Deep Sea Company for 2016 and 2015. Enter the numbers without decimals. Do not round off the numbers. Add % sign after the numbers.…

- Selected comparative statement data for Oriole Company are presented below. All balance sheet data are as of December 31. 20222021Net sales$1,165,000 $1,125,000Cost of goods sold705,000 645,000Interest expense20,000 15,000Net income154,945 145,000Accounts receivable145,000 125,000Inventory105,000 100,000Total assets785,000 700,000Preferred stock (6%)205,000 200,000Total stockholders’ equity635,000 525,000 Compute the following ratios for 2022. (Round answers to 1 decimal place, e.g. 1.8 or 2.5%) (a)Profit marginenter the profit margin in percentages %(b)Asset turnoverenter the asset turnover in times times(c)Return on assetsenter the return on assets in percentages %(d)Return on common stockholders’ equityenter the return on common stockholders' equity in percentages %2013 2014 Sales$4,500 $4,775 Depreciation7501050COGS24222430Interest180215Cash200400Accts Receivables200300Notes Payable100150Long-term debt29561850Net fixed assets80009200Accounts Payable50100Inventory18001600Dividends225275Tax rate35%35% 1. What is the cash flow from operating activities? 2. What is the cash flow from financing activities? What is the days sales in accounts receivable or the AR period?44- Calculate net profit from the following? Net sales OMR 100000, Cost of goods sold OMR 40000, Rent received OMR 20000, Salaries OMR 10000, Insurance OMR 6000 and Depreciation OMR 8000. a. OMR 64000 b. OMR 70000 c. OMR 56000 d. OMR 60000

- How to compute this problem? Problem:The data shown below were obtained from the financial records of the BST Corporation for the year ended December 31, 2020. Sound Break CorporationIncome and Retained Earnings StatementFor the year Ended December 31, 2020Net Sales P1,000,000Cost of Goods Sold:Inventory, Dec. 31, 2019 P250,000Purchases 720,000Total Goods Available P970,000Inventory 220,000 750,000Gross Margin on Sales P 250,000Selling and Administrative (including Depreciation of P20,000) 125,000Net Income before Tax P 125,000Provision for Income Tax 35,000Net Income for the Year P 90,000Retained Earnings, beginning 130,000Total P 220,000Dividends Paid 30,000Retained Earnings, December 31, 2020 P 190,000 Sound Break CorporationBALANCE SHEETDecember 31, 2019 and 2020 ASSETS 2019 2020Current Assets:Cash P 75,000 P 85,000Marketable Securities 25,000 25,000Trade Receivables, net 185,000 245,000Inventory, at cost 250,000 220,000Prepaid Expenses 15,000 10,000Total Current Assets…Sound Break CorporationIncome and Retained Earnings StatementFor the year Ended December 31, 2020Net Sales P1,000,000Cost of Goods Sold:Inventory, Dec. 31, 2019 P250,000Purchases 720,000Total Goods Available P970,000Inventory 220,000 750,000Gross Margin on Sales P 250,000Selling and Administrative (including Depreciation of P20,000) 125,000Net Income before Tax P 125,000Provision for Income Tax 35,000Net Income for the Year P 90,000Retained Earnings, beginning 130,000Total P 220,000Dividends Paid 30,000Retained Earnings, December 31, 2020 P 190,000 Sound Break CorporationBALANCE SHEETDecember 31, 2019 and 2020 ASSETS 2019 2020Current Assets:Cash P 75,000 P 85,000Marketable Securities 25,000 25,000Trade Receivables, net 185,000 245,000Inventory, at cost 250,000 220,000Prepaid Expenses 15,000 10,000Total Current Assets P550,000 P585,000Property and Other Assets:Equipment, net P340,000 P320,000Other Assets 15,000 15,000Total Property and Other Assets P355,000 P335,000 Total Assets…THE ATHLETIC ATTICIncome StatementFor the Year Ended December 31, 2024Net sales $8,900,000Cost of goods sold 5,450,000Gross profit 3,450,000Expenses: Operating expenses $1,600,000 Depreciation expense 210,000 Interest expense 50,000 Income tax expense 360,000 Total expenses 2,220,000Net income $1,230,000 THE ATHLETIC ATTICBalance SheetsDecember 31 2024 2023Assets Current assets: Cash $164,000 Accounts receivable 790,000 Inventory 1,405,000 Supplies 110,000Long-term assets: Equipment 1,150,000 Less: Accumulated depreciation (420,000) Total assets $3,199,000 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $115,000 Interest payable 0 Income tax payable 40,000 Long-term liabilities: Notes payable 600,000 Stockholders' equity: Common stock 700,000…