Bank Reconciliation June 30, 202e Bank statement balance $ 8,700 Book balance $ 9,260 Add: Deposit of June 3e in transit 1,300 $10, e0e Deduct: Outstanding cheque m14 740 Adjusted bank balance $ 9, 260 Adjusted book balance $ 9,260 The Cash account In the General Ledger appeared as follows on July 31: Cash Acct. No. 101 Date Explanation PR Debit Credit Balance 2020 June 30 Balance 9,260 July 31 CR3 4,672 13,932 31 CD6 2,909 11,023 A list of deposits made and cheques written during July, taken from the Cash Recelpts Journal and Cash Disburs shown below: Deposits Made July $1,190 1,5se 1,339 11 24 31 593 Total July Cash Receipts $ 4,672

Bank Reconciliation June 30, 202e Bank statement balance $ 8,700 Book balance $ 9,260 Add: Deposit of June 3e in transit 1,300 $10, e0e Deduct: Outstanding cheque m14 740 Adjusted bank balance $ 9, 260 Adjusted book balance $ 9,260 The Cash account In the General Ledger appeared as follows on July 31: Cash Acct. No. 101 Date Explanation PR Debit Credit Balance 2020 June 30 Balance 9,260 July 31 CR3 4,672 13,932 31 CD6 2,909 11,023 A list of deposits made and cheques written during July, taken from the Cash Recelpts Journal and Cash Disburs shown below: Deposits Made July $1,190 1,5se 1,339 11 24 31 593 Total July Cash Receipts $ 4,672

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter7: Internal Control And Cash

Section: Chapter Questions

Problem 21E

Related questions

Question

prepare a bank reconciliation at june 31

Transcribed Image Text:The bank reconciliation prepared by Winfield Construction on June 30, 2020, appeared as follows:

winfield Construction

Bank Reconciliation

June 30, 2020

Bank statement balance

$ 8,700 Book balance

$ 9,260

Add:

Deposit of June 30 in transit

1,300

$10, e00

Deduct:

Outstanding cheque #14

740

Adjusted bank balance

$ 9, 260 Adjusted book balance

$ 9,260

The Cash account in the General Ledger appeared as follows on July 31:

Cash

Acct. No. 101

Date

Explanation PR

Debit

Credit

Balance

2020

June

Balance

9,260

13,932

11,023

30

July

31

CR3

4,672

31

CD6

2,909

A list of deposits made and cheques written during July, taken from the Cash Recelpts Journal and Cash Disbursements Journal, is

shown below:

Deposits Made

July

8

$1,190

11

1,55e

24

1,339

31

593

Total July Cash Receipts

$ 4,672

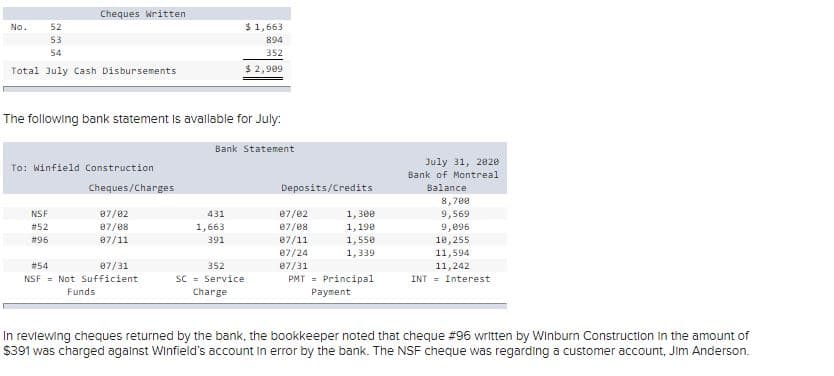

Transcribed Image Text:Cheques Written

$ 1,663

No.

52

53

894

54

352

Total July Cash Disbursements

$ 2,909

The following bank statement Is avallable for July:

Bank Statement

To: Winfield Construction

July 31, 282e

Bank of Montreal

Cheques/Charges

Deposits/Credits

Balance

1, 300

1,190

8,700

9,569

9,096

NSF

07/02

431

07/02

#52

87/08

1,663

07/08

#96

07/11

391

07/11

1,550

10,255

11,594

11,242

07/24

1,339

#54

87/31

352

07/31

NSF = Not Sufficient

Funds

SC = Service

Charge

PMT = Principal

INT = Interest

Payment

In revlewing cheques returned by the bank, the bookkeeper noted that cheque #96 written by Winburn Construction in the amount of

$391 was charged agalnst Winfield's account in error by the bank. The NSF cheque was regarding a customer account, Jim Anderson.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage