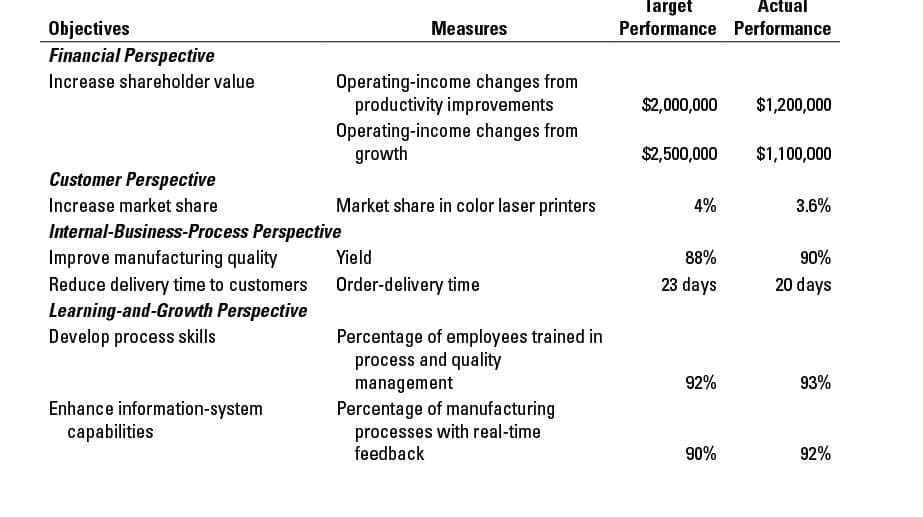

Balanced scorecard. Vic Corporation manufactures various types of color laser printers in a highly automated facility with high fixed costs. The market for laser printers is competitive. The various color laser printers on the market are comparable in terms of features and price. Vic believes that satisfying customers with products of high quality at low costs is important to achieving its target profitability. For 2017, Vic plans to achieve higher quality and lower costs by improving yields and reducing defects in its manufacturing operations. Vic will train workers and encourage and empower them to take the necessary actions. Currently, a significant amount of Vic’s capacity is used to produce products that are defective and cannot be sold. Vic expects that higher yields will reduce the capacity that Vic needs to manufacture products. Vic does not anticipate that improving manufacturing will automatically lead to lower costs because many costs are fixed costs. To reduce fixed costs per unit, Vic could lay off employees and sell equipment, or it could use the capacity to produce and sell more of its current products or improved models of its current products. Vic’s balanced scorecard (initiatives omitted) for the just-completed fiscal year 2017 follows. (SEE ATTACHEMENT below)

Balanced scorecard. Vic Corporation manufactures various types of color laser printers in a highly automated facility with high fixed costs. The market for laser printers is competitive. The various color laser printers on the market are comparable in terms of features and price. Vic believes that satisfying customers with products of high quality at low costs is important to achieving its target profitability. For 2017, Vic plans to achieve higher quality and lower costs by improving yields and reducing defects in its manufacturing operations. Vic will train workers and encourage and empower them to take the necessary actions. Currently, a significant amount of Vic’s capacity is used to produce products that are defective and cannot be sold. Vic expects that higher yields will reduce the capacity that Vic needs to manufacture products. Vic does not anticipate that improving manufacturing will automatically lead to lower costs because many costs are fixed costs. To reduce fixed costs per unit, Vic could lay off employees and sell equipment, or it could use the capacity to produce and sell more of its current products or improved models of its current products.

Vic’s balanced scorecard (initiatives omitted) for the just-completed fiscal year 2017 follows. (SEE ATTACHEMENT below)

1. Was Vic successful in implementing its strategy in 2017? Explain.

2. Is Vic’s balanced scorecard useful in helping the company understand why it did not reach its target market share in 2017? If it is, explain why. If it is not, explain what other measures you might want to add under the customer perspective and why.

3. Would you have included some measure of employee satisfaction in the learning-and-growth perspective and new-product development in the internal-business-process perspective? That is, do you think employee satisfaction and development of new products are critical for Vic to implement its strategy? Why or why not? Explain briefly.

4. What problems, if any, do you see in Vic improving quality and significantly downsizing to eliminate unused capacity?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps