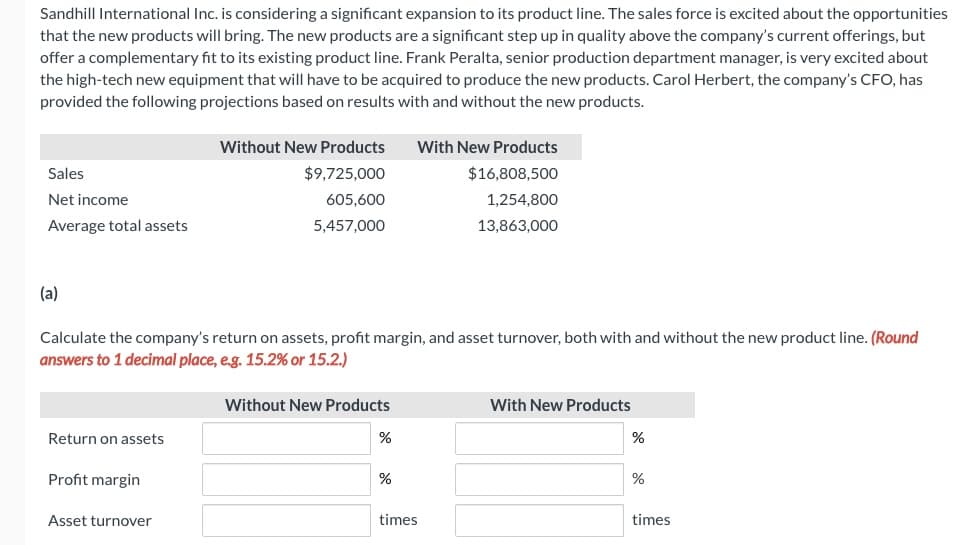

Sandhill International Inc. is considering a significant expansion to its product line. The sales force is excited about the opportunitie that the new products will bring. The new products are a significant step up in quality above the company's current offerings, but offer a complementary fit to its existing product line. Frank Peralta, senior production department manager, is very excited about the high-tech new equipment that will have to be acquired to produce the new products. Carol Herbert, the company's CFO, has provided the following projections based on results with and without the new products. Without New Products With New Products Sales $9,725,000 $16,808,500 Net income 605,600 1,254,800 Average total assets 5,457,000 13,863,000 (a) Calculate the company's return on assets, profit margin, and asset turnover, both with and without the new product line. (Round answers to 1 decimal place, e.g. 15.2% or 15.2.) Without New Products With New Products Return on assets Profit margin Asset turnover times times

Sandhill International Inc. is considering a significant expansion to its product line. The sales force is excited about the opportunitie that the new products will bring. The new products are a significant step up in quality above the company's current offerings, but offer a complementary fit to its existing product line. Frank Peralta, senior production department manager, is very excited about the high-tech new equipment that will have to be acquired to produce the new products. Carol Herbert, the company's CFO, has provided the following projections based on results with and without the new products. Without New Products With New Products Sales $9,725,000 $16,808,500 Net income 605,600 1,254,800 Average total assets 5,457,000 13,863,000 (a) Calculate the company's return on assets, profit margin, and asset turnover, both with and without the new product line. (Round answers to 1 decimal place, e.g. 15.2% or 15.2.) Without New Products With New Products Return on assets Profit margin Asset turnover times times

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter13: The Balanced Scorecard: Strategic-based Control

Section: Chapter Questions

Problem 21P: At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive...

Related questions

Question

Transcribed Image Text:Sandhill International Inc. is considering a significant expansion to its product line. The sales force is excited about the opportunities

that the new products will bring. The new products are a significant step up in quality above the company's current offerings, but

offer a complementary fit to its existing product line. Frank Peralta, senior production department manager, is very excited about

the high-tech new equipment that will have to be acquired to produce the new products. Carol Herbert, the company's CFO, has

provided the following projections based on results with and without the new products.

Without New Products

With New Products

Sales

$9,725,000

$16,808,500

Net income

605,600

1,254,800

Average total assets

5,457,000

13,863,000

(a)

Calculate the company's return on assets, profit margin, and asset turnover, both with and without the new product line. (Round

answers to 1 decimal place, e.g. 15.2% or 15.2.)

Without New Products

With New Products

Return on assets

%

Profit margin

%

Asset turnover

times

times

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub